Fall Toy Preview: Success Without Crowds

Fall Toy Preview: Success Without Crowds

From an aesthetic point of view, the Fall Toy Preview was great. There was no clutter and lots of open space. At the heart of the show on the twelfth floor of the Dallas Market Center the corridors before, between, and behind the booths were as wide as boulevards. Unfortunately, the wide open spaces were the result of there being significantly fewer booths.

Attendance at this show is always tricky to evaluate because exhibitors and buyers are tucked away in closed booth cubby holes for much of the

day. My favorite “metric” is to look over the edge at lunchtime and see how crowded things look around the food court. This year the traffic was sadly sparse. Even the Starbucks line was short (scientific inquiry at its best). If the show were to be judged by looking around and taking a head count, you would think that the show was a failure…but you’d be wrong.

day. My favorite “metric” is to look over the edge at lunchtime and see how crowded things look around the food court. This year the traffic was sadly sparse. Even the Starbucks line was short (scientific inquiry at its best). If the show were to be judged by looking around and taking a head count, you would think that the show was a failure…but you’d be wrong.

All the exhibitors that I spoke with were in high spirits and had very full dance cards. Buyers were there en masse. Wal-Mart, Target, Toys ‘R’ Us, Amazon, Walgreens, CVS were all well represented. In all, about 350 retailers were in attendance. There was a bit of a kerfuffle when a lone Kohl’s buyer canceled at the last minute, citing Ebola fears, although I suspect it was really more of a babysitting issue. True, both retailers and exhibitors seemed to send smaller contingents than in years past. This certainly contributed to the lower headcount. That said, the teams were sufficient to get the job done. No one seemed to be absolutely scrambling. More troubling is that year after year, more manufacturers seem to be dropping out of the event.

I hear a lot of manufacturers complain about the Dallas Show as a waste of time and money. I have listened to it for years and when I hear it, what usually runs through my head is – “you have unreasonable expectations.” If you think you are going to have a big breakthrough with Wal-Mart or Target at the Fall Toy Preview – that just ain’t gonna happen. If, on the other hand, you work the show as it is intended, focus on getting retailer feedback on product, packaging, merchandising, product packs, and pricing, you will certainly get that. Also, if you can meet with twenty mid-tier retailers in one place over a three-day period, I can’t imagine why you wouldn’t go ahead and do that. My thought has always been, if you go into a trade show with the proper expectations, you will come away feeling successful. Of course, what do I know, I’m “just a headhunter.”

Obviously, the October Trade Show Season is a mess. We have buyers running to Los Angeles during the two weeks prior to Dallas and running back to LA or Hong Kong or both in the two weeks after. For good or ill, the toy industry today is overwhelmingly centered in Southern California. So let’s agree to try to find an appropriate venue in the Los Angeles area. That should be pretty simple.

The bigger problem is scheduling. The reality is that the larger companies like Mattel, Spin Master, MGA, and Jakks Pacific don’t want to show at the same time as the rest of the toy industry. I understand the big boys wanting to monopolize buyers’ time without having them “distracted” by their smaller and often more innovative competitors. Unfortunately, this situation hurts the toy industry as a whole. It’s probably a conflict of interest for the largest companies to sit on the TIA Board, while at the same time undermining TIA events and initiatives which are meant to support the industry as a whole. It’s pretty clear that if the TIA scheduled an October show in the Los Angeles, then the big boys would just move their events to before or after it. Since they’re not going to play ball with the rest of the industry, here’s a relatively simple solution which should serve everyone.

Let there be a two week Toy Trade Show located in the Los Angeles area in October. During the first week, the largest companies can use their current spaces and exhibit their wares in the same way that they are doing now. So as to not discriminate, any other manufacturer who feels that their product line and sales volume is strong enough to peel buyers away from the big boys are welcome to rent space and try to do so. Keep in mind that buyers are going to have to get into cars and drive in Los Angeles traffic just to see you so you may be disappointed.

During the second week, the TIA can identify and arrange for a venue for all the other exhibitors, which should be a convenient one stop shop. Since the toy industry is clearly unable to arrive at and adhere to a common sense solution like this, it is up to the buyers. It is the buyers who are being run around willy nilly. It is time for them to be the grown-ups in the room and play some hardball. The buying community should come together and go to the TIA and say, “Arrange this for us. This is where we will go and this is when we will be there. If a manufacturer wants to see us, this is where they should be – end of story.” That should get someone’s attention. Do I really expect Target to kick Mattel out for not being in attendance? No, but Mattel might find that three or four feet of their shelf space was given to somebody else. Be there or be square. As for me personally, I sorta like the idea of being in New York in October and Los Angeles in February.

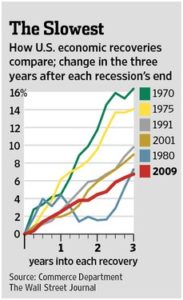

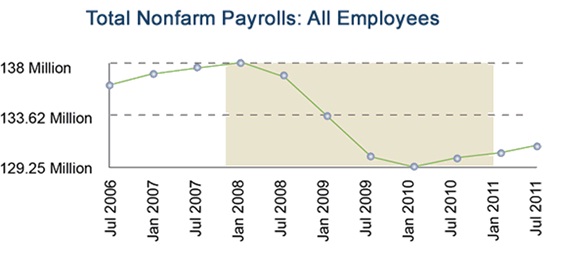

Meanwhile back in the USA, the economy continues to improve. In September, the headline unemployment rate fell to 5.9%, the lowest level since July 2008. Wage growth has continued to lag but that is typical of an economic recovery. Overall wages won’t rise until the talent pool grows tighter. U-6, which includes consultants and part time workers who would prefer full time work remains stubbornly high. A possible explanation are the rules imposed by Obamacare, which require employers to provide health insurance to most full time workers but not to part timers. That is causing some employers to control schedules so that people don’t work enough hours to qualify as full time.

There are reasons to be optimistic about the upcoming holiday sales season. Retail sales rose broadly in August and consumer sentiment hit a 14 month high in September. According to NPD, US and European toy sales will be up 3 to 4 per cent this year. Even beleaguered Toys ‘R’ Us had its first half comparable store sales turn positive for the first time since 2010. We have hot products which will drive consumers to the stores. Anything Frozen is flying off the shelves. Minecraft has addicted a generation of 8 year olds. Teenage Mutant Ninja Turtles are inexplicably back big time. Moose Toys has several hot lines with Shopkins, Little Live Pets, and Mutant Mania. Lastly, cheaper oil will lower gasoline prices, which should increase purchasing power for U.S. consumers in time for the holiday sales season.

Toy industry hiring continues to be strong but the mix of job openings continues to be abnormal. For our thirty plus year career, two-thirds of Toyjobs searches have been in Marketing and Product Development. Another 25% were Sales with the rest being “other” (QA, supply chain, etc.) Since last October, when toy hiring rebounded sharply, about 90% of searches have been for Sales Execs. That continues to this day. The toy industry being a seasonal business also tends to hire cyclically with August through December being the hiring season for Sales people. February through July tends toward Marketing and Product Development. I’m hoping that predictions of a strong holiday sales season prove true and that it stimulates a Marketing and Product Development hiring binge next Spring. We will have to wait and see.

All the best,

Tom Keoughan