Proceed Quickly and with a Light Foot

Heading into 2024 toy manufacturers are mostly optimistic. The year 2022 had left us with an enormous inventory glut and retailers spent 2023 working down inventories. They ordered merchandise light and late. For Toyjobs that meant that the first four months was essentially dead. Fortunately, retail orders started finally advancing in May and consumers picked up the pace of their holiday shopping in November and December. Lo and behold, Christmas came once again.

The inventory pile up meant that most toy companies were flat to down 15% although there were a few exceptions. Flat to down isn’t good for anyone but let’s remember what we’re comparing it to. The pandemic pushed toy sales to rocket in 2020 and 2021. The pandemic wasn’t “normal” nor were the heightened sales volumes. We should instead be comparing our recent sales volumes to 2019. Those comps should lead us all to complain a little less loudly.

Retailers were mostly able to clear their inventories in 2023 and we’re coming into the new year pretty clean. Unfortunately, manufacturers still have excess goods stacked up in warehouses and sucking up storage fees. But on the whole, as we enter 2024, things look pretty positive.

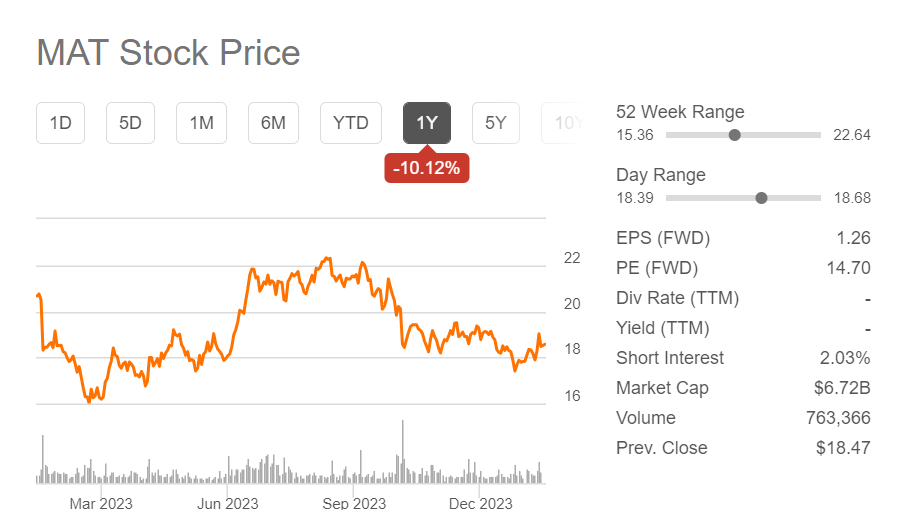

Voyeurs should have an interesting time watching a couple of our industry behemoths. First, an activist investor is trying to force major changes at Mattel whose stock is at the same level it was at twenty years ago. And Hasbro said that it laid off 800 people last year and will do another 1100 in 2024. Those numbers are huge for a company of their size. Personally, I’m always a little suspicious when a public company announces massive layoffs. Oftentimes, big cutbacks are announced for Wall St. but never quite actually happen, at least in the numbers that were initially publicized. I’m hearing that a lot of the downsizing will happen in Hasbro’s redundant international operations where they often have full Sales, Marketing, and Logistics teams in every country. I mean, do we really need separate full offices in Germany, Austria, AND Belgium? Additionally, I am expecting major changes at Hasbro over the next few years. Rumors are rife but we’ll have to wait and watch the action. Popcorn please!

