It’s a Mad, Mad, Mad, Mad, Mad World but through all the twists, turns and tumbles it’s been an excellent year for toy sales.

NPD Group recently stated that toy sales were up by 19% during the first three quarters of the year even though it is usually not until the fourth quarter that toy sales truly shine. This holiday  season will certainly be different but Americans impulse to spend in the period between Thanksgiving and Christmas should never be underestimated. With many kids schooling from home, work from home parents have been snapping up products to keep idle hands busy, productive and out of their hair. Arts and crafts, puzzles and games have scored big as have larger outdoor items as families have been enhancing their living spaces now that COVID has them spending so much more time in them.As is often the case, there appears to be disconnect between what parents want to buy for their kids and what kids actually want. As the holidays approach kids are clamoring for screens and software. Devices and video games make up eight of the top 10 items on kids wish lists.

season will certainly be different but Americans impulse to spend in the period between Thanksgiving and Christmas should never be underestimated. With many kids schooling from home, work from home parents have been snapping up products to keep idle hands busy, productive and out of their hair. Arts and crafts, puzzles and games have scored big as have larger outdoor items as families have been enhancing their living spaces now that COVID has them spending so much more time in them.As is often the case, there appears to be disconnect between what parents want to buy for their kids and what kids actually want. As the holidays approach kids are clamoring for screens and software. Devices and video games make up eight of the top 10 items on kids wish lists.

The official holiday sales season appeared to get off to a slow start as U.S. shoppers spent significantly less than last year over the five day stretch from Thanksgiving through Cyber Monday. Total sales were down 14% according to the National Retail Federation. Fewer people hit the stores over Black Friday weekend and many retailers are holding back on discounts because they are sitting on lean inventories. Wal-Mart, Best Buy and others also put their Black Friday promotions online and along with Amazon encouraged shoppers to buy earlier in the season. The bright side to all this was a great reduction in the number of big screen TV brawls, store shootings and teenage taser battles.

As more consumers are doing their holiday shopping from the sofa due to the pandemic, Amazon is doing eye-popping numbers. One Wall Street firm is estimating that they could capture 42% of every dollar spent during the holiday shopping period. A “Bricks and Mortar Surprise!” is that Wal-Mart, Target and even Kohl’s are also performing strongly.

Confounding toy manufacturers is the fact that despite sky high demand they have had trouble getting product from port to shelf. Major ports such as Long Beach and Los Angeles are seriously backed up due to a shortage of loading equipment and operators as well as trucks and drivers during the pandemic. Due to this year’s overwhelming e-commerce sales many manufacturers are focused on maintaining maximum availability at Amazon.

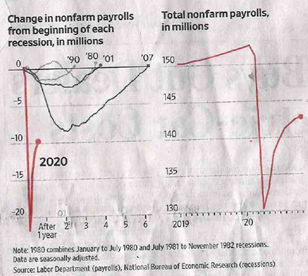

Toy industry hiring which had been dreadful throughout the spring and early summer picked up strongly just before Labor Day. Thus far that has continued but I’m concerned by the swift growth in coronavirus related hospitalizations. The most recent employment numbers saw the labor market recovery beginning to slow. Employers added 245,000 jobs added in November down from 610,000 jobs in October. On the other hand, the unemployment rate edged slightly lower from 6.9% to 6.7% and new applications for unemployment benefits – a proxy for layoffs – also fell last week after a recent pickup. In addition consumer spending grew in October for the sixth straight month. Toyjobs hasn’t seen toy industry hiring start to slow yet but I can’t help but see the Thanksgiving holiday as a pandemic fatigue fiasco which will cause a spike within the surge. Although I’m usually a cautiously optimistic fellow I see the holidays as a six week superspreader event which will prove quite difficult to tamp down until widespread vaccine availability arrives. That can’t be good for public health which can’t be good for business-and certainly can’t be good for hiring.

Winter is coming

Tom, I enjoyed reading your piece about how Covid has affected toy industry sales and consumer consumption patterns in 2020. Let’s pray that the vaccine is widely distributed and life returns to normal by the end of the first quarter of 2021.

Wishing you and yours Happy Holiday wishes Tom