Proceed Quickly and with a Light Foot

Heading into 2024 toy manufacturers are mostly optimistic. The year 2022 had left us with an enormous inventory glut and retailers spent 2023 working down inventories. They ordered merchandise light and late. For Toyjobs that meant that the first four months was essentially dead. Fortunately, retail orders started finally advancing in May and consumers picked up the pace of their holiday shopping in November and December. Lo and behold, Christmas came once again.

The inventory pile up meant that most toy companies were flat to down 15% although there were a few exceptions. Flat to down isn’t good for anyone but let’s remember what we’re comparing it to. The pandemic pushed toy sales to rocket in 2020 and 2021. The pandemic wasn’t “normal” nor were the heightened sales volumes. We should instead be comparing our recent sales volumes to 2019. Those comps should lead us all to complain a little less loudly.

Retailers were mostly able to clear their inventories in 2023 and we’re coming into the new year pretty clean. Unfortunately, manufacturers still have excess goods stacked up in warehouses and sucking up storage fees. But on the whole, as we enter 2024, things look pretty positive.

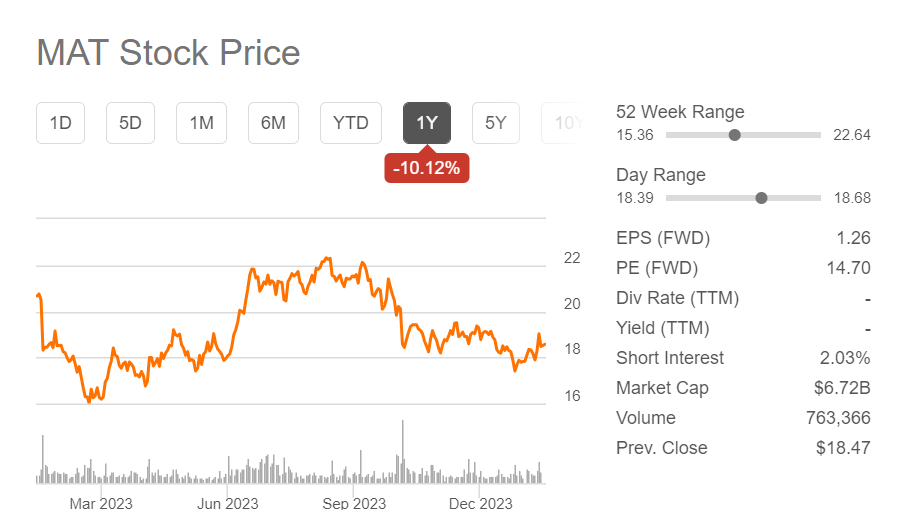

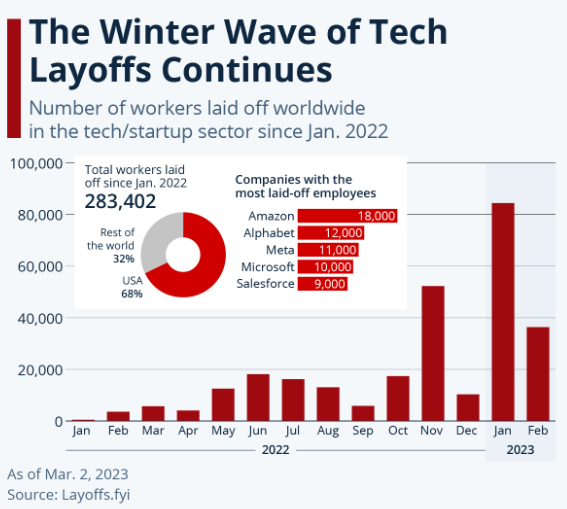

Voyeurs should have an interesting time watching a couple of our industry behemoths. First, an activist investor is trying to force major changes at Mattel whose stock is at the same level it was at twenty years ago. And Hasbro said that it laid off 800 people last year and will do another 1100 in 2024. Those numbers are huge for a company of their size. Personally, I’m always a little suspicious when a public company announces massive layoffs. Oftentimes, big cutbacks are announced for Wall St. but never quite actually happen, at least in the numbers that were initially publicized. I’m hearing that a lot of the downsizing will happen in Hasbro’s redundant international operations where they often have full Sales, Marketing, and Logistics teams in every country. I mean, do we really need separate full offices in Germany, Austria, AND Belgium? Additionally, I am expecting major changes at Hasbro over the next few years. Rumors are rife but we’ll have to wait and watch the action. Popcorn please!