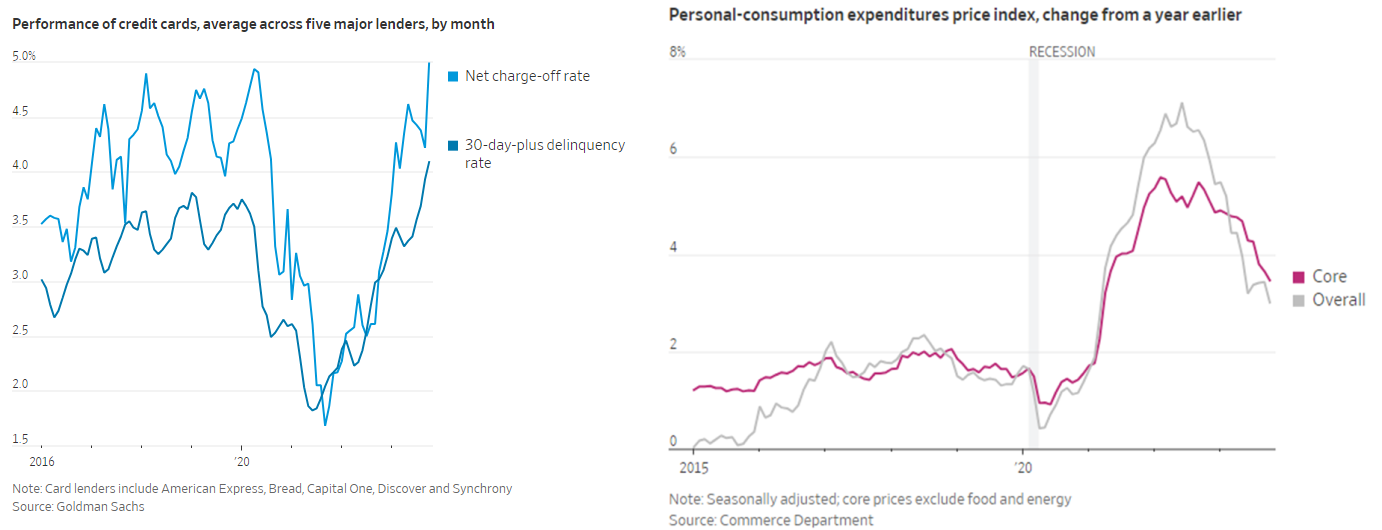

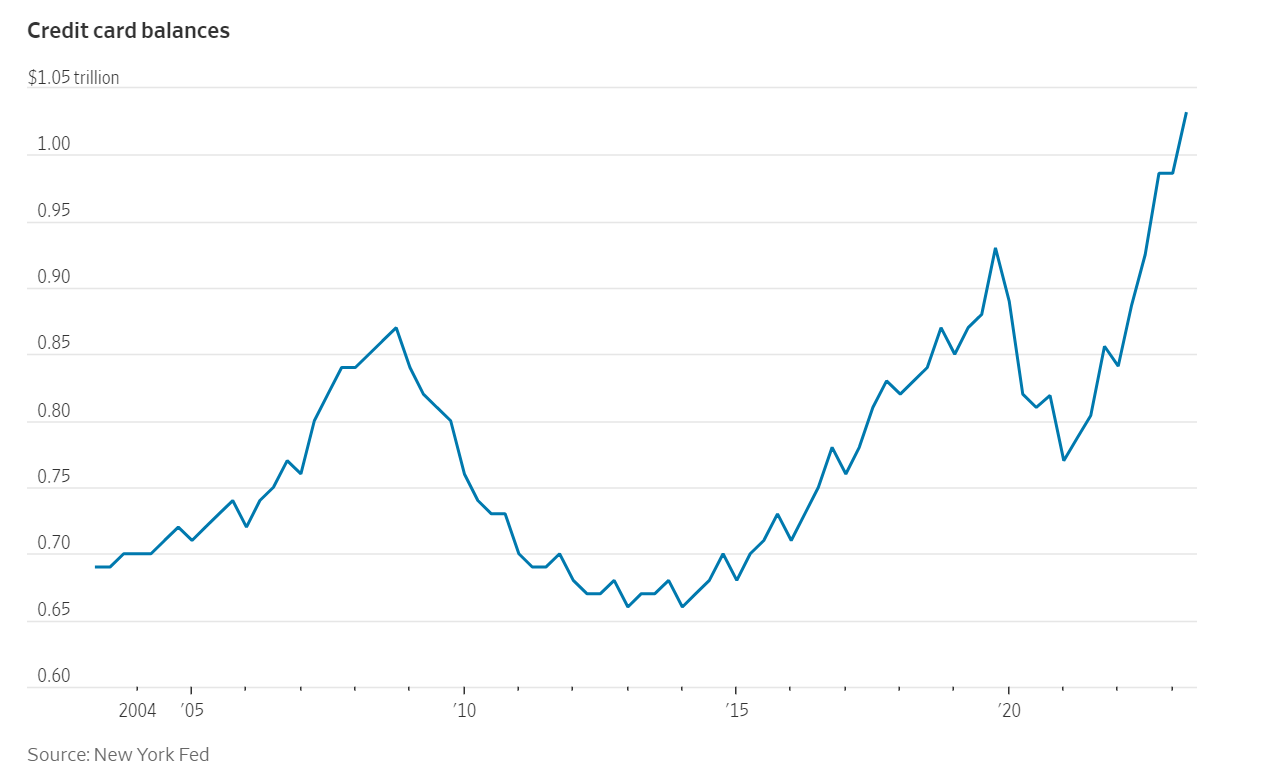

After a pretty miserable 2023, Toyjobs has started the year strong. Now that companies have crunched their holiday sales numbers and returned from Nuremburg, we expect hiring to accelerate. That said, there are some potential clouds on the horizon. Credit card balances are elevated and growing higher at a time when high interest rates are making it harder to pay them off. Delinquencies on credit cards have doubled over the last two years. At the same time consumer bank balances have dropped precipitously. Add to that buy now, pay later services like Afterpay and Klarna surged 14% last year and people who use those services are more than twice as likely to already be delinquent on something else like a credit card, car loan, or mortgage. The concern is that consumers as a group are overextended at a time when it’s harder to pay off snowballing debt. Will they get a grip on it by next holiday sales season? I don’t know but I tend to think not. This is not likely to end well. My advice is to proceed quickly but with a light foot. Think of tip toeing quickly over a rickety bridge. I’ll see you out there. Track shoes and umbrella.

Credit card balances are elevated and growing higher at a time when high interest rates are making it harder to pay them off. Delinquencies on credit cards have doubled over the last two years. At the same time consumer bank balances have dropped precipitously. Add to that buy now, pay later services like Afterpay and Klarna surged 14% last year and people who use those services are more than twice as