There’s not that much new to report. Toy industry hiring is slowly continuing to trend higher. This despite the fact that the largest toy companies continue to lay people off. Mattel, Hasbro, Lego, etc. used to pump so many goods through Toys ‘R’ Us that they will never make up that volume. They will still be the largest toy companies, but they will be smaller than they were for the foreseeable future.

The exception is MGA. For all of Isaac Larian’s… let’s call them idiosyncrasies, he has been able to show that product is still King. It should also be noted that while MGA is a large company by sales volume, it’s not staffed like a large company.

Many small and medium-sized companies are much nimbler. They can develop product from start to finish at a much quicker pace. Unlike the big boys, they are not bogged down by meetings, meetings, meetings. It’s easier to turn a speedboat than an aircraft carrier – and you need far less people to man it.

Small and medium companies are also adapting by putting out a greater number of product lines but “skinnying” them up in the realization that except for a “toy warehouse” no other retailer is going to stock all those iterations and add-ons. They also have a far easier time replacing lost TRU volume by gaining a couple of extra feet at a Best Buy or a Cracker Barrel or a Kohl’s. Mattel can try to do that but it’s not even going to move the needle.

Since the Hong Kong Toy Show, many small and medium toy companies have been looking to add senior executives who can affect their businesses in a meaningful way. These companies have come to realize that good things aren’t going to just happen. They have to MAKE them happen. They are adding top people who can be game changers and drive new initiatives. While companies are adding senior people, they are not yet adding a lot of people overall. This senior executive hiring isn’t happening at all companies. I would put it at about 30%. That said, it is slowly but steadily broadening out.

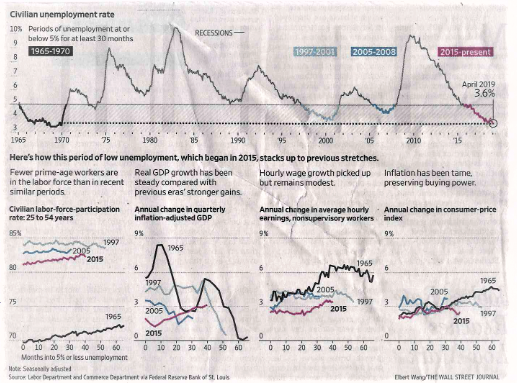

The toy industry has been fortunate in that if we had to lose a Toy’s ‘R’ Us it was best to do it against the backdrop of a strong economy. A few short months ago, economists were predicting a recession in 2019. No one is saying that anymore. Over the last five years, GDP numbers have been weak in the first quarter and picked up later in the year. The first quarter of 2019 saw a robust GDP of 3.2%. Will that number hold up in coming quarters? Who knows?… But the point is that the economy should continue to be strong.

The current leading candidate in the U.S.-China trade talks. The recent back chatter had been that both sides are backing down for some of their demands and looking to settle on face-saving half measures. Then Reuters reported that last Friday the Chinese sent over a copy of the trade agreement that they had marked up in a way that walked back months of negotiations. This provoked the Tweeter-in-Chief to start issuing a barrage of tariff escalation threats. We can only hope that this is mostly posturing. Both Xi and Trump are playing a dangerous game of chicken which threatens the global economy. The risk/reward ratio of this behavior is not favorable to anyone. Hopefully, everyone will just calm down and settle on a partial deal. That won’t solve things in the long run, but it’s better to dodge a bullet today as long as we’re moving in the right direction. We can only hope that cooler heads prevail.

Against this strong economic background, the toy industry will continue to have its challenges. More and more, small and medium-sized toy companies are meeting those head-on. I envision that toy industry hiring will continue to grow slowly but steadily. After a brief period of July summer doldrums, I expect that hiring will begin to gather steam as companies start to prepare for the 2020 toy sales cycle. Should a strong economy lead to a strong 2019 holiday sales season, I envision that early next year we will be approaching normalization. Let’s hope I’m not wrong.

All the Best,

Tom Keoughan