Rosy forecasts but weak real world numbers make for uncertainty

Retail Projections

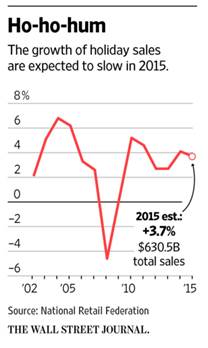

Early forecasts for Holiday Spending 2015 have been quite optimistic. Households have been enjoying fatter wallets, thanks to lower gasoline prices and cheaper imports, thanks to a stronger dollar. Retail sales reflected this by growing from January to July. NPD has reported that toy sales were up 6.5% in the first half and is projecting 6.2% growth for the year as a whole. The National Retail Federation is forecasting a holiday sales increase of 3.7%. That sounds good but less so when you consider last year’s 4.1% gain.

Early forecasts for Holiday Spending 2015 have been quite optimistic. Households have been enjoying fatter wallets, thanks to lower gasoline prices and cheaper imports, thanks to a stronger dollar. Retail sales reflected this by growing from January to July. NPD has reported that toy sales were up 6.5% in the first half and is projecting 6.2% growth for the year as a whole. The National Retail Federation is forecasting a holiday sales increase of 3.7%. That sounds good but less so when you consider last year’s 4.1% gain.

Retail Reality

Forecasts are fun and they can be helpful, but let’s not ignore what’s going on in the real world. A retail sales slowdown began in August and the Commerce Department recently revised the growth rate down to 0.0% for the month. September retail sales numbers were not perceptibly better with only a 0.1% growth rate. While low gas prices have been increasing disposable income and the strong dollar has led to some price deflation, consumers have been channeling additional spending toward services such as vacations and restaurant meals. Before we get pessimistic, let’s keep in mind that for economic data, some months counts less than others. August is rarely a good indicator – it’s summer! And September can often be a transitional month, especially when Labor Day arrives late, as it did this year.

Weak Jobs Reports

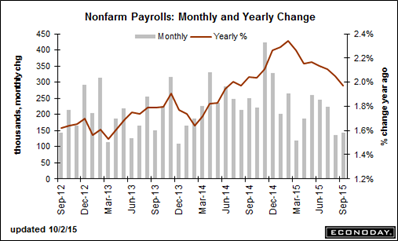

Concurrent to the slow-down in the retail sales is what we’re seeing in the job market. While job creation was strong in the first six months of the year, in September there were only 142,000 net new jobs. The numbers for July and August were also revised downward so that the third quarter monthly average for net new jobs was 167,000. That’s down from a monthly average of 198,000 for all of 2015 so far, which is down from 260,000 a month in 2014. While we should be concerned, again let’s not get overly pessimistic quite yet. Third quarter job gains have a historical tendency to run below average for the year and the deceleration often turns out to be temporary, rebounding in the October to December quarter. Again – it’s summer! …I’m going to wait for the October numbers before I really try to figure out what’s going on.

Concurrent to the slow-down in the retail sales is what we’re seeing in the job market. While job creation was strong in the first six months of the year, in September there were only 142,000 net new jobs. The numbers for July and August were also revised downward so that the third quarter monthly average for net new jobs was 167,000. That’s down from a monthly average of 198,000 for all of 2015 so far, which is down from 260,000 a month in 2014. While we should be concerned, again let’s not get overly pessimistic quite yet. Third quarter job gains have a historical tendency to run below average for the year and the deceleration often turns out to be temporary, rebounding in the October to December quarter. Again – it’s summer! …I’m going to wait for the October numbers before I really try to figure out what’s going on.

Wallowing Wal-Mart

The big news last week was Wal-Mart. The retail behemoth said that, while sales would be flat, earnings could fall as much as 12% next year. The lower margins will be the result of “investments” in staffing at US stores and actual investments in ecommerce. When Wal-Mart experiences margin pressure – “Let the vendor beware!” – that can only  mean bad news for its suppliers. Already they are asking all suppliers to pay fees to keep inventory in Wal-Mart warehouses and in some cases, they are strong arming vendors into accepting extended payment terms. One can only imagine that there will be more of this type of thing to come.

mean bad news for its suppliers. Already they are asking all suppliers to pay fees to keep inventory in Wal-Mart warehouses and in some cases, they are strong arming vendors into accepting extended payment terms. One can only imagine that there will be more of this type of thing to come.

