The sudden demise of Toys “R” Us has been very disruptive to the toy hiring market. It’s crazy out there. Many companies have laid people off but lots of companies are hiring as well. Oddly enough, many companies are doing both as they reorganize their rosters for the changes and challenges ahead.

By the beginning of 2018, most toy manufacturers expected that Toys “R” Us was going to be a bit shaky moving forward and had instituted plans to limit any potential damage by shipping less, later and tightening payment terms. They were hedging their bets but remained confident that business would continue amongst constant reassurances by Toys “R” Us Execs to: “Remain calm. All is well.” Then shortly after the completion of the January and February Toy Shows, Toys “R” Us declared bankruptcy. While everyone knew that things were wobbly, nobody expected Toys “R” Us to fall so far and so fast. After all Kmart has been wobbly but still standing for over a decade.

In a typical year, very little toy industry hiring gets done in January and February as Toy Execs are overbooked and over busy crazily traveling the globe to attend anywhere from three to five shows. Not only are they too busy to hire they also would prefer to wait and see how retailers react to their wares before opening their wallets to add to staff.

Usually, about two weeks after the final trade show in New York, manufacturers put the finishing touches on plans and projections and the phones begin to ring here at Toyjobs World Headquarters. With the sudden and unexpected demise of Toys “R” Us, manufacturers had to reconfigure their expectations. Publicly there was a lot of finger pointing, magical thinking and gnashing of teeth. After about two months, forecasts were changed and plans were redrawn and search starts picked up in early May leading to increased but not overwhelming hiring in June, July and August.

Toy hiring follows toy sales and I would imagine that toy sales and will be somewhat lower in 2018 as manufacturers search and battle for shelf space to replace their Toys “R” Us acreage. I would think that challenge will continue but to a lesser extent into 2019 as Toys “R” Us begins to fade into the rear-view mirror. I envision that toy sales and therefore toy hiring will remain disrupted but steadily gaining strength over the next year and a half.

I realize that is very much at odds with recently published NPD data. Toy industry grows its sales by 7 percent in the First Half!! Yeah, but … Consumers were lured into the Toys “R” Us stores by the trumpeting of huge markdowns which didn’t really look all that “yuge” once you were in the store. I know mothers who went to Toys “R” Us every couple of weeks in search of big bargains that barely existed. After all, if you’re going to lie to your employees and lie to your vendors why not lie to the public as well. Probably because traffic, even disappointed traffic, equals increased sales. Unfortunately, those sales didn’t help the toy industry all that much. They were sales of previously shipped and unpaid for merchandise. I would envisage that most of the proceeds went into the pockets of the bankruptcy attorneys rather than toy companies. So I see that 7% Toy Industry Sales Growth as a very flawed number in this period. Sales of toys off retailers shelves was indeed a very different things than sales by toy manufacturers.

That said they toy industry is reacting to and recovering from the Toys “R” Us debacle amongst a very bright backdrop. It’s better to face challenges in an increasingly robust economic environment. After all, this isn’t 2009 and the world isn’t going to end tomorrow. Rising employment, wages and tax cuts have consumer spending on a tear and US GDP rose to 4.1% in the second quarter, Wal-Mart just hit it out of the park. CEO, Doug McMillon was quoted last week as saying “Customers tell us that they feel better about the current health of the U.S. economy as well as their personal finances. They’re more confident about their employment opportunities.”

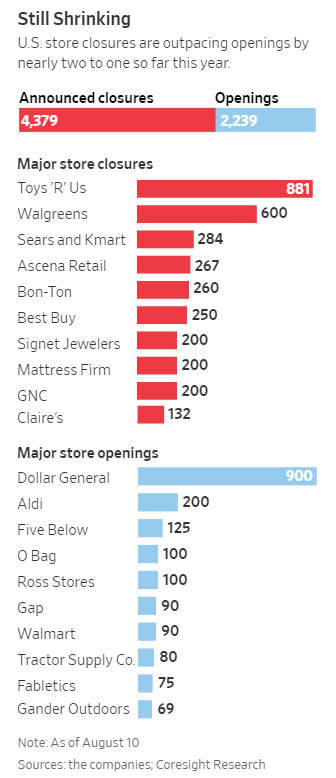

The evolving retail landscape toward online shopping continues but many brick and mortar retailers like Wal-mart, Home Depot, Nordstrom, and Coach have recently been reporting strong numbers while others (JCPenney, Bon-Ton, Claire’s) are either closing stores or going bankrupt. Weaker competitors are being weeded out and clearing some of the over capacity that has plagued retail. As a result, the remaining chains are growing even stronger.

The good news is that consumers still want to buy toys. Toy manufacturers will just have to be ever more nimble in getting their products in from of them.

Say what you will about Trump’s antics but the economy is humming. I’m still wary about Trumpian trade issues. I suspect, but can’t know for certain, that things will get worked out with Mexico, Canada, and Europe. That said, playing a game of chicken with China is a very different deal. Eventually, after much dickering, we will probably end up with face saving half measures (or more likely quarter measures) … eventually.

Free product idea for a Skill and Action Game:

The Game of Chicken: Trump, Trade and Tariff Edition

“Crossing the River by Feeling the Stones”

Tom Keoughan