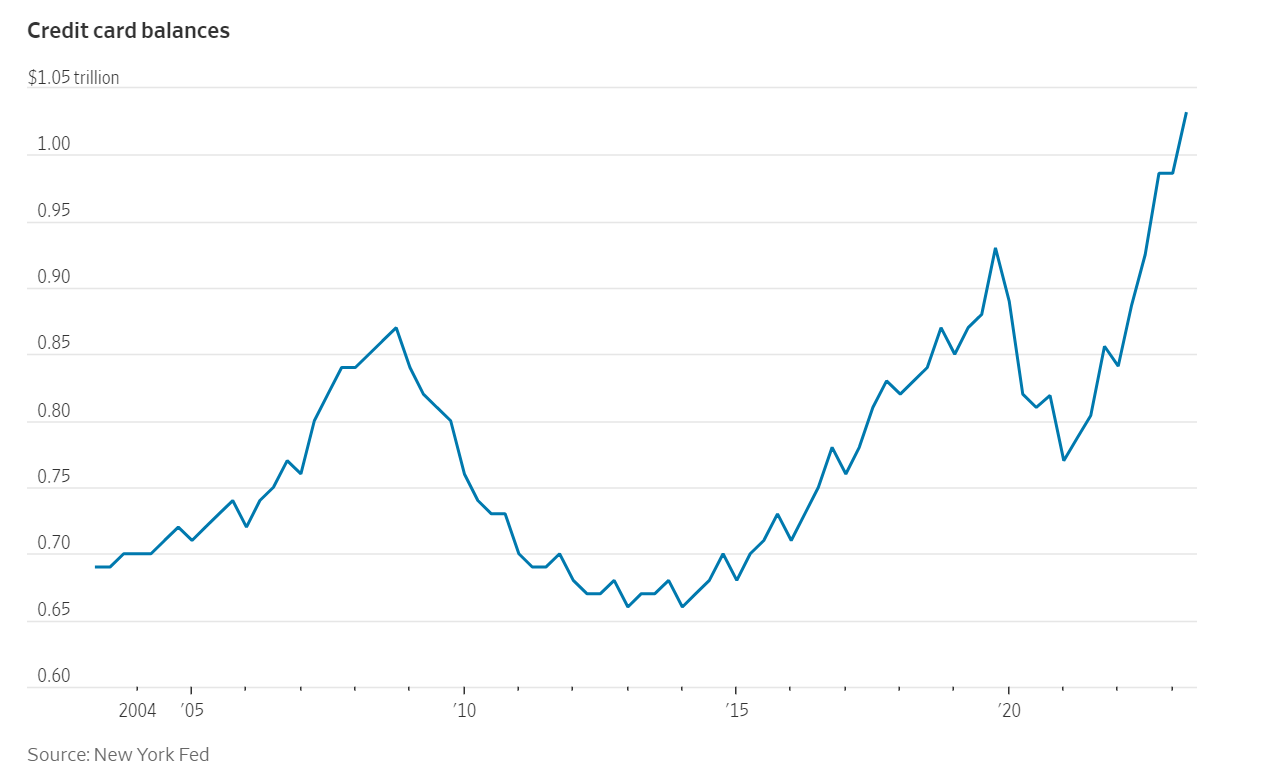

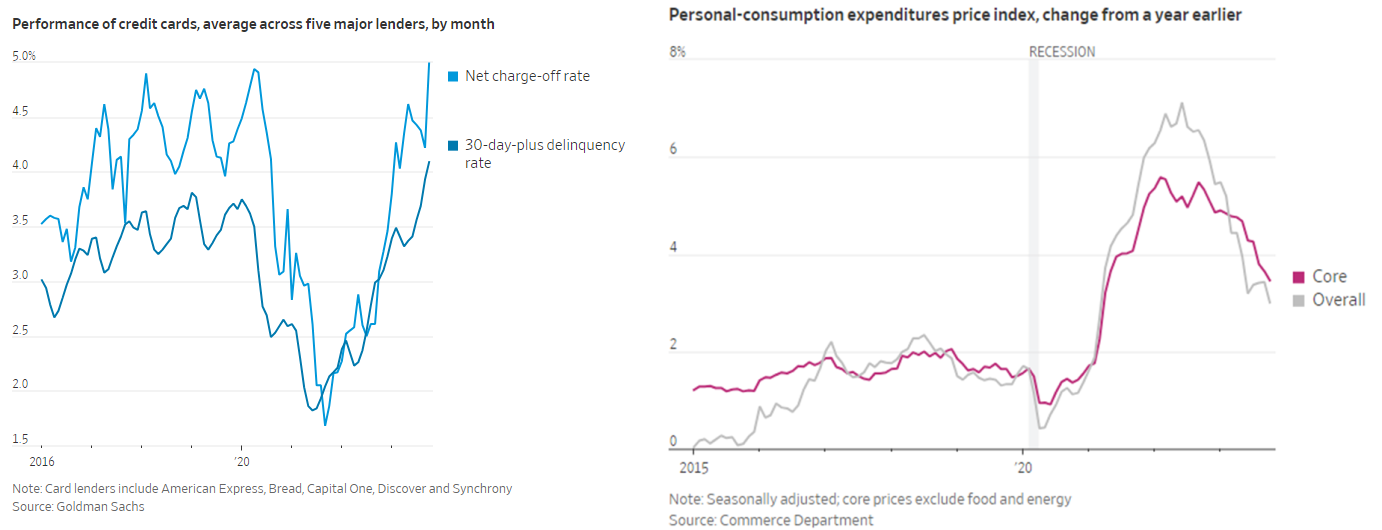

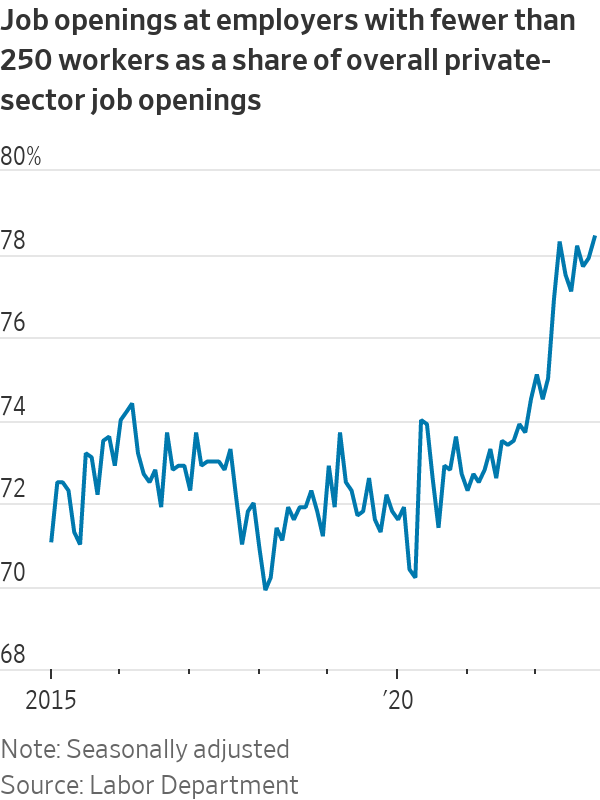

After a pretty miserable 2023, Toyjobs has started the year strong. Now that companies have crunched their holiday sales numbers and returned from Nuremburg, we expect hiring to accelerate. That said, there are some potential clouds on the horizon. Credit card balances are elevated and growing higher at a time when high interest rates are making it harder to pay them off. Delinquencies on credit cards have doubled over the last two years. At the same time consumer bank balances have dropped precipitously. Add to that buy now, pay later services like Afterpay and Klarna surged 14% last year and people who use those services are more than twice as likely to already be delinquent on something else like a credit card, car loan, or mortgage. The concern is that consumers as a group are overextended at a time when it’s harder to pay off snowballing debt. Will they get a grip on it by next holiday sales season? I don’t know but I tend to think not. This is not likely to end well. My advice is to proceed quickly but with a light foot. Think of tip toeing quickly over a rickety bridge. I’ll see you out there. Track shoes and umbrella.

