Toyjobs First Half Forecast

While the much ballyhooed recession hasn’t hit yet, we do see signs of the economy starting to slow. Consumers, having been squeezed by high inflation and rising interest rates, have cut back on retail spending in both November and December. As the consumer goes – so goes the U.S. economy and companies are responding by beginning to pause hiring. While hiring was extremely robust in 2022, it is now also in the early stages of cooling down. I would say that December – January looks like an inflection point.

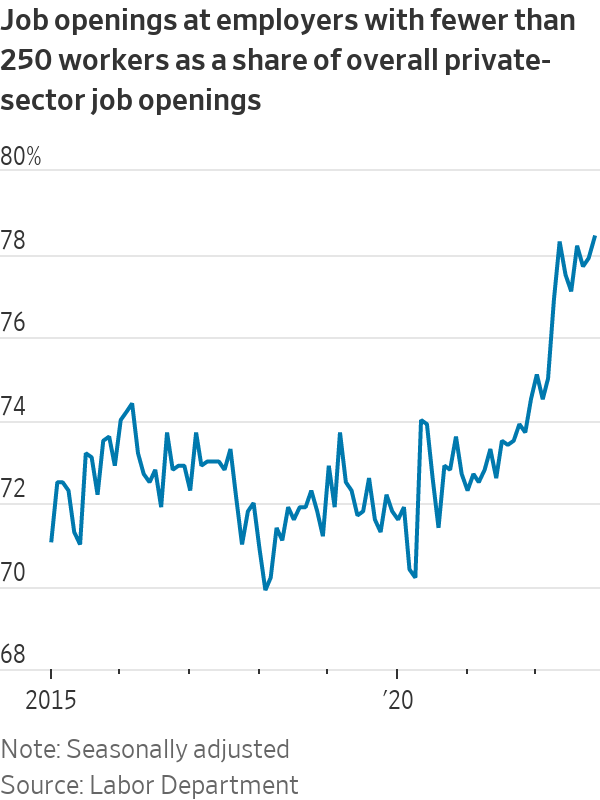

image via wsj.com

The slowing rate of hiring will change the negotiating dynamic between hirers and hirees. During the last couple of years when workers have been hard to find, employees held the upper hand and could demand higher wages, greater workplace flexibility, etc. Over time the negotiating dynamic swings back and forth like a pendulum driven by economic conditions. But this pendulum effect also has a lag time as both parties tend to think that the environment is in their favor for longer than it really is. They also try to hold on to the advantage for as long as possible. This is true on both sides of the equation – employers and employees. We are right now at an inflection point where the employee advantage is just beginning to slip away but employees are not ready to believe it or admit it to themselves, while for employers it is still a bit too early to start applying pressure.

Amidst this backdrop, the toy industry has its own set of problems which should be acute during the first half of 2023. Slower holiday sales have left us with a massive inventory glut both at the retail and the manufacturer level. Retailers have been advertising huge discounts. I wouldn’t be surprised if Walmart starting having Big Merch Bonfires in their most rural parking lots. Not only does this mean large markdowns for manufacturers but also that they are unlikely to have much in the way of first quarter resupply orders.

Second, China’s recent lurch from a policy of Covid Zero to Que Sera? Sera? Is leading to massive waves of infection across the country. While this will eventually begin to peter out the sudden change may prove to be especially hard on for China’s large elderly population which is severely under-vaccinated and when they are vaccinated it is with less effective vaccines. Knowing what we know about China’s demographics, a more cynical person might wonder if there wasn’t something sinister going on?

Additionally, we are in the midst of the Chinese Lunar New Year holidays and urban workers will be spreading Covid to families in the hinterlands where healthcare facilities are sparse and subpar. How might the health of families affect if and when workers return to their job?

Lastly, as China works its way through its self-manufactured Covid spike and begins to reopen that will cause the price of oil and therefor plastics to surge. An increasing price for key materials can’t be good for margins.

