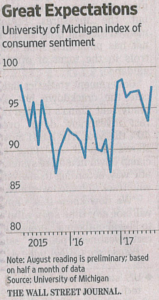

In early August US consumer sentiment jumped to its highest level since January. With unemployment continuing to head lower and a robust stock market, this is a trend that might continue. Unlike earlier in the year, consumers seem to now be putting their money where their mouth is. Consumer spending has increased rapidly and credit card debt is now at the highest level in US history.

In early August US consumer sentiment jumped to its highest level since January. With unemployment continuing to head lower and a robust stock market, this is a trend that might continue. Unlike earlier in the year, consumers seem to now be putting their money where their mouth is. Consumer spending has increased rapidly and credit card debt is now at the highest level in US history.

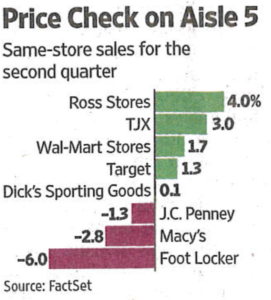

Where is all this money going? E-Commerce is obviously a big beneficiary while the bricks and mortar retail landscape is pretty bleak. Retail sales have been declining rapidly at department stores like Macy’s, Kohl’s, and J.C. Penney as well as sporting good chains like Dick’s Sporting Goods and Foot Locker. Kmart, which recently laid off 1500 people at its Hong Kong office, appears to be in its final death throes. Food and Drug chains have been mostly holding up but the supermarket is now under assault with “nonprofit” market share grabber Amazon slashing prices at Whole Foods. It is also pretty easy to envision a time in the not too distant future when E-Commerce will topple the pharmacy giants.

The physical retailers who have been growing sales are the low priced ones – including Wal-Mart, TJX, Ross Stores,  Old Navy, Dollar General, and Best Buy. The only path to sales growth seems to be through lower prices. That creates a painful choice between growth and profits and will force retailers to reduce their cost structure at the same time they are trying to build up E-commerce.

Old Navy, Dollar General, and Best Buy. The only path to sales growth seems to be through lower prices. That creates a painful choice between growth and profits and will force retailers to reduce their cost structure at the same time they are trying to build up E-commerce.

Traditional retailers like Macy’s and Kohl’s have developed large online businesses but they are caught trying to leverage warehouses and distribution systems designed for sending big trucks full of goods to stores rather than pick and pack locations that ship stuff directly to consumers. This is one of the factors which cause their E-commerce profits to be reduced to around 4% rather than the 8%-10% they enjoy at store locations. Over time they should be able to retool, but that will cost money that will be coming from increasingly smaller margins as more of their sales dollars shift online. One can expect that they will attempt to increase margins by squeezing vendors and by treating their warehouses as profit centers – a la Target.

Toy industry hiring is following the script I envisioned earlier in the year. Hiring was extremely strong in the usually weak first quarter. But the combination of heavy inventory carry over from the holiday shopping season and weak first quarter retail sales caused retailers to pull back and their suppliers to step on the brakes. During May and June toy companies were telling me that while they needed to hire additional people they were going to hold off. By late July, the combination of heavily discounted 2017 inventory finally selling through and 2018 goods starting to ship along with consumers starting to spend, companies started to move forward with their staffing plans. Since returning from vacation in late July, Toyjobs has been starting searches at a furious pace. These searches should be concluded sometime in September. In the short run, as long as sentiment and spending hold up I expect that strong toy industry hiring will continue. The one potential problem is the poor health of traditional retail. Their problems will translate into problems for their vendors very quickly.

In the longer run, while retailers are working on developing E-commerce, vendors should be looking at new strategies as well. To be successful in the future, these strategies will have to be more comprehensive than just selling more to Amazon.

On that cheery note I look forward to seeing y’all in Dallas.

Tom Keoughan