Toyjobs Blog – Toy jobs news, Toy job updates, Toy jobs industry, Toy jobs and careers.

What Will the Buyers Do?

In honor of New York Toy Fair, terrible weather hit the New York area as monsoon rains like something out of Southeast Asia ushered in the beginning of the show.

As always, first stop was the TOTY Awards and it was great to see so many people I hadn’t seen in so long. The venue was slam packed – “We’re going to need a bigger room.” While the awards were dominated by Barbie, LEGO, and Squishmallows as expected, it’s always good to see smaller companies like Playmonster, Thames & Kosmos, Magna-Tiles and WowWee break through for a prize. The night ran too long as these types of things tend to do but I liked the Gong Show buzzer thing which helped move things along. I would say that there was an awful lot of awards. More isn’t always better and often seems like it’s just a mechanism to sell more seats to the show.

The Toy Industry Hall of Fame honored several of the ancients and then both Mary Couzin and the Spin Master Triplets were well deserved inductees.

The show proper broke Saturday morning as the sun came out. Again it was good to see so many long lost faces. I spent day one on the main floor and while the mood was good, traffic seemed light. Some of that could probably be explained by all of the weather-related flight cancellations the day before. Mattel, Hasbro, and MGA were noticeably absent but these are the usual suspects that never support Toy Association trade shows anyway. It was good to see that LEGO stepped up and took a very large space front and center. Most companies organized combination open/closed booths which made the show inviting while allowing companies to maintain some confidentiality on their newer wares.

On Sunday, I hit the basement which seemed much better lit than usual although it looked to me like there was less exhibitor space than I remember. It also seemed that many traditional “basement dwellers” had moved upstairs. Traffic was strong and I was surprised that the majority of companies told me that traffic had been heavy there the day before as well. By now the major retail buyers had filtered in and I was heartened to hear that almost all of the important retailers were in attendance.

On day three, I woke up to find that my feet were already completely numb. I decided that was probably a good thing. If I couldn’t even feel them then my feet probably wouldn’t hurt too much that day. It was mop up time and I focused on trying to see anybody I hadn’t already seen. Traffic again seemed stronger than on day one but what was glaringly obvious was that the mom-and-pop store trade were not attending the show. That could have been partially because of the weather. It could have been because of the high cost of New York in September/October vs. February. It could have been partially because they were already set up for holiday sales 2023. Mostly, I think it’s because this wasn’t the right time of the year for them. They weren’t ready to think about the 2024 holidays and their pockets weren’t already stuffed with this year’s Christmas cash.

Every exhibitor I spoke with was happy with the show’s results and that’s what really counts, isn’t it? There seemed to be fewer exhibitors. Traffic seemed light. But although attendance was quantity light it was quality dense and manufacturers were able to have productive meetings with almost all of their key customers like: Walmart, Target, Amazon, Costco, Barnes & Noble, etc.

So, while New York Toy Fair was a success despite being somewhere “lesser than” the real hubbub was all about the future. The murmurs started even before the show began but by Sunday, the news was out. It had been decided, even before the show began, that Toy Fair was moving back to the early part of the year (probably a good thing) and that as of 2026 it was moving to New Orleans. Where?! What?! Who?!

WAIT! STOP PRESSES!

The next several paragraphs were about how, while I really like New Orleans, having a trade show there at the proposed times could be quite problematic (conflicting shows, Super Bowls, Mardi Gras, etc).

The Toy Association’s Board of Directors has just announced that they are deep sixing New Orleans in favor of keeping Toy Fair in New York.

I am therefore scrapping what was a small screed and will simply say that we’ll give The Toy Association a plus for responsiveness but a minus for creating unnecessary mayhem.

We now return to our regularly scheduled program…

Lastly, we come to the September Previews. The time seems right for previews whether in LA, Dallas, or someplace else. Lots of toy companies are already having previews. Lots of companies are building showrooms or taking space in LA. The rest of us have often been told that we can’t have a full blown show there because they can’t find a venue but nobody really believes that. Reality is that the West Coast behemoths (Mattel, MGA, etc.) don’t want their smaller, nimbler competitors anywhere near the retailers. They want to monopolize all of the buyers time for themselves. If you scheduled a proper trade show they would simply switch their dates. Buyers themselves aren’t going to keep going back and forth repeatedly either.