On the upside, the supply chain is continuing to unkink and it is predicted to be back close to “normal” by mid-year. We’ll have to wait and see how the change in China’s Covid policy affects that timeline. Additionally, it is a strong year for kids movie releases, coming especially from Disney and Hasbro. Hopefully that will help drive consumers back to the stores next fall.

Additionally, it is a strong year for kids movie releases, coming especially from Disney and Hasbro. Hopefully that will help drive consumers back to the stores next fall.

How does this all translate into toy industry hiring? At Toyjobs we are coming off an excellent 2022. That said, in January search starts have slowed but not stopped. To an extent, this is true every year as many retailers and manufacturers are still finishing up crunching their 2022 holidays sales numbers. My prediction is that for the first half of 2023, large toy companies will do very little hiring. Small companies will continue to do less but some hiring of key players. In a small company, it’s much harder to distribute additional workload across a small staff. Beyond the first half? I got nothin’…except to say that I think things will be better than the previous six months.

All the best,

Tom Keoughan

Too Many Cross Currents

I don’t envy toy industry executives right now. Even in the best of times they are in the seasonal fashion business which is always tricky. This year there are so many cross currents that it must be difficult to know what to do. The only bright light I see is that two years of sky high freight rates and delivery delays have reverted back closer to normal. That said, the situation in China where most of the toy factories are located is very fluid. Amidst widespread protests, labor shortages, and a never-ending game of Covid lockdown Whac-a-mole, I can’t imagine that many company’s plans are actually following their desired timelines.

Add to that cost input inflation. Paints, plastics, labor, fuel, and electricity have all risen dramatically in price over the last two years. Consumer prices have been soaring with people paying more for less. Except, it seems, toys and clothing. If I would have written in a college exam blue book for one of my Economics courses that we would have massive inflation AND an inventory glut at the same time, I definitely would not have gotten a passing grade. But here we are. Bentonville is at Defcon 1 with red lights flashing and sirens blaring.

My continuing forecast, based on an extremely cloud crystal ball, is that one half of population will Party Like It’s 1999 and keep spending on both goods and services in this first “post-pandemic” (Covid is still here but we’ve stopped behaving like it’s a pandemic) holiday season. Come January, the bills will come due – and with sky high interest rates attached.

For the other half of the population, hard times have already arrived.

Toy dollar sales volume will be lower but not really that bad as they face very difficult comparisons to the previous two years of explosive pandemic-driven growth. Margins, however, will be a different story. Toys are more expensive to make and an inventory glut has led to retail discounting beginning even before Halloween. Everybody will be trying to eke their profits out of their supplies margins – from retailer-to-toy company-to-factory-to-components and raw materials.

Inflation gluts will likely lead to lots of leftover merchandise after the holidays which will mean very little early year resupply in 2023 and a difficult first half for the toy business. This will come at about the same time that the consumer will be closing his then empty wallet.

Up until now, toy companies are continuing to hire. Toyjobs continues to have one of its best years ever after a short trade show induced dip, but I see dark clouds on the near horizon and they look like they’re heading this way.

I’m sorry that this piece is so scattered but with so many conflicting cross currents, my mind hasn’t coalesced (congealed?) around a coherent narrative.

May you live in interesting times,

Tom Keoughan

Toy Industry Sailing in Choppy Seas

The toy industry faces choppy seas as we move into the holidays sales season. Many retailers asked for product to be brought in early this year as they sought to avert a repeat of 2021 when supply chain congestion caused product delays and shortages. They are now dealing with an inventory glut of overstocked shelves and stuffed warehouses.

The toy industry faces choppy seas as we move into the holidays sales season. Many retailers asked for product to be brought in early this year as they sought to avert a repeat of 2021 when supply chain congestion caused product delays and shortages. They are now dealing with an inventory glut of overstocked shelves and stuffed warehouses.

