Let me first say that I love the Fall Toy Preview Show in Dallas. I can spend two days and meet with twenty-five toy company presidents. Toy execs have a fair amount of down time in Dallas and I’ve become pretty good at catching them standing around without a lot to do. That said, what’s good for me isn’t necessarily good for the companies who are spending a lot of money to exhibit there. Let’s face it, last year’s Fall Toy Preview was pretty abysmal, but I was pretty confident that the TIA and its board realized that. My thinking was that they would make some changes to improve it.

Early Tuesday I noticed that cosmetically it was a better show. Overall space was reduced and the booths were configured in such a way as to make it “feel more full.” That didn’t really hide the fact that the aisles had a number of blind alleys with no exhibitors in them. It also didn’t hide the fact that key toy manufacturers continued to pull out. There were a bunch of new companies up on the 13th floor but a lot of those were one trick ponies rather than companies with full product lines. I’m not sure how much buyer attention they really got. It seemed as it the TIA did a really good job of selling them.

I’ve always felt that Trade Shows were most productive when manufacturers primarily focus on working the mid-tier accounts. While it’s nice to get a little face time with buyers from Wal-Mart, Target and Toys R’ Us, generally speaking you are not going to accomplish a lot with them at a show. It’s preferable to travel to their headquarters and spend some focused quality time. At a show, mid-tier accounts are more likely to move the ball meaningfully forward. By having them in one place at one time you can also potentially cut costs by reducing visits to headquarters. Unfortunately, half of the mid-tier did not show up. Kohl’s Meijer, Shopko, Walgreen’s and others were nowhere to be seen. You’ll still have to go to Grand Rapids. You’ll still have to go to Green Bay.

Those are the criticisms and mid-day on a Tuesday a lot of the toy execs that I spoke with were a little bit grumbly. However, by the end of the show the negative perceptions had radically changed. By Wednesday afternoon, literally everyone I spoke with said they were having a great show. The comment I heard the most was: “We had less meetings but they were really productive meetings.” And, while a bunch of the Midwest Mid-Tier accounts didn’t attend, Amazon, Family Dollar, CVS, Michael’s, Hobby Lobby and others were there and open for business.

One often mentioned major disappointment was that Toys R’Us didn’t send any senior executives. The Buyers were there but the senior team that had been planning to attend cancelled at the last minute. Certainly they would have been besieged by questions but the proper thing to do was send a team to deliver a consistent, coherent message as a balm to the vendors they had just recently stung.

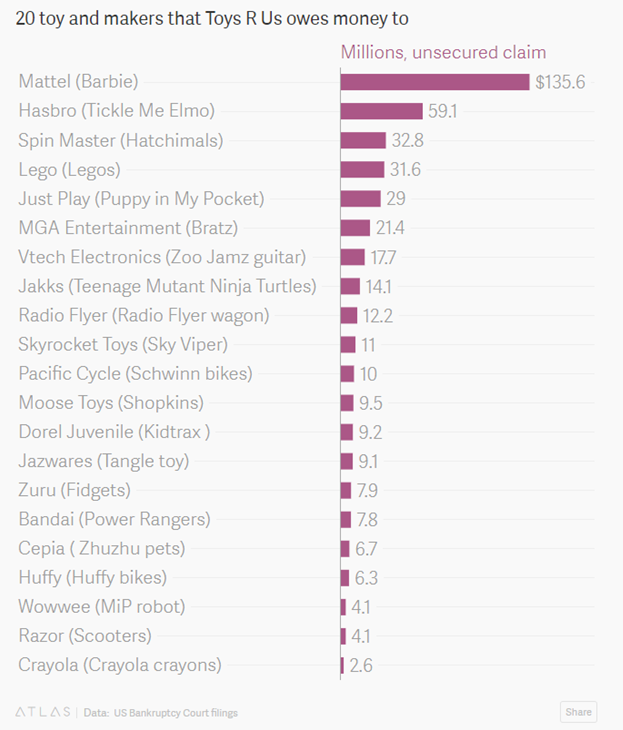

Perhaps the TRU no show was due to the basic unfairness of the US bankruptcy code. Under the law, Toys R’Us will get to choose a list of “critical vendors” which it says are “critical” to its ongoing business. If you are a large toy company like Mattel, Hasbro, Lego, Spin Master, Jakks or MGA you may receive 90% of the monies that you are owed by Toys R’Us while the smaller fry may only get a nickel on the dollar. If you’re a small toy company and you object too much well then your products need not grace our shelves going forward. Even if you’re a large company and you are negotiating too hard you can find yourself dropped from critical vendor status. It appears that during the Chapter 11 workout, Toys R’Us has a pretty strong hand.

