Employment numbers seem to be a mad jumble. Is unemployment going up or going down? Are companies laying off or hiring? …or both? Last Fridays Jobs Report showed that 311,000 jobs were added yet the unemployment rate had moved up from 3.4% to 3.6%. How does that work?

As for the unemployment rate – more people “joined the workforce.” In the Department of Labor survey, if you say that you aren’t actively looking for work then you aren’t counted as part of the workforce. As people run out of government pandemic money at the same time that high inflation has everything costing more; more people get off of the sofa and start looking for work. They are then counted as “part of the workforce” and until they find a job, they are unemployed. The Labor Department considers sofa time to be some sort of a magic limbo as if when people starting looking for work they suddenly POP! into existence.

image via everydaysciencestuff.com

As for hiring trends, they are still being driven by the reverberations of the pandemic. The Covid pandemic has been the largest mass event in most of our lifetimes. It was like a giant asteroid hit the ocean. No Bruce Willis to save us this time. The big splash sent tsunamis in every direction. The waves are smaller now but they are still pretty high and are still driving everything in their paths. It could take five or even ten years before the waves subside into ripples.

The pandemic affected the various sectors of the economy in different ways – some subtle, some more profound. Early on bars, restaurants, hotels, gyms, and spas all shut down, throwing all of those employees out of work. As people were staying home, ecommerce, streaming, and every manner of internet-related business boomed and had to be staffed up at a rapid clip.

image via statistica.com

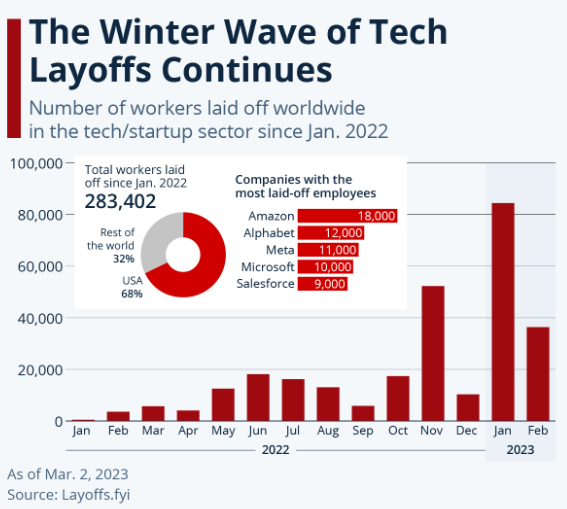

Currently, as we get back toward normal, the previously shuttered service economy is cranking up and all of those businesses are trying to restaff. At the same time, large tech companies extrapolated their rapid growth into the future and thought their businesses would quickly grow to the sky. They overhired on a massive scale and, as a result, are now laying off employees in droves.

In the toy industry, and in most consumer product businesses, people were working from home and they weren’t going out socially either. They feathered their nests and made their homes into castles. They loaded up on consumer goods – if they could get them. At the same time they were working from home, their kids were home, too. They were in school at home – sort of. Parents needed to find things to help their kids learn at home, be entertained at home, and…keep them occupied. This meant everything from toys to learning aids to arts and crafts to big backyard pools. Toy sales had a couple years of stellar growth. As consumer products sales rocketed up, inevitably supply chains began to experience shortages from start to finish in everything from raw materials, factory time, workers, and especially transportation.

After retailers were unable to get enough goods in 2021 to maximize their sales, they shifted their strategy. They ordered sooner, they ordered more, they ordered repeatedly. Manufacturers also wanted to maximize their sales so they were happy to ship more and ship early to make sure that their goods would reach the shelves in time for the 2022 holiday sales season.

Unfortunately, this was taking place just as we were moving into a period of sky high inflation. Inflation was particularly bad in the oil sector which, in turn, has feedback loops into everything else. For the toy industry, oil = plastics = raw materials. It is also the fuel for transportation from trucks to container ships and back to tracks again. Inflation caused consumers to start to buy less.

Toy sales for 2022 were flat. That said, it was a bit hard to shed too many tears after the incredible growth rates of 17% in 2020 and another 14% in 2021. After a couple of years like that, flat ain’t so bad. The real damage came because just as retailers and manufacturers were ramping up the consumer was dialing it down. This left us with an enormous inventory glut. In our last newsletter, we joked that Walmart might be holding Big Merch Bonfires in their most rural parking lots. That was tongue in cheek. Six weeks later, we’re hearing serious recurring rumors that Walmart dumped $1 billion dollars of merchandise at TJ Maxx.

image via SILive.com

This is leading to a very tough first half for toy companies. True to form retailers are laying much of the financial responsibility for the inventory glut at the feet of their suppliers. Mark downs, chargebacks, call them what you will. “When times are good, we own the goods. When times are bad, we’re a consignment shoppe.” There is no post-holiday resupply and with so many marked down goods out there, it’s difficult for manufacturers to clear their own inventory. For 2023, retailers are playing it very close to the vest. They’re ordering slower. They’re ordering smaller. Their hope seems to be that they’ll be able to reorder when the inventory glut clears. Additionally, that gives top performers time to reveal themselves. The big question is will retailers place large enough orders to fulfill their holiday sales needs and will they place them soon enough to be built and shipped in time? Toy companies are left trying to decide whether to build and hold or just build less. With retailers’ most recent, of many recurring examples, that they are NOT suppliers’ partners red hot in their memories, and their pockets I suspect, that manufacturers will do the latter. I would not be surprised to see an inventory shortage and early empty shelves in holiday sales season 2023. This will be a difficult year but hopefully it is one of transition which helps reset the table for 2024 and beyond. It would be good to see the post pandemic waves continue to diminish to a level that it just a bit easier to navigate.

What does this all mean for toy industry hiring? I’m sure you’ve all seen the news of toy company layoffs. Especially the large ones like Hasbro and Mattel. Over the last two weeks there have been a smattering of smaller layoffs at smaller companies as well. Toyjobs has filled a few searches that were carryovers from projects that we started and expected to close last year. Thus far in 2023, there have been very few new search starts. There is a potential cloud break that I’m hearing about but not yet seeing. Many of my clients are telling me that they are planning to hire people but are being cautious until they get larger commitments from retailers. If retailers want goods to arrive in time for the holiday sales season they probably have to make those commitments by some time in May at the latest. I’m still not seeing it yet. It could be a sweet whisper on the wind…or it could be a siren song.

image via aphunniblog.edu

Keep your weight on the back foot,

Tom Keoughan

Leave A Comment