Major retailers have issued billions in cancellations. Walmart has containers stacked in their parking lots because stores are still full of back-to-school merchandise. Amazon is now scheduling multiple Prime Day-like events as many retailers are beginning their Black Friday Blowouts even before Halloween.

Their profits will certainly decline as they compete to cut prices faster than their peers in a race to the bottom. This will cause their margins to take a beating. Although they have already whacked suppliers with cancellations, you can be sure that they will be eager to share their margin squeeze with their vendor “partners” who will be “made offers they can’t refuse.”

As the pandemic seems to be winding down, instead of consumers buying “things” to feather their cocoons, they have switched to getting out there and spending on services: restaurants, travel, fun! Hasbro reported pretty awful earnings last week which they blamed on consumers becoming increasingly price sensitive amidst rampant inflation.

These will both be major factors in this year’s holiday sales season but it’s early. My gut feeling is that in what will hopefully be the first (mostly) post-pandemic Christmas, people will live it up and spend on both services AND products.  The annual hangover will occur in the first quarter of next year when consumers look at their elevated credit card balances and the sky-high interest rates they will have to pay. That will likely coincide with the recession hitting in earnest. Hangover 2023 may prove to be particularly nasty.

The annual hangover will occur in the first quarter of next year when consumers look at their elevated credit card balances and the sky-high interest rates they will have to pay. That will likely coincide with the recession hitting in earnest. Hangover 2023 may prove to be particularly nasty.

On the positive side, the pandemic-driven stop-start-stop economy is now at a point where freight costs have significantly declined. The general thesis seems to be that, as retailers digest and work through heavy inventories, supply chains will be normalized (excluding chips) by next summer.

What has this meant for toy industry hiring? For the past year and a half, companies have been hiring hand over fist, but search starts literally dropped off a cliff on Labor Day. During September we were able to complete the searches that we had already started but no new searches came in. We weren’t sure if that was due to the rocky economy (uh oh!) or just the usual cycle as companies prepare for and participate in major trade shows and gain insight into their fortunes for the following year. Then, during the second week of October, search starts lurched into gear again. It’s still too early to call – it’s only been two weeks – but I am cautiously hopeful. “Hopeful” is assuredly not as good as “optimistic,” but we shall have to wait and see what happens.

If I were to look into my rather murky crystal ball, I envision an okay sell through season – which ain’t bad coming after two years of stellar growth – followed by a very rocky first half of 2023. After that, things could smooth out although that’s much too far away to see with any clarity and we should always be wary of another Covid Knuckleball. I may be completely wrong and I have been completely wrong before. In any case, my current posture if to keep moving forward but with my weight heavily set on the back foot.

May you live in interesting times,

Tom Keoughan

Low Visibility in All Directions

During the past year, toy companies have been hiring hand over fist. Toyjobs is poised to have one of its best years ever. Why then do I have this feeling of uneasiness? I think it’s because things feel like we are at the tipping point to a downturn.

Search starts appear to be slowing. That is probably due to one of two factors and at this juncture I can’t tell which. First, we are at the beginning of the 2023 sales cycle. Target and Walmart have been out in LA during the past couple of weeks. They, and many of the rest of their retail brethren, will be back out there a few weeks hence. That will be followed by a migration to Dallas for toy industry’s first trade show in a couple of years. Maybe that’s it. Toy companies usually pause hiring before a trade show in order to gain visibility into what business will look like in the year ahead. After that, they crunch numbers for a week or two and then move forward with staffing adds or changes – or they don’t. Hopefully, that’s all that is going on and search starts will rev up again in early October.

