Toyjobs Blog – Toy jobs news, Toy job updates, Toy jobs industry, Toy jobs and careers.

Toyjobs Sees Surge in Search Starts

There’s a lot of gloom and doom on Wall Street right now which the media is only too happy to capitalize on in order to sell more advertising to more eyeballs (for the media it’s a sort of a stimulus program). However, most economists think there is only a 25-30% chance of a double dip recession. That percentage is up from 20-25% but economists overwhelmingly feel that the most likely outcome is continued slow growth (CSG?). While CSG doesn’t feel all that good, we’ve gotten used to it and it’s a helluva lot better than 2009, right?

Big investment managers on Wall Street are jumpy and stock indices are swinging wildly on any even minor news. “The current Greek bailout plan is in danger! Oh, heavens! …Gee, I think there will be another one. Factories in Pennsylvania, Delaware and South Jersey slowed down in the month of July! Oh, my.” I’m told (because I ain’t no expert) that a lot of this crazy volatility is caused by hare triggered computerized high frequency trading. The stock market has been trading in a range for a while so these programs are set to sell massive blocks of stock when we reach a point near the top of the range and conversely scoop stocks up when we near the bottom. This leads to wild gyrations which will take a little while to settle out.

On a positive note, retails sales were up 0.5% in July and figures for the previous two months were revised upward as well. Japanese supply chain disruptions are coming to an end. Prices have come down for oil, energy transportation and commodities. Unfortunately for the toy industry there are still problems in China with: manufacturing costs, labor, electricity and transportation.

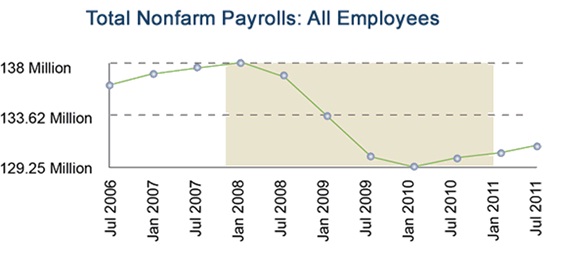

The job market continues to slowly improve and unemployment has stabilized at just over 9%. The government also revised its May and June jobs reports upward. July non-farm payrolls increased by 117,000 (154,000 private market jobs minus government layoffs) which is the tenth straight monthly gain. 117,000 additional jobs per month isn’t enough to keep up with population growth (for that we need approx. 200,000) but it is heading in the right direction.

While it will be interesting to see the August numbers, we have to remember that during July and August we are in the midst of “the summer doldrums” when hiring slows down on a seasonal basis even during good times. I expect that we will see noticeably improved numbers in the October and November jobs reports. I hear you – “Where did that come from? What makes you say that, Tom?” Well, for one thing – I am in the employment business.

Toyjobs noticed a much improved employment atmosphere in January as companies started with new budgets after a decent, though unspectacular, Christmas. The slope of the improvement curve steepened in mid May as retailers went from “happy talk” to actually placing orders. Unfortunately we then hit July and August during which hiring slows down while hiring managers go on vacation and everybody (me too) is a little more focused on “outside activities.” A lot of the searches that we started in late May and June slowed to a crawl during July and will be finalized in the next couple of weeks. If we were publishing two or three weeks from now you would see a much bigger list of Toyjobs Success Stories (or you can just check back next month). Summer doldrums generally continue through the first half of August while toy company executives stare at their phones and pray that they don’t ring with purchase order cancellations. When they start breathing again about the third week of August, they suddenly seem to realize that the Fall Toy Preview is upon us and they better get moving if they want their team in place for the 2012 selling season. This year they didn’t all wait until late August. Toyjobs saw a surge in search starts at the beginning of August. Those searches are being worked now and will likely be filled in September/October. I foresee continued strength in search starts in late August and September. Why? Because that’s the usual seasonal pattern. Let me curb my enthusiasm by saying that we are nowhere near back to normal again but we are in so much better shape than we were two years ago and things seem to be getting better faster.

So, if you’re out of work, make the day after Labor Day the time when you renew your efforts to reach out to your network. If you’re working but would like to change jobs, now is the time to dust off your resume and tweak it up a bit. If you’re a hiring manager, think about how you can shorten your “decision cycle” and “pull the trigger” quicker. Otherwise one of your competitors might hire the person you want.

Muddling through more confidently,

Tom Keoughan