likely to already be delinquent on something else like a credit card, car loan, or mortgage. The concern is that consumers as a group are overextended at a time when it’s harder to pay off snowballing debt. Will they get a grip on it by next holiday sales season? I don’t know but I tend to think not. This is not likely to end well. My advice is to proceed quickly but with a light foot. Think of tip toeing quickly over a rickety bridge. I’ll see you out there. Track shoes and umbrella.

All the best,

Tom Keoughan

Optimistic But Proceed With Caution

It has been a difficult year for toy companies due to a massive inventory glut. In 2022, retailers bulked up orders and advanced shipping timelines hoping to thwart continuing pandemic-related supply chain chaos. This left shelves at both stores and warehouses groaning with excess goods. Retailers have spent the year working down inventories. Orders for new goods were light and late as they both reduced quantity and narrowed variety to bestsellers. Many retailers now say that they cleaned up their stock and are on more solid footing.

It has been a difficult year for toy companies due to a massive inventory glut. In 2022, retailers bulked up orders and advanced shipping timelines hoping to thwart continuing pandemic-related supply chain chaos. This left shelves at both stores and warehouses groaning with excess goods. Retailers have spent the year working down inventories. Orders for new goods were light and late as they both reduced quantity and narrowed variety to bestsellers. Many retailers now say that they cleaned up their stock and are on more solid footing.