On the other hand, we are in an increasingly difficult economic environment. Inflation is running at 8 or 9%. Shoppers are spending more but getting less. We are in a recession, at least according to the generally accepted definition of one. Companies, in all categories, are growing cautious. Many have begun hiring freezes and even layoffs.

image via Motley Fool

Closer to home in the toy business, even though container costs have come down dramatically and are also moving a lot faster, plastic resin prices are still high and obtaining chips is a difficult dance. I often hear people say that the toy industry is “recession resistant” but I can’t help thinking: “Sales may be but margins are not.” Target has been cancelling billions in orders while Walmart has been doing the same, as well as cancelling its own people. The retail names on every salesman’s lips these days are Ross Stores and TJ Maxx. This all portends a much uglier scenario.

So, which is it? Pre-trade show pause or economic slowdown? Probably some of both. That said, I can’t shake the feeling that the economy is like a car that has run out of gas but is still coasting. Moving slower and slower until it finally rolls to a stop. Yellow lights flashing…

image via giphy.com

All the best,

Tom Keoughan

Short and Sweet

So there’s really not much new to report since last time. Sales volumes continue to be strong, margins contin ue to be tight. Supply chain woes continue with sky high material costs, chip shortages, the apparent alien abduction of all of the world’s truck drivers and an endless game of Chinese lockdown Whac-a-mole.

ue to be tight. Supply chain woes continue with sky high material costs, chip shortages, the apparent alien abduction of all of the world’s truck drivers and an endless game of Chinese lockdown Whac-a-mole.

The Toy Industry is looking to hire a lot more people and for the most part is succeeding in doing so. The one real trouble spot I see is Brand Managers and Marketing Communications Managers.

There are really two reasons that I can identify that are exacerbating the problem. First, these people are currently in high demand. Lots of companies are looking for them. That has led to a marketplace where candidates are getting offers from two or three different companies. At the same time, companies have chosen this group to hold the line on salaries. At the start of a Brand Manager search I find myself telling clients that their salaries are too low but companies aren’t budging even though they are willing to raise salaries for other types of jobs. “That’s what we have in our budget.” “Okay, but your budget doesn’t match the marketplace.”

The second major factor is demographics. The people who populate these jobs most often are in their mid-twenties to late thirties. It seems the cultural norm for this group is to be unresponsive. Phone?  Email? Text? Smoke Signal? It doesn’t seem to matter. Never before in human history have there been so many ways to communicate and never before are so many people so desperate not to do so. With many people rejecting to even have a yes or no choice about a potentially advantageous career move we end up having smaller pools of candidates. It seems to affect Marketing people the worst. Salespeople don’t do this. Designers of the same age group don’t do this. The very people who are supposed to have the most business savvy seem to be the least savvy about their own personal business and careers. Ah well, end of screed.

Email? Text? Smoke Signal? It doesn’t seem to matter. Never before in human history have there been so many ways to communicate and never before are so many people so desperate not to do so. With many people rejecting to even have a yes or no choice about a potentially advantageous career move we end up having smaller pools of candidates. It seems to affect Marketing people the worst. Salespeople don’t do this. Designers of the same age group don’t do this. The very people who are supposed to have the most business savvy seem to be the least savvy about their own personal business and careers. Ah well, end of screed.

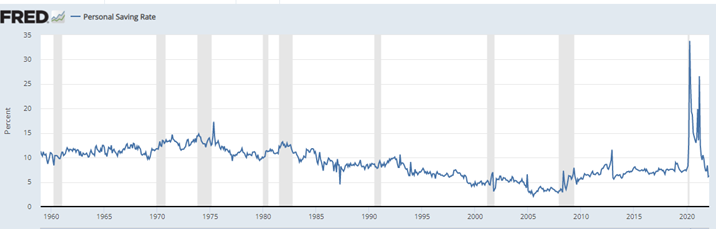

Moving forward I think that 2022 will be a pretty good year. Perhaps not as good as 2020 and 2021 but solid and happier as the pandemic hopefully continues to dissipate. Inflation is a major challenge but consumers are continuing to spend. More money is being directed toward necessities, but people are trying to maintain their lifestyles – for now at least. This is causing them to spend down their record high savings and increase their credit card balances. Neither of those things bode well for the future.  Add to that an increasing interest rate environment and a Fed which does not have a very good record at engineering soft landings and I see clouds (or is it smoke) on the horizon for 2023. Now is the season to be hoarding your acorns. Winter is coming.