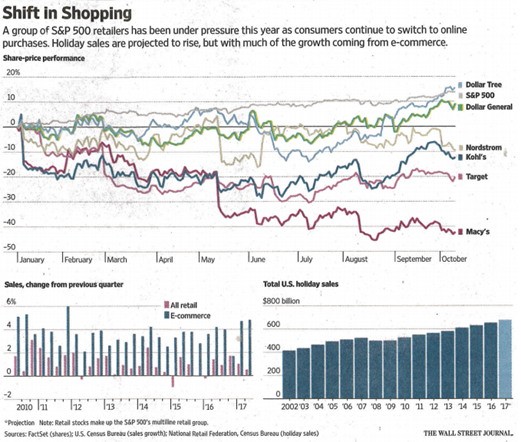

Of course, everybody wants Toys R’Us to survive. Aside from Amazon it buys the broadest range of toys on the planet. Eliminating their debt will allow them to operate at a profit but they will need to make some sweeping changes going forward. Lifting the debt load from their backs should give them ample money to make those changes, but first they need a strategy. They need to shutter unprofitable stores and clean up the ones they keep open. They should broaden their product selection and become a destination. Unfortunately, they have to become a destination because most of their stores stand alone. They are a separate trip. Roll with that and go BIG! Become a kid’s destination with play zones, food, PIZZA!, host birthday parties and hook up with movie theatres. Of course, these changes may risk lowering their dollars per foot of shelf space. Maybe it’s worth it? Also, Toys R’Us had an early advantage in e-commerce sales but their performance has been quite poor. They should bring someone in from the outside to fix it.

All of that is way above my pay grade but what I do know is that now that TRU is in Chapter 11 they have to pay their vendors going forward. It’s time to fill the pipe. Toys R’Us has a period of time to adapt to the ongoing American Retail Transformation (ART…yeah, I made that up). They need to bring in the people to formulate a prescient and winning strategy and then they need to execute. If they don’t it may be five years it may be ten but they could find themselves going from Chapter 11 to “Chapter 22.”

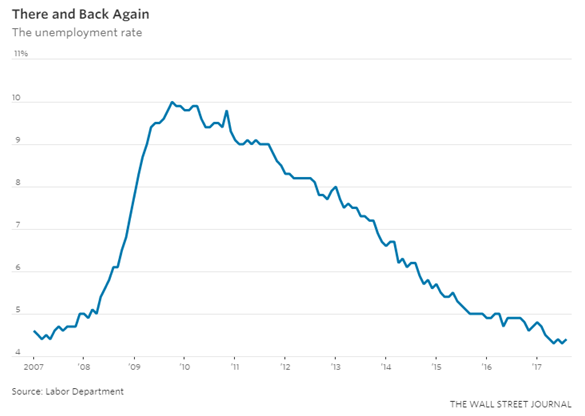

The Toys R’Us bankruptcy has meant uncertainty for toy manufacturers. The current turmoil and transformation going on in retail has meant even more uncertainty. When confronted by uncertainty most companies cut spending which means reduced hiring. Even with unemployment returning to its pre-economic crisis lows, toy companies have been slow to hire.

Early in the year Toy Executives were telling me that they needed to add people but didn’t want to start searches yet. That changed in early August and they were having Toyjobs start searches in droves. As recently as the Dallas Fall Toy Preview, I was telling people that “we have done all these searches where companies have picked their person but haven’t pulled the trigger.” Fortunately, we successfully concluded three searches in the last week. I also expect to close two or three more in the next week and a half. What does that mean going forward? Uncertainty. It’s hard to say.

I’d like to close with an ancient Chinese curse: “May you live in interesting times.” And follow it with another quote of a more recent vintage: “We spent the second thirty five years trying to figure out how the first thirty five could have been so easy.” –Mick Jagger

All the Best,

Tom Keoughan