Brief Rain Delay – Waiting for Takeoff

While the headlines blared “Retailers’ Holiday Sales Disappoint” this was based on same store sales which were up but not as much as anticipated. Those projections seemed to be based on mostly wishing. However, same store sales is a retail metric meant to measure a retailer’s health. If you “make stuff” that you sell through retailers, a more meaningful metric is total sales, which measures all the “stuff” sold in all of a retailers’ stores. If a retailer builds more stores and in total sells more “stuff” as “stuffmakers” it’s not our primary concern that the retailer didn’t sell quite as much as they wanted in each store. We want to know how much “total stuff” of ours they sold.

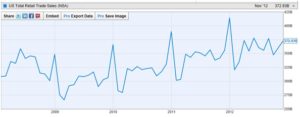

Same stores Sales increased by 4.5% according to Thomson Reuters but this was skewed upward due to Costco being the most heavily weighted company in their index and Costco knocked it out of the park. Same store sales minus Costco increased 2.8%. Those aren’t break out the champagne numbers, but they’re not too shabby. Total Sales should be up by more. Unfortunately, the best chart I could find only runs through November 2012. New data will be available on February 13 (Click Here For Chart). We will also publish the new chart new chart next month.

The holiday sales season was characterized by heavy online shopping in November and early December followed by strong bricks and mortar purchases at discounted prices during the two weeks leading up to Christmas. Toy sales followed this pattern and were flattish overall with a weak November and strong late December.

Leapfrog was a huge winner with four of the top ten toys of 2012. Costco, Kohl’s and Macy’s did very well on the retail side. Amazon sales were quite strong but, as always, profitability is suspect. Times were tough for Hasbro who experienced weak holiday results and is planning to cut 10% of its workforce. Toys ‘R’ Us posted poor results both in the US and internationally. Sears/Kmart remained wobbly.

Both TRU and Best Buy accused Wal-Mart of posting online bait and switch ads. They claimed that the retailing giant would run internet ads claiming lower prices but then their stores would have either different models or be out of stock. Wal-Mart’s rather disingenuous response was “our ads don’t claim to compare identical products.” Wal-Mart had been accused of similar tactics back in the old print ad days of the mid-nineties. We’ll have to wait and see how this plays out.

As Toy Executives return from Hong Kong, I’m hearing that while late December toy sales were very strong that they didn’t make up for the rest of the holidays sales season. Retailer’s are carrying too much inventory which is compromising open to buy dollars and little early year restocking will be necessary. This will hurt toy company’s in the first half which has always been a difficult period for them anyway. The other thing I’m hearing is that in 2013 Teenage Mutant Ninja Turtles are going to be huge

Looking forward, we’re a long way off from Christmas 2013 but the elimination of the payroll tax cut could hurt consumer spending since in the current economy many households are living paycheck to paycheck. Europe is in recession which will impact the largest toy companies and smaller ones at the margin. That said, the economy has stabilized and continues to improve. Bipartisan shenanigans in Washington will continue to dampen economic growth during the first part of the year. That, as well as, the European situation and existing retail inventories should cause things to continue to muddle through until May or June. As we move past those headwinds, the economy should gain strength in the second half. I then see blue skies in 2014 although it’s really much too early to make a firm call.

Toy industry hiring should follow these economic trends which, for now at least, seem to match up well with the toy world’s annual business cycle. Look for companies to be cautious but to add where they have to in the first half and regain confidence and increase hiring as the year moves forward. Let’s keep our fingers crossed

Seeing lights at the end of the tunnel,

Tom Keoughan