Add to that an increasing interest rate environment and a Fed which does not have a very good record at engineering soft landings and I see clouds (or is it smoke) on the horizon for 2023. Now is the season to be hoarding your acorns. Winter is coming.

All the best,

Tom Keoughan

Toy Industry Talent Shortage Continues

Despite the pandemic and the continuing supply chain crisis, the U.S. toy industry had another banner year with 13% sales growth in 2021. Predictably, this has led to a talent shortage in 2022. As we begin to move out of the pandemic, labor shortages have plagued industries across the board but seem even more acute in the toy business as companies seek to invest the proceeds of several consecutive years of strong growth into new product offerings. There has been a surge in Marketing and Product Development roles which to me indicates that companies are looking to do new things and start new initiatives.

This has come in an atmosphere where it is more difficult to find the same number of interested candidates per position than we used to. While we all have heard of “The Great Resignation” much of that has passed. Lots of people have changed jobs during the last nine months and understandably are not interested in doing so again soon. Additionally, companies are holding on to their staffs by giving lots of promotions and raises. Doing that it both easier AND cheaper than having to refill positions or worse yet, do without.

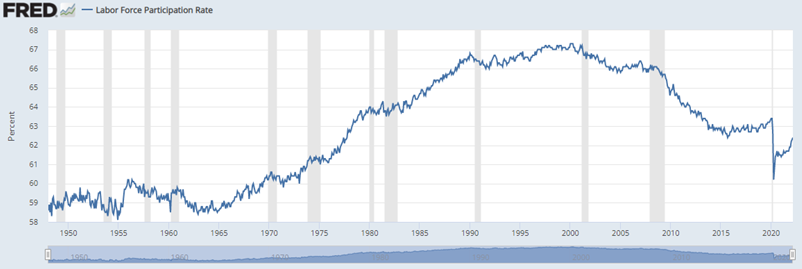

There is some hope on the horizon as the labor participation rate is beginning to creep up from pandemic lows. Some people who stayed home to care for children during school and daycare disruptions are now free to look for a job. With the pandemic beginning to dissipate, there are also a lot fewer people either home sick or caring for sick relatives. Add to that without “free money” household savings are declining especially as inflation is causing prices to rise for rent, gasoline, groceries, and everything else. My thinking is that these factors should increase the workforce but as summer approaches (Wait, what? Yeah, already), it may take until next September for these forced to be felt fully.

Here at Toyjobs, we know how to find the best people even if, for now, it is difficult to find as many strong candidates for each search. We just wrapped up our best first quarter ever! Certainly, the talent wars were a contributing factor, but I also attribute it to the changing annual migration patterns of toy industry executives. The first quarter has always been our worst with the entire toy business hopping on planes every January 2nd and cycling through Hong Kong, Nuremburg, London to New York with maybe a side trip to Atlanta. My view has always been that there were way more trade shows than necessary and often imagined an entire industry frantically laundering suitcases full of dirty shirts.

I’ve always liked the Dallas Toy Fair since there always seems to be a lot of toy execs standing around without a whole heckuva lot to do. That well suits continuous laps of glad handing and back slapping. That said, I am well aware that the Toy Association doesn’t tailor these things for my purposes. So just one more go ‘round in Dallas – savor it.

The New York Toy Fair’s move to the autumn makes a whole lot of sense. It really fits well with the industry’s buying and product development cycles, not to mention – the weather. That said, you will still find me swallowing fistfuls of Aleve while chain-complaining about “The World’s Hardest Floors.” At least I’ve had a couple of years since the last one to recover.

All the best,

Tom Keoughan