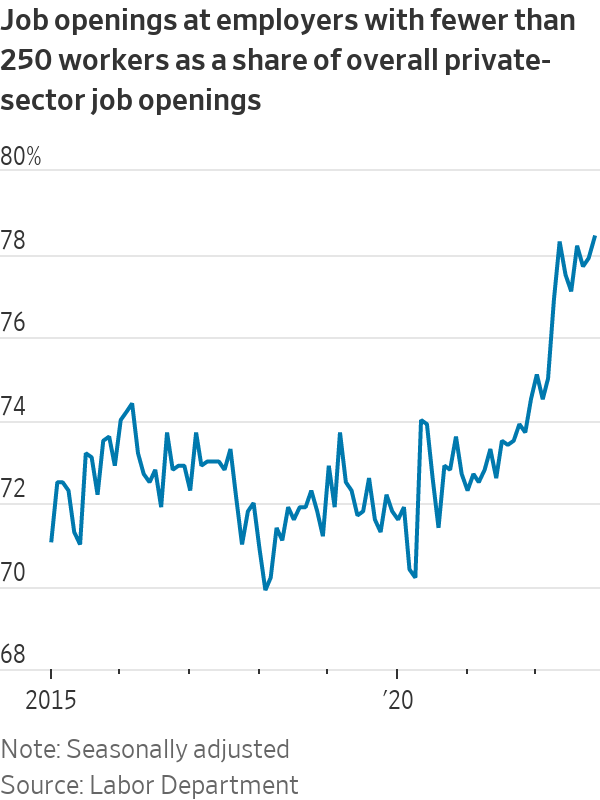

While the much ballyhooed recession hasn’t hit yet, we do see signs of the economy starting to slow. Consumers, having been squeezed by high inflation and rising interest rates, have cut back on retail spending in both November and December. As the consumer goes – so goes the U.S. economy and companies are responding by beginning to pause hiring. While hiring was extremely robust in 2022, it is now also in the early stages of cooling down. I would say that December – January looks like an inflection point.

image via wsj.com

The slowing rate of hiring will change the negotiating dynamic between hirers and hirees. During the last couple of years when workers have been hard to find, employees held the upper hand and could demand higher wages, greater workplace flexibility, etc. Over time the negotiating dynamic swings back and forth like a pendulum driven by economic conditions. But this pendulum effect also has a lag time as both parties tend to think that the environment is in their favor for longer than it really is. They also try to hold on to the advantage for as long as possible. This is true on both sides of the equation – employers and employees. We are right now at an inflection point where the employee advantage is just beginning to slip away but employees are not ready to believe it or admit it to themselves, while for employers it is still a bit too early to start applying pressure.

Amidst this backdrop, the toy industry has its own set of problems which should be acute during the first half of 2023. Slower holiday sales have left us with a massive inventory glut both at the retail and the manufacturer level. Retailers have been advertising huge discounts. I wouldn’t be surprised if Walmart starting having Big Merch Bonfires in their most rural parking lots. Not only does this mean large markdowns for manufacturers but also that they are unlikely to have much in the way of first quarter resupply orders.

Second, China’s recent lurch from a policy of Covid Zero to Que Sera? Sera? Is leading to massive waves of infection across the country. While this will eventually begin to peter out the sudden change may prove to be especially hard on for China’s large elderly population which is severely under-vaccinated and when they are vaccinated it is with less effective vaccines. Knowing what we know about China’s demographics, a more cynical person might wonder if there wasn’t something sinister going on?

Additionally, we are in the midst of the Chinese Lunar New Year holidays and urban workers will be spreading Covid to families in the hinterlands where healthcare facilities are sparse and subpar. How might the health of families affect if and when workers return to their job?

Lastly, as China works its way through its self-manufactured Covid spike and begins to reopen that will cause the price of oil and therefor plastics to surge. An increasing price for key materials can’t be good for margins.

On the upside, the supply chain is continuing to unkink and it is predicted to be back close to “normal” by mid-year. We’ll have to wait and see how the change in China’s Covid policy affects that timeline. Additionally, it is a strong year for kids movie releases, coming especially from Disney and Hasbro. Hopefully that will help drive consumers back to the stores next fall.

Additionally, it is a strong year for kids movie releases, coming especially from Disney and Hasbro. Hopefully that will help drive consumers back to the stores next fall.

How does this all translate into toy industry hiring? At Toyjobs we are coming off an excellent 2022. That said, in January search starts have slowed but not stopped. To an extent, this is true every year as many retailers and manufacturers are still finishing up crunching their 2022 holidays sales numbers. My prediction is that for the first half of 2023, large toy companies will do very little hiring. Small companies will continue to do less but some hiring of key players. In a small company, it’s much harder to distribute additional workload across a small staff. Beyond the first half? I got nothin’…except to say that I think things will be better than the previous six months.

All the best,

Tom Keoughan

Leave A Comment