Both households and businesses started the year riding a wave of rising expectations for growth under a new business-friendly President but thus far the euphoria hasn’t translated into broad economic gains.

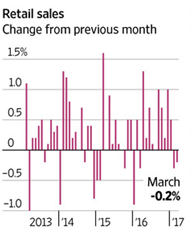

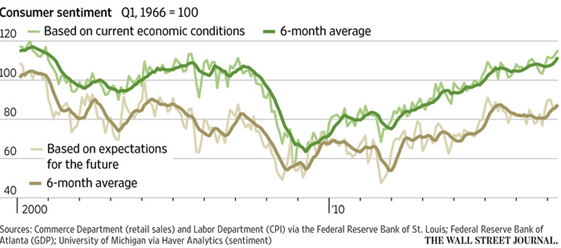

R etail spending actually declined in the first quarter and GDP growth was a paltry 0.7%. Job gains were quite disappointing in March. We’ll learn the April numbers on Friday. It’s too early to blame this on the Trump administration. Anyone who knows anything about economics knows that it generally operates with lag times. That said, there is a gap between sky high expectations and things that have actually gotten done. Both consumer and CEO confidence have been at record highs (although now are beginning to drift down) but weak retail spending tells a different tale. Both companies and consumers are saying one thing but doing something different with their wallets. Employment and wage growth should support higher consumer spending but thus far has not.

etail spending actually declined in the first quarter and GDP growth was a paltry 0.7%. Job gains were quite disappointing in March. We’ll learn the April numbers on Friday. It’s too early to blame this on the Trump administration. Anyone who knows anything about economics knows that it generally operates with lag times. That said, there is a gap between sky high expectations and things that have actually gotten done. Both consumer and CEO confidence have been at record highs (although now are beginning to drift down) but weak retail spending tells a different tale. Both companies and consumers are saying one thing but doing something different with their wallets. Employment and wage growth should support higher consumer spending but thus far has not.

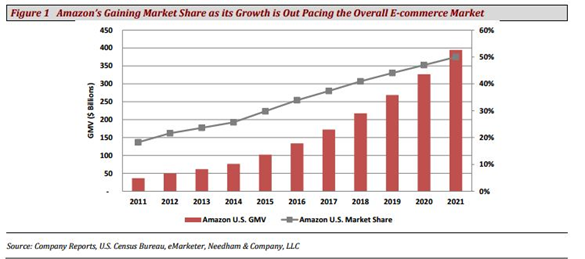

The retail environment is changing dramatically as online retailers, Amazon particularly, experience rapid growth. The following numbers, if correct, are astounding. Needham analyst Kerry Rice estimated that: “Amazon’s market share of the American retail sector was 34 percent based on gross merchandise volume. Ebay has a market share of 7.7 percent followed by Wal-Mart at just under 5 percent.” He anticipates Amazon to grow its U.S. market share to 50 percent over the next five years.

Those numbers make it easy to understand why approximately 3000 retail stores closed thus far this year, more than double the number from the same period in 2016. Also, 10 retailers have sought bankruptcy so far in 2017 vs. just nine for all of 2016. We should probably pencil in Sears/Kmart though I expect that they won’t file until January 2018 after they pocket the Christmas cash… and stiff their vendors. This isn’t the first time that retail has been turned upside down. Twenty-five years ago, Wal-Mart and Target killed mom and pop stores and Barnes & Noble and Toys ‘R’ Us disrupted smaller chains. Toy manufacturers should be thinking hard and thinking fast about how to meet the challenge of this massive retail transformation.

What high economic confidence with low economic performance has meant for toy industry hiring is that Toyjobs started the year off with a bang. Typically, the first quarter can be quite challenging for us. Companies load us up with searches but can’t find the time to interview and hire due to the near constant travel schedule to all of the various trade shows. From April through June we usually hit it out of the park. Thus far that seems to have been reversed this year. We experienced a very strong first quarter but have been in a lull for the last two or three weeks.

Part of this can be explained by the divergence in economic confidence and the real-world economy. I also attribute it to tight first quarter toy company cash flows. The toy industry enjoyed a robust 5 percent growth rate in sales last year but there was also a lot of inventory left on store shelves after the holiday buying season. So, there hasn’t been a real need for retailers to restock. Add to that Toys ‘R’ Us has decided to hold back payments to many of the larger manufacturers for merchandise they sold last year. Rather than getting the big check they were counting on and budgeted for in January, many manufacturers won’t be getting paid until October. If you don’t play along “we don’t have to buy your goods this year.”

I expect all of this to start to return to normal as we move through the year. Manufacturer budgets will start to loosen up and hopefully the economy begins to kick into gear once the Trump administration starts to actually accomplish things, but for now? …we are in a bit of a lull.

All the best,

Tom Keoughan

Final thought: We here at Toyjobs and indeed the entire toy industry will sadly miss Loren Taylor. He was honest, kind, and fair with everyone he ever dealt with. He was a true gentleman. We lost one of the good ones.