Credit card balances are elevated and growing higher at a time when high interest rates are making it harder to pay them off. Delinquencies on credit cards have doubled over the last two years. At the same time consumer bank balances have dropped precipitously. Add to that buy now, pay later services like Afterpay and Klarna surged 14% last year and people who use those services are more than twice as likely to already be delinquent on something else like a credit card, car loan, or mortgage. The concern is that consumers as a group are overextended at a time when it’s harder to pay off snowballing debt. Will they get a grip on it by next holiday sales season? I don’t know but I tend to think not. This is not likely to end well. My advice is to proceed quickly but with a light foot. Think of tip toeing quickly over a rickety bridge. I’ll see you out there. Track shoes and umbrella.

All the best,

Tom Keoughan

Additionally, it is a strong year for kids movie releases, coming especially from Disney and Hasbro. Hopefully that will help drive consumers back to the stores next fall.

Additionally, it is a strong year for kids movie releases, coming especially from Disney and Hasbro. Hopefully that will help drive consumers back to the stores next fall.

The toy industry faces choppy seas as we move into the holidays sales season. Many retailers asked for product to be brought in early this year as they sought to avert a repeat of 2021 when supply chain congestion caused product delays and shortages. They are now dealing with an inventory glut of overstocked shelves and stuffed warehouses.

The toy industry faces choppy seas as we move into the holidays sales season. Many retailers asked for product to be brought in early this year as they sought to avert a repeat of 2021 when supply chain congestion caused product delays and shortages. They are now dealing with an inventory glut of overstocked shelves and stuffed warehouses.

The annual hangover will occur in the first quarter of next year when consumers look at their elevated credit card balances and the sky-high interest rates they will have to pay. That will likely coincide with the recession hitting in earnest. Hangover 2023 may prove to be particularly nasty.

The annual hangover will occur in the first quarter of next year when consumers look at their elevated credit card balances and the sky-high interest rates they will have to pay. That will likely coincide with the recession hitting in earnest. Hangover 2023 may prove to be particularly nasty.

ue to be tight. Supply chain woes continue with sky high material costs, chip shortages, the apparent alien abduction of all of the world’s truck drivers and an endless game of Chinese lockdown Whac-a-mole.

ue to be tight. Supply chain woes continue with sky high material costs, chip shortages, the apparent alien abduction of all of the world’s truck drivers and an endless game of Chinese lockdown Whac-a-mole. Email? Text? Smoke Signal? It doesn’t seem to matter. Never before in human history have there been so many ways to communicate and never before are so many people so desperate not to do so. With many people rejecting to even have a yes or no choice about a potentially advantageous career move we end up having smaller pools of candidates. It seems to affect Marketing people the worst. Salespeople don’t do this. Designers of the same age group don’t do this. The very people who are supposed to have the most business savvy seem to be the least savvy about their own personal business and careers. Ah well, end of screed.

Email? Text? Smoke Signal? It doesn’t seem to matter. Never before in human history have there been so many ways to communicate and never before are so many people so desperate not to do so. With many people rejecting to even have a yes or no choice about a potentially advantageous career move we end up having smaller pools of candidates. It seems to affect Marketing people the worst. Salespeople don’t do this. Designers of the same age group don’t do this. The very people who are supposed to have the most business savvy seem to be the least savvy about their own personal business and careers. Ah well, end of screed. Add to that an increasing interest rate environment and a Fed which does not have a very good record at engineering soft landings and I see clouds (or is it smoke) on the horizon for 2023. Now is the season to be hoarding your acorns. Winter is coming.

Add to that an increasing interest rate environment and a Fed which does not have a very good record at engineering soft landings and I see clouds (or is it smoke) on the horizon for 2023. Now is the season to be hoarding your acorns. Winter is coming.