Toyjobs Logs Best Month Ever

In April, Toyjobs has logged its best month ever and we still have ten days left. In the toy business, a lot of searches are started early in the year but companies have difficulty arranging interview times and moving the ball forward in January and February due to all of the trade shows. Lots of jobs end up getting filled in March and April. That’s what we have seen in each of the last two years.

Search starts are continuing at a rapid pace. Toy sales were up approximately 6.5% last year. That makes companies happy and happy companies are hiring! Let’s hope it continues. Lots of hiring is good for everyone.

I’m sorry this is so brief but I gotta get back to work.

All the best,

Tom Keoughan

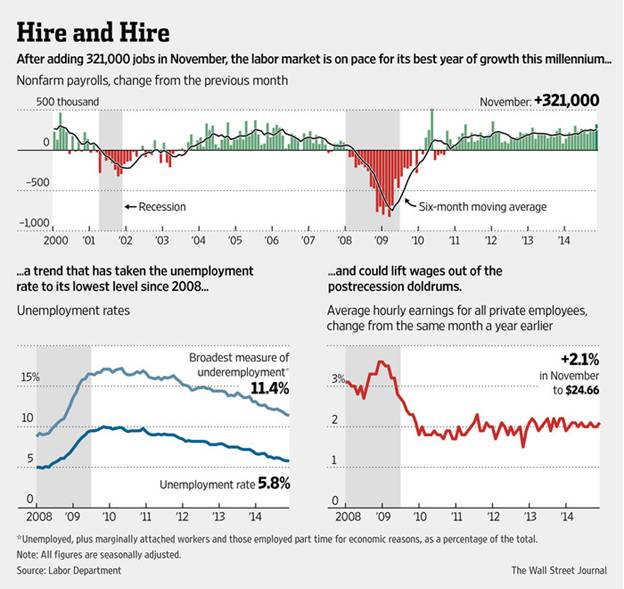

90,000 jobs. Days when the office is closed due to weather also takes a greater toll than it is generally given credit for. There are the snow days themselves and then there are the next few days of playing catch up. Yes, I know everyone claims that they can get all the work done or are even more productive from home but we all know that’s not entirely true, don’t we? This means multiple days taken away from interviewing and decision making all of which pushes actual hiring down the road.

90,000 jobs. Days when the office is closed due to weather also takes a greater toll than it is generally given credit for. There are the snow days themselves and then there are the next few days of playing catch up. Yes, I know everyone claims that they can get all the work done or are even more productive from home but we all know that’s not entirely true, don’t we? This means multiple days taken away from interviewing and decision making all of which pushes actual hiring down the road.