Light ordering meant less need for containerships and containers, the cost of which had skyrocketed during the pandemic. In addition, logistics companies ordered huge numbers of containerships to be built in the erroneous belief that demand would grow to the sky forever. Less need for shipping at a time of more ships has collapsed prices which is an obvious boon to manufacturers.

2023 has been a year to muddle and make it through. Most toy companies I speak with say they are flat to 15% down from 2022 sales. That said, they are almost uniformly optimistic about 2024. Their thinking is that reduced inventories and light ordering will largely empty the shelves by the end of the this year’s holiday sales season. Add in low transportation costs and companies are eagerly looking forward to 2024 with “Reasons to be Cheerful”:

However…despite gangbuster sales volumes during the five days from Thanksgiving through Cyber Monday overall retail sales have started to slow with an actual decline in October. Consumers are beginning to get squeezed by dwindling pandemic savings and the resumption of student loan payments. Job and wage growth has also started to slow. Perhaps most important is credit card debt. Credit card debt and delinquencies have soared this year and soared at a time of astronomical interest rates.

American spending habits might not be sustainable much longer. I’m not saying that consumers won’t be in for one last splurge during the holidays. In fact, I kinda think that will be the case. What I am concerned about is that the hangover could set in early next year and it promises to be a doozy.

A recession has been forecast for about two years now but consumer spending has kept it at bay. The consumer may be beginning to crack and the recession may be about to roll in.

That leaves us with a mixed view. My crystal ball is never very clear, but my best advice to friends, families, and toy companies is: “Proceed…but proceed with caution.” Of course, that’s my advice most of the time anyway so take it for what it’s worth.

Happy Holidays to All!

And a Happy Sell Through Season Too!

Tom Keoughan

What Will the Buyers Do?

In honor of New York Toy Fair, terrible weather hit the New York area as monsoon rains like something out of Southeast Asia ushered in the beginning of the show.

As always, first stop was the TOTY Awards and it was great to see so many people I hadn’t seen in so long. The venue was slam packed – “We’re going to need a bigger room.” While the awards were dominated by Barbie, LEGO, and Squishmallows as expected, it’s always good to see smaller companies like Playmonster, Thames & Kosmos, Magna-Tiles and WowWee break through for a prize. The night ran too long as these types of things tend to do but I liked the Gong Show buzzer thing which helped move things along. I would say that there was an awful lot of awards. More isn’t always better and often seems like it’s just a mechanism to sell more seats to the show.

The Toy Industry Hall of Fame honored several of the ancients and then both Mary Couzin and the Spin Master Triplets were well deserved inductees.

The show proper broke Saturday morning as the sun came out. Again it was good to see so many long lost faces. I spent day one on the main floor and while the mood was good, traffic seemed light. Some of that could probably be explained by all of the weather-related flight cancellations the day before. Mattel, Hasbro, and MGA were noticeably absent but these are the usual suspects that never support Toy Association trade shows anyway. It was good to see that LEGO stepped up and took a very large space front and center. Most companies organized combination open/closed booths which made the show inviting while allowing companies to maintain some confidentiality on their newer wares.

On Sunday, I hit the basement which seemed much better lit than usual although it looked to me like there was less exhibitor space than I remember. It also seemed that many traditional “basement dwellers” had moved upstairs. Traffic was strong and I was surprised that the majority of companies told me that traffic had been heavy there the day before as well. By now the major retail buyers had filtered in and I was heartened to hear that almost all of the important retailers were in attendance.

On day three, I woke up to find that my feet were already completely numb. I decided that was probably a good thing. If I couldn’t even feel them then my feet probably wouldn’t hurt too much that day. It was mop up time and I focused on trying to see anybody I hadn’t already seen. Traffic again seemed stronger than on day one but what was glaringly obvious was that the mom-and-pop store trade were not attending the show. That could have been partially because of the weather. It could have been because of the high cost of New York in September/October vs. February. It could have been partially because they were already set up for holiday sales 2023. Mostly, I think it’s because this wasn’t the right time of the year for them. They weren’t ready to think about the 2024 holidays and their pockets weren’t already stuffed with this year’s Christmas cash.

