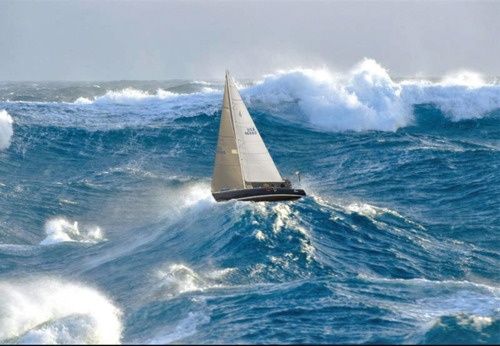

The toy industry faces choppy seas as we move into the holidays sales season. Many retailers asked for product to be brought in early this year as they sought to avert a repeat of 2021 when supply chain congestion caused product delays and shortages. They are now dealing with an inventory glut of overstocked shelves and stuffed warehouses.

The toy industry faces choppy seas as we move into the holidays sales season. Many retailers asked for product to be brought in early this year as they sought to avert a repeat of 2021 when supply chain congestion caused product delays and shortages. They are now dealing with an inventory glut of overstocked shelves and stuffed warehouses.

Major retailers have issued billions in cancellations. Walmart has containers stacked in their parking lots because stores are still full of back-to-school merchandise. Amazon is now scheduling multiple Prime Day-like events as many retailers are beginning their Black Friday Blowouts even before Halloween.

Their profits will certainly decline as they compete to cut prices faster than their peers in a race to the bottom. This will cause their margins to take a beating. Although they have already whacked suppliers with cancellations, you can be sure that they will be eager to share their margin squeeze with their vendor “partners” who will be “made offers they can’t refuse.”

As the pandemic seems to be winding down, instead of consumers buying “things” to feather their cocoons, they have switched to getting out there and spending on services: restaurants, travel, fun! Hasbro reported pretty awful earnings last week which they blamed on consumers becoming increasingly price sensitive amidst rampant inflation.

These will both be major factors in this year’s holiday sales season but it’s early. My gut feeling is that in what will hopefully be the first (mostly) post-pandemic Christmas, people will live it up and spend on both services AND products.  The annual hangover will occur in the first quarter of next year when consumers look at their elevated credit card balances and the sky-high interest rates they will have to pay. That will likely coincide with the recession hitting in earnest. Hangover 2023 may prove to be particularly nasty.

The annual hangover will occur in the first quarter of next year when consumers look at their elevated credit card balances and the sky-high interest rates they will have to pay. That will likely coincide with the recession hitting in earnest. Hangover 2023 may prove to be particularly nasty.

On the positive side, the pandemic-driven stop-start-stop economy is now at a point where freight costs have significantly declined. The general thesis seems to be that, as retailers digest and work through heavy inventories, supply chains will be normalized (excluding chips) by next summer.

What has this meant for toy industry hiring? For the past year and a half, companies have been hiring hand over fist, but search starts literally dropped off a cliff on Labor Day. During September we were able to complete the searches that we had already started but no new searches came in. We weren’t sure if that was due to the rocky economy (uh oh!) or just the usual cycle as companies prepare for and participate in major trade shows and gain insight into their fortunes for the following year. Then, during the second week of October, search starts lurched into gear again. It’s still too early to call – it’s only been two weeks – but I am cautiously hopeful. “Hopeful” is assuredly not as good as “optimistic,” but we shall have to wait and see what happens.

If I were to look into my rather murky crystal ball, I envision an okay sell through season – which ain’t bad coming after two years of stellar growth – followed by a very rocky first half of 2023. After that, things could smooth out although that’s much too far away to see with any clarity and we should always be wary of another Covid Knuckleball. I may be completely wrong and I have been completely wrong before. In any case, my current posture if to keep moving forward but with my weight heavily set on the back foot.

May you live in interesting times,

Tom Keoughan

Leave A Comment