When everyone heads off for summer vacation; any public utterance takes on greater importance because there are so many fewer voices in the air. The stock market may move but with so few active buyers and sellers it is difficult to discern if there is much conviction in its zigs or zags.

What we do know is that the eurozone is still locked in an existential crisis. There are rumblings of a slowdown in China and we are hurtling ever faster toward the fiscal cliff. While “Rome” may not yet be burning; both European and American politicians are either fiddling around or have gone on vacation.

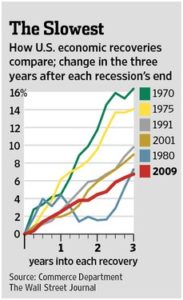

The looming fiscal cliff and the threat that it may cause a double-dip recession is already making it difficult for businesses to plan, hire or expand. Retail sales have also stalled for several months as consumers wait for the other shoe to drop. Both businesses and consumers appear to be sitting on their wallets as they wait out tax, regulatory and election uncertainty. All this has caused the US economy to slow sharply.

While July gave us a better than expected jobs report with nonfarm payrolls rising by a seasonally adjusted 163,000, there appears to be something amiss. The Institute for Supply Management’s index of business activity fell below 50% (the dividing line between expansion and contraction) for the second month in a row for the first time since the depths of the Great Recession in 2009. At the same time the Bureau of Labor Statistics found that July factory jobs increased by 25,000. Hmmm, that seems a bit puzzling. It turns out that the BLS added 377,000 jobs for seasonal adjustment, the largest such adjustment for July in the last ten years. So, here in the real world, rather than there being 25,000 additional jobs there were actually 352,000 fewer.

The July unemployment rate ticked from 8.2% to 8.3%, while Toyjobs’ favorite statistic – U6, which includes people who’d prefer a full time job or more rewarding job but can’t find one, moved from 14.9% to 15.9%. That means that one in every seven Americans is either unemployed or underemployed. Paradoxically, the stock market keeps going up, reaching four year highs last week. Of course, this is also subject to a seasonal effect as stocks were traded in very small volumes as many buyers and sellers have gone to the beach.

The July unemployment rate ticked from 8.2% to 8.3%, while Toyjobs’ favorite statistic – U6, which includes people who’d prefer a full time job or more rewarding job but can’t find one, moved from 14.9% to 15.9%. That means that one in every seven Americans is either unemployed or underemployed. Paradoxically, the stock market keeps going up, reaching four year highs last week. Of course, this is also subject to a seasonal effect as stocks were traded in very small volumes as many buyers and sellers have gone to the beach.

There are, however, some reasons to be cheerful. Anecdotally, here at Toyjobs, we have, as expected, seen actual hiring slow during the summer months as companies have difficulty actually pulling the trigger due to vacations, daydreaming on Fridays, etc. There are, however, many searches “in process” which should close soon as the majority of people return to their desks. Also, search starts have been quite high since the beginning of August which is early in the annual job opening cycle. Stay tuned to our job board in the coming weeks as we’ll be posting many new toy jobs.

Also, the types of new job openings have started to shift. Over the last four years, what hiring there was has focused on Sales, Sourcing and Safety which can be translated to “revenues, cost reduction and regulation.” We are just beginning to see a boom in Marketing and Product Development jobs, which have been largely absent. Hopefully this is an indication that toy companies are no longer “hunkered down” and are ready to develop new products and try new things. Perhaps buyers are becoming less risk averse; at least in terms of the items they’re picking even if they’re still not willing to order on a timely basis.

Also, the National Retail Federation is projecting an almost 22% rise in back-to-school sales. We should keep in mind that these are only predictions based on a survey model and people will often say that they are going to spend more than they actually do. Add to that, back-to-school sales are a notoriously poor predictor of holiday spending – where the big money is.

The overall story here is that summer statistics, like summer love, is notoriously capricious. We shouldn’t put too much stock in them. We shouldn’t take too seriously the non-vacationing jabberers pointing at them to support whatever strain of the truth they are paid to push on the rest of us. Summers are slow and there is less going on which gives whatever is happening the appearance of greater significance. It’s wise to wait for September and, better yet, October data which is much more reliable to try to divine what our true circumstances are. That said, it would be incredibly beneficial if currently vacationing or campaigning politicos would give a one year extension to the current taxation, spending and regulatory regime providing both businesses and consumers the confidence needed to get their heads and wallets back into the game. No need to leave the beach. Ya’ll can just Skype it in.

All the best,

Tom Keoughan