Every exhibitor I spoke with was happy with the show’s results and that’s what really counts, isn’t it? There seemed to be fewer exhibitors. Traffic seemed light. But although attendance was quantity light it was quality dense and manufacturers were able to have productive meetings with almost all of their key customers like: Walmart, Target, Amazon, Costco, Barnes & Noble, etc.

So, while New York Toy Fair was a success despite being somewhere “lesser than” the real hubbub was all about the future. The murmurs started even before the show began but by Sunday, the news was out. It had been decided, even before the show began, that Toy Fair was moving back to the early part of the year (probably a good thing) and that as of 2026 it was moving to New Orleans. Where?! What?! Who?!

WAIT! STOP PRESSES!

The next several paragraphs were about how, while I really like New Orleans, having a trade show there at the proposed times could be quite problematic (conflicting shows, Super Bowls, Mardi Gras, etc).

The Toy Association’s Board of Directors has just announced that they are deep sixing New Orleans in favor of keeping Toy Fair in New York.

I am therefore scrapping what was a small screed and will simply say that we’ll give The Toy Association a plus for responsiveness but a minus for creating unnecessary mayhem.

We now return to our regularly scheduled program…

Lastly, we come to the September Previews. The time seems right for previews whether in LA, Dallas, or someplace else. Lots of toy companies are already having previews. Lots of companies are building showrooms or taking space in LA. The rest of us have often been told that we can’t have a full blown show there because they can’t find a venue but nobody really believes that. Reality is that the West Coast behemoths (Mattel, MGA, etc.) don’t want their smaller, nimbler competitors anywhere near the retailers. They want to monopolize all of the buyers time for themselves. If you scheduled a proper trade show they would simply switch their dates. Buyers themselves aren’t going to keep going back and forth repeatedly either.

September in LA is going to continue to grow in importance. Even mid-sized companies should probably put a stake in the ground and build a showroom out there. Use it as your licensing office in the off-season. The key question in terms of the exact show scheduling should be: what will the buyers do? After all, that’s really who you’re trying to attract. Without buyers you might as well be a bunch of people sitting on folding chairs sunning themselves at the flea market. How long will buyers be willing to stay on the road? How many consecutive buying trips will they be willing to take? How many clean shirts will they be willing to invest in? And can they all find hotels that include laundry service? Figure out what the buyers will do and work backwards from there.

When it comes to tradeshows, like so much in business, it comes down to listening to your customers. Amidst all the brouhaha and second-guessing, the real question is: “What will the buyers do?” In an inverse to The Field of Dreams – if they’ll come, you should build it.

All the best,

Tom Keoughan

Toy Industry Limping but Picking Up Speed

It’s been a difficult year for the toy industry. So, what else is new? It’s always something…and it’s usually something different. The inventory glut meant very little early year restocking by retailers. This has continued with buyers ordering less and late.

Most toy companies shutdown hiring and many even had layoffs during the first third of the year. But somewhere in the backs of our minds, we knew that if retailers wanted any new product at all for the holiday shopping season, they would have to turn “happy talk” into paper by about May 1st. While no one thought that would set off wholesale hiring, many of my clients were telling me that they needed one or two key players but that they weren’t going to commit to any hiring until retailers committed to orders. Privately, I was predicting/hoping that when the orders began the toy business would get a much needed jumpstart. In early May, with my fingers crossed, my phone began to ring…

It’s been a busy summer and Toyjobs has been, and is in, the process of filling lot of Sales jobs. I’m hoping that after September previews and the New York Toy Fair that things will begin to open up for Marketing and Product Development jobs as well.

I view the pandemic like an asteroid hitting the ocean. First, we experienced a tsunami or two. Then BIG WAVES. The waves are slowly getting smaller now but the ripples will be felt for years.