September in LA is going to continue to grow in importance. Even mid-sized companies should probably put a stake in the ground and build a showroom out there. Use it as your licensing office in the off-season. The key question in terms of the exact show scheduling should be: what will the buyers do? After all, that’s really who you’re trying to attract. Without buyers you might as well be a bunch of people sitting on folding chairs sunning themselves at the flea market. How long will buyers be willing to stay on the road? How many consecutive buying trips will they be willing to take? How many clean shirts will they be willing to invest in? And can they all find hotels that include laundry service? Figure out what the buyers will do and work backwards from there.

When it comes to tradeshows, like so much in business, it comes down to listening to your customers. Amidst all the brouhaha and second-guessing, the real question is: “What will the buyers do?” In an inverse to The Field of Dreams – if they’ll come, you should build it.

All the best,

Tom Keoughan

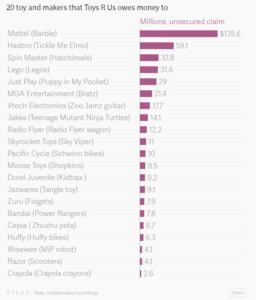

Model. Toys ‘R’ Us will rent store space that they will then rent to toy manufacturers at a profit and then toy manufacturers can sell their wares directly to consumers. Presumably, they will also rent space that they will then rent to you at a profit to store replenishment goods. The Flea Markets will also provide “rich data analytics”- the sort of thing that you can already got from Wal-Mart, Target, Amazon and NPD. They are currently interviewing to hire “Relationship Managers” to be front men because the company’s leadership has historically proven itself to be less than trustworthy. Pay no attention to the man behind the curtain-the man who makes the decisions.

Model. Toys ‘R’ Us will rent store space that they will then rent to toy manufacturers at a profit and then toy manufacturers can sell their wares directly to consumers. Presumably, they will also rent space that they will then rent to you at a profit to store replenishment goods. The Flea Markets will also provide “rich data analytics”- the sort of thing that you can already got from Wal-Mart, Target, Amazon and NPD. They are currently interviewing to hire “Relationship Managers” to be front men because the company’s leadership has historically proven itself to be less than trustworthy. Pay no attention to the man behind the curtain-the man who makes the decisions.

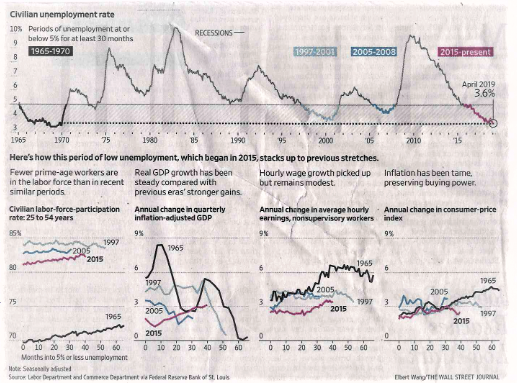

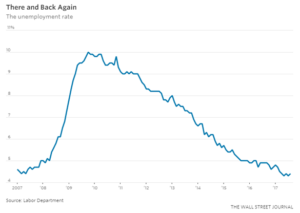

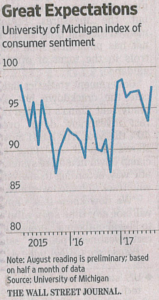

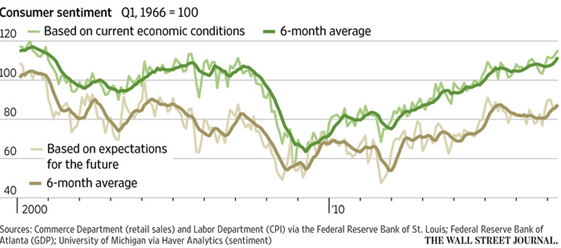

In early August US consumer sentiment jumped to its highest level since January. With unemployment continuing to head lower and a robust stock market, this is a trend that might continue. Unlike earlier in the year, consumers seem to now be putting their money where their mouth is. Consumer spending has increased rapidly and credit card debt is now at the highest level in US history.