Strategically, changes needed to be made. Wal-Mart was falling behind in the retail wars. It’s difficult to compete with a company like Amazon, which is apparently comfortable not making any money for more than twenty years. From a timing standpoint, this makes perfect sense. New CEO Doug McMillon is a lifer who enjoys broad support. He is relatively young and will probably be in the CEO chair for another 10-15 years. He will be able to chart the new lows as his starting point as he goes about setting new strategy and rebuilding the retail juggernaut. He certainly has the time and resources to turn things around, but he has to get the strategy right. Not that he’ll notice, but we at Toyjobs wish him the best of luck.

Putting together a strategy to right the Wal-Mart ship is way above my pay grade, but I do have just one little question – we hear a lot about a “seamless customer strategy” and “click and collect” where a consumer can buy online and then stop by a store to pick up their purchases. My question is – why would I want to do that?? When I can simply purchase online and have my items delivered to my door. Just sayin’.

Dallas Fall Toy Preview

I found most people at the Dallas Fall Toy Preview to be very optimistic. The Frozen phenomenon seems to be fading fast butShopkins has been and Star Wars soon will be taking the world by storm. Wicked Cool had a very strong looking product line and over at the Auldey RC booth, people were busting through the doors.

Certainly there were the usual complaints – “Why are we here?” and “This place is empty.” But, when I asked manufacturers if their dance cards were full, they almost unanimously answered “yes.” In fact, in a completely new trend, instead of ambling in late, buyers were arriving for appointments early – even a day early. It seems that everyone wanted to get out of town as quickly as possible. I’m guessing that Thursday was completely dead, but can’t really tell you because I had already left for Austin to enjoy a much deserved long weekend of good food and good music.

October continues to be a crazy time in the toy industry with buyers and manufacturers pinballing between Dallas, LA, and Hong Kong at an accelerating rate and with even more disjointed schedules than ever. I know more than a few execs that will be in all three locations (simultaneously?) this month. The TIA still needs to figure this out. Things are getting messier, not better.

Navigating Conflicting Signals

What do we make of all of this conflicting noise? Should we try to make sense of things or just bury our heads in the sand? I feel like I’m crossing a deep river barefoot and just feeling around for smooth stones with my feet. Not that anyone listens to me but I am going to acknowledge, but not put much faith in, all of the conflicting

like I’m crossing a deep river barefoot and just feeling around for smooth stones with my feet. Not that anyone listens to me but I am going to acknowledge, but not put much faith in, all of the conflicting signals until I see the October numbers. Historically, October is a solid bellwether month. I’m optimistic but am going to be conservative in planning and spending until things actually happen. I think that there’s going to be an absolute ton of Star Wars merchandise sold but I also think there will be an awful lot of it left on the shelves. What then? “Curb Your Enthusiasm” and don’t become “Irrationally Exuberant.” It’s likely to be a strong holiday shopping season, but at this point that is far from certain. Be prepared for the aftermath. I am filled with both optimism and uncertainty and I’d prefer to be surprised on the upside.

signals until I see the October numbers. Historically, October is a solid bellwether month. I’m optimistic but am going to be conservative in planning and spending until things actually happen. I think that there’s going to be an absolute ton of Star Wars merchandise sold but I also think there will be an awful lot of it left on the shelves. What then? “Curb Your Enthusiasm” and don’t become “Irrationally Exuberant.” It’s likely to be a strong holiday shopping season, but at this point that is far from certain. Be prepared for the aftermath. I am filled with both optimism and uncertainty and I’d prefer to be surprised on the upside.

May the force be with us,

Tom Keoughan