For the toy industry, it has been a wild ride. From pandemic to shutdowns to amped up sales to supply chain crises and finally to inventory gluts. Retail short ordering will likely lead to empty shelves by the end of the year. Next year should see even smaller waves and business returning to something approaching normal. Stay focused. We’re through the worst of it.

I look forward to seeing you all in New York at the first major toy fair since 2020 (God, I hate the Javits Center 😊)

Tom Keoughan

Deciphering the Jobs Report

Employment numbers seem to be a mad jumble. Is unemployment going up or going down? Are companies laying off or hiring? …or both? Last Fridays Jobs Report showed that 311,000 jobs were added yet the unemployment rate had moved up from 3.4% to 3.6%. How does that work?

As for the unemployment rate – more people “joined the workforce.” In the Department of Labor survey, if you say that you aren’t actively looking for work then you aren’t counted as part of the workforce. As people run out of government pandemic money at the same time that high inflation has everything costing more; more people get off of the sofa and start looking for work. They are then counted as “part of the workforce” and until they find a job, they are unemployed. The Labor Department considers sofa time to be some sort of a magic limbo as if when people starting looking for work they suddenly POP! into existence.

image via everydaysciencestuff.com

As for hiring trends, they are still being driven by the reverberations of the pandemic. The Covid pandemic has been the largest mass event in most of our lifetimes. It was like a giant asteroid hit the ocean. No Bruce Willis to save us this time. The big splash sent tsunamis in every direction. The waves are smaller now but they are still pretty high and are still driving everything in their paths. It could take five or even ten years before the waves subside into ripples.

The pandemic affected the various sectors of the economy in different ways – some subtle, some more profound. Early on bars, restaurants, hotels, gyms, and spas all shut down, throwing all of those employees out of work. As people were staying home, ecommerce, streaming, and every manner of internet-related business boomed and had to be staffed up at a rapid clip.

image via statistica.com

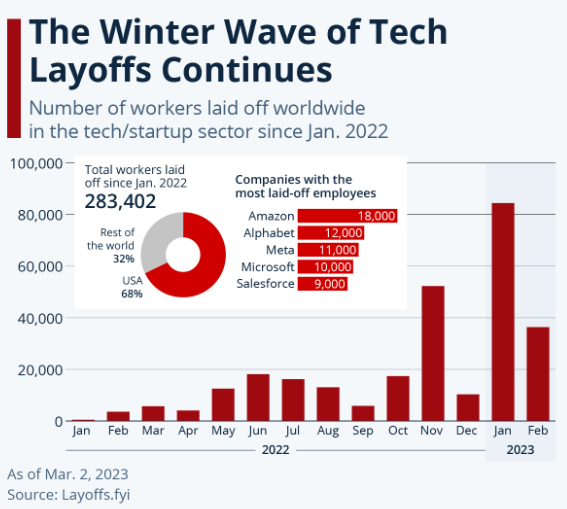

Currently, as we get back toward normal, the previously shuttered service economy is cranking up and all of those businesses are trying to restaff. At the same time, large tech companies extrapolated their rapid growth into the future and thought their businesses would quickly grow to the sky. They overhired on a massive scale and, as a result, are now laying off employees in droves.

In the toy industry, and in most consumer product businesses, people were working from home and they weren’t going out socially either. They feathered their nests and made their homes into castles. They loaded up on consumer goods – if they could get them. At the same time they were working from home, their kids were home, too. They were in school at home – sort of. Parents needed to find things to help their kids learn at home, be entertained at home, and…keep them occupied. This meant everything from toys to learning aids to arts and crafts to big backyard pools. Toy sales had a couple years of stellar growth. As consumer products sales rocketed up, inevitably supply chains began to experience shortages from start to finish in everything from raw materials, factory time, workers, and especially transportation.

After retailers were unable to get enough goods in 2021 to maximize their sales, they shifted their strategy. They ordered sooner, they ordered more, they ordered repeatedly. Manufacturers also wanted to maximize their sales so they were happy to ship more and ship early to make sure that their goods would reach the shelves in time for the 2022 holiday sales season.