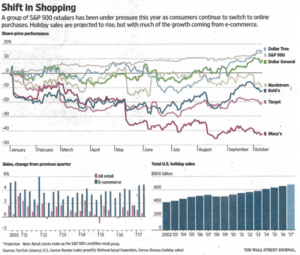

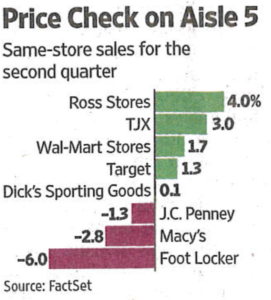

In early August US consumer sentiment jumped to its highest level since January. With unemployment continuing to head lower and a robust stock market, this is a trend that might continue. Unlike earlier in the year, consumers seem to now be putting their money where their mouth is. Consumer spending has increased rapidly and credit card debt is now at the highest level in US history. Old Navy, Dollar General, and Best Buy. The only path to sales growth seems to be through lower prices. That creates a painful choice between growth and profits and will force retailers to reduce their cost structure at the same time they are trying to build up E-commerce.

Old Navy, Dollar General, and Best Buy. The only path to sales growth seems to be through lower prices. That creates a painful choice between growth and profits and will force retailers to reduce their cost structure at the same time they are trying to build up E-commerce.

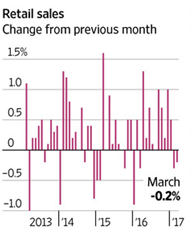

etail spending actually declined in the first quarter and GDP growth was a paltry 0.7%. Job gains were quite disappointing in March. We’ll learn the April numbers on Friday. It’s too early to blame this on the Trump administration. Anyone who knows anything about economics knows that it generally operates with lag times. That said, there is a gap between sky high expectations and things that have actually gotten done. Both consumer and CEO confidence have been at record highs (although now are beginning to drift down) but weak retail spending tells a different tale. Both companies and consumers are saying one thing but doing something different with their wallets. Employment and wage growth should support higher consumer spending but thus far has not.

etail spending actually declined in the first quarter and GDP growth was a paltry 0.7%. Job gains were quite disappointing in March. We’ll learn the April numbers on Friday. It’s too early to blame this on the Trump administration. Anyone who knows anything about economics knows that it generally operates with lag times. That said, there is a gap between sky high expectations and things that have actually gotten done. Both consumer and CEO confidence have been at record highs (although now are beginning to drift down) but weak retail spending tells a different tale. Both companies and consumers are saying one thing but doing something different with their wallets. Employment and wage growth should support higher consumer spending but thus far has not.

This year was highlighted by a Lifetime Achievement Award for former Mattel Chairman and CEO, Jill Barad, as well as a Gamechanger Award for Hollywood’s Geena Davis. Congratulations to all Wonder Women nominees and Award winners!

This year was highlighted by a Lifetime Achievement Award for former Mattel Chairman and CEO, Jill Barad, as well as a Gamechanger Award for Hollywood’s Geena Davis. Congratulations to all Wonder Women nominees and Award winners! Life at Toyjobs is often slow during the first quarter as toy companies are too busy traveling from show to show to be able to even think about or doing. That said, this year we have been quite busy to date with strong numbers of search starts and completions. Three consecutive years of strong sales growth has put toy companies into an optimistic mood. Optimistic companies try new things and add new people. I expect that to continue with a lone caveat.

Life at Toyjobs is often slow during the first quarter as toy companies are too busy traveling from show to show to be able to even think about or doing. That said, this year we have been quite busy to date with strong numbers of search starts and completions. Three consecutive years of strong sales growth has put toy companies into an optimistic mood. Optimistic companies try new things and add new people. I expect that to continue with a lone caveat.