Unfortunately, this was taking place just as we were moving into a period of sky high inflation. Inflation was particularly bad in the oil sector which, in turn, has feedback loops into everything else. For the toy industry, oil = plastics = raw materials. It is also the fuel for transportation from trucks to container ships and back to tracks again. Inflation caused consumers to start to buy less.

Toy sales for 2022 were flat. That said, it was a bit hard to shed too many tears after the incredible growth rates of 17% in 2020 and another 14% in 2021. After a couple of years like that, flat ain’t so bad. The real damage came because just as retailers and manufacturers were ramping up the consumer was dialing it down. This left us with an enormous inventory glut. In our last newsletter, we joked that Walmart might be holding Big Merch Bonfires in their most rural parking lots. That was tongue in cheek. Six weeks later, we’re hearing serious recurring rumors that Walmart dumped $1 billion dollars of merchandise at TJ Maxx.

image via SILive.com

This is leading to a very tough first half for toy companies. True to form retailers are laying much of the financial responsibility for the inventory glut at the feet of their suppliers. Mark downs, chargebacks, call them what you will. “When times are good, we own the goods. When times are bad, we’re a consignment shoppe.” There is no post-holiday resupply and with so many marked down goods out there, it’s difficult for manufacturers to clear their own inventory. For 2023, retailers are playing it very close to the vest. They’re ordering slower. They’re ordering smaller. Their hope seems to be that they’ll be able to reorder when the inventory glut clears. Additionally, that gives top performers time to reveal themselves. The big question is will retailers place large enough orders to fulfill their holiday sales needs and will they place them soon enough to be built and shipped in time? Toy companies are left trying to decide whether to build and hold or just build less. With retailers’ most recent, of many recurring examples, that they are NOT suppliers’ partners red hot in their memories, and their pockets I suspect, that manufacturers will do the latter. I would not be surprised to see an inventory shortage and early empty shelves in holiday sales season 2023. This will be a difficult year but hopefully it is one of transition which helps reset the table for 2024 and beyond. It would be good to see the post pandemic waves continue to diminish to a level that it just a bit easier to navigate.

What does this all mean for toy industry hiring? I’m sure you’ve all seen the news of toy company layoffs. Especially the large ones like Hasbro and Mattel. Over the last two weeks there have been a smattering of smaller layoffs at smaller companies as well. Toyjobs has filled a few searches that were carryovers from projects that we started and expected to close last year. Thus far in 2023, there have been very few new search starts. There is a potential cloud break that I’m hearing about but not yet seeing. Many of my clients are telling me that they are planning to hire people but are being cautious until they get larger commitments from retailers. If retailers want goods to arrive in time for the holiday sales season they probably have to make those commitments by some time in May at the latest. I’m still not seeing it yet. It could be a sweet whisper on the wind…or it could be a siren song.

image via aphunniblog.edu

Keep your weight on the back foot,

Tom Keoughan

Toyjobs First Half Forecast

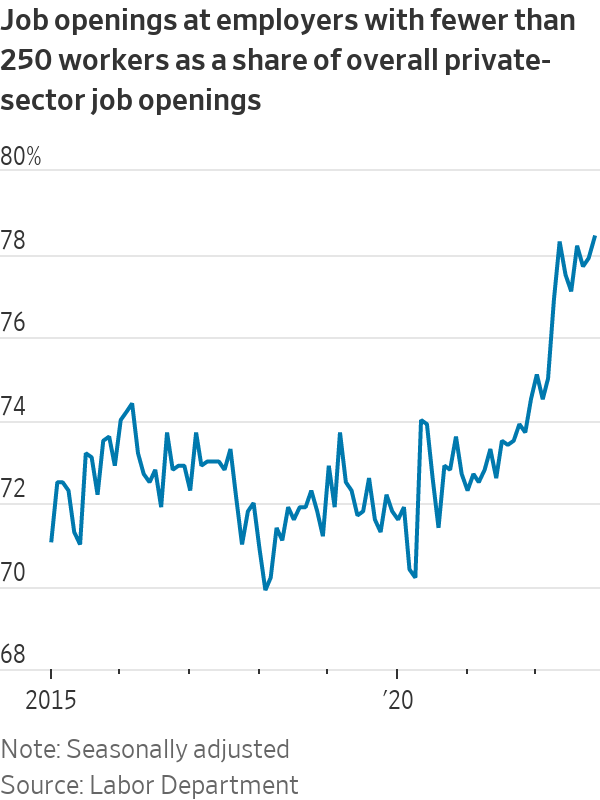

While the much ballyhooed recession hasn’t hit yet, we do see signs of the economy starting to slow. Consumers, having been squeezed by high inflation and rising interest rates, have cut back on retail spending in both November and December. As the consumer goes – so goes the U.S. economy and companies are responding by beginning to pause hiring. While hiring was extremely robust in 2022, it is now also in the early stages of cooling down. I would say that December – January looks like an inflection point.

image via wsj.com

The slowing rate of hiring will change the negotiating dynamic between hirers and hirees. During the last couple of years when workers have been hard to find, employees held the upper hand and could demand higher wages, greater workplace flexibility, etc. Over time the negotiating dynamic swings back and forth like a pendulum driven by economic conditions. But this pendulum effect also has a lag time as both parties tend to think that the environment is in their favor for longer than it really is. They also try to hold on to the advantage for as long as possible. This is true on both sides of the equation – employers and employees. We are right now at an inflection point where the employee advantage is just beginning to slip away but employees are not ready to believe it or admit it to themselves, while for employers it is still a bit too early to start applying pressure.

Amidst this backdrop, the toy industry has its own set of problems which should be acute during the first half of 2023. Slower holiday sales have left us with a massive inventory glut both at the retail and the manufacturer level. Retailers have been advertising huge discounts. I wouldn’t be surprised if Walmart starting having Big Merch Bonfires in their most rural parking lots. Not only does this mean large markdowns for manufacturers but also that they are unlikely to have much in the way of first quarter resupply orders.

Second, China’s recent lurch from a policy of Covid Zero to Que Sera? Sera? Is leading to massive waves of infection across the country. While this will eventually begin to peter out the sudden change may prove to be especially hard on for China’s large elderly population which is severely under-vaccinated and when they are vaccinated it is with less effective vaccines. Knowing what we know about China’s demographics, a more cynical person might wonder if there wasn’t something sinister going on?

Additionally, we are in the midst of the Chinese Lunar New Year holidays and urban workers will be spreading Covid to families in the hinterlands where healthcare facilities are sparse and subpar. How might the health of families affect if and when workers return to their job?

Lastly, as China works its way through its self-manufactured Covid spike and begins to reopen that will cause the price of oil and therefor plastics to surge. An increasing price for key materials can’t be good for margins.

On the upside, the supply chain is continuing to unkink and it is predicted to be back close to “normal” by mid-year. We’ll have to wait and see how the change in China’s Covid policy affects that timeline. Additionally, it is a strong year for kids movie releases, coming especially from Disney and Hasbro. Hopefully that will help drive consumers back to the stores next fall.

Additionally, it is a strong year for kids movie releases, coming especially from Disney and Hasbro. Hopefully that will help drive consumers back to the stores next fall.

How does this all translate into toy industry hiring? At Toyjobs we are coming off an excellent 2022. That said, in January search starts have slowed but not stopped. To an extent, this is true every year as many retailers and manufacturers are still finishing up crunching their 2022 holidays sales numbers. My prediction is that for the first half of 2023, large toy companies will do very little hiring. Small companies will continue to do less but some hiring of key players. In a small company, it’s much harder to distribute additional workload across a small staff. Beyond the first half? I got nothin’…except to say that I think things will be better than the previous six months.

All the best,

Tom Keoughan