Tax cuts aren’t about to make America’s inequality problem go away. But with an assist from a tight job market, they are bound to make the less-well heeled feel more flush.

That should support middle class spending, benefiting many retailers and other consumer-facing businesses. It could also upend a longstanding trend in retailing where companies serving the lower and upper rungs of income performed well and those that traditionally served the middle class struggled.

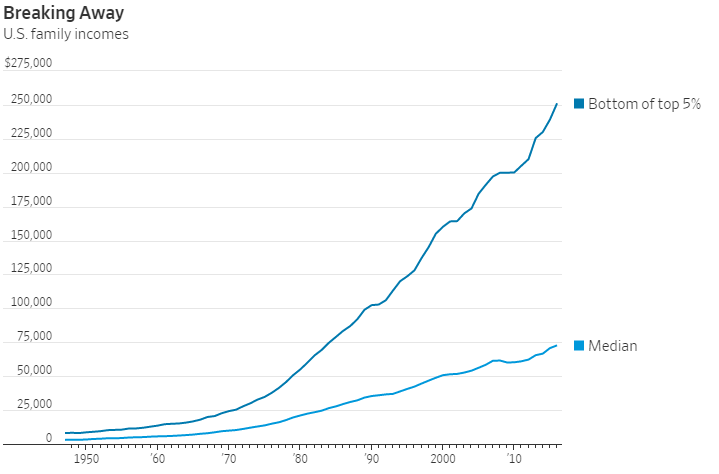

Rising inequality is a decadeslong problem. As of 2016, the lowest-earning family in the top 5% by income made $251,183 a year, according to the Commerce Department, or 3.5 times the median family’s $72,707. That compared with 3.2 times in 2000 and 2.9 times in 1990.

The tax package Donald Trump signed into law in December is unlikely to reverse inequality. Estimates from both the Tax Policy Center, which is run by a former Obama administration official, and the conservative-leaning Tax Foundation show that households in the top fifth by income will receive larger percentage increases in after-tax income this year as a result of tax cuts than households in the middle fifth. Similarly, while economists agree that some of the benefit from lower corporate taxes will accrue to workers, most think that the bigger benefit will be to investors.

Investors shouldn’t let such considerations diminish the importance of what is happening to middle-class paychecks. Starting this month, the individual tax-cut started translating into higher pay for many Americans. And the less well off they are, the more likely they are to spend it. That could have a powerful effect: A typical family with children that earns $75,000 annually will pay $2,119 less in taxes this year, according to the Tax Policy Center.

The spillover from the corporate tax cut means that many middle class workers’ before-tax wages could be heading higher, too. While the $1,000 bonuses some businesses have handed out since the tax law’s passage don’t move the needle much, the competition for workers and new investment the tax cut will spur is another matter. This is especially true since the tax cut is hitting with unemployment already low and wage growth picking up.

The extra money in the pockets of lower-income consumers, in particular, could alter the retail landscape. Stores such as Dollar General could get less of their business as shoppers make more big shopping trips to stores like Walmart . Further up the income rung, middle-class consumers will spend more, but that doesn’t mean they will spend it indiscriminately. Companies seen as offering good value on the dollar—Walmart, again, as well as Amazon.com and Costco Wholesale —will get much of their business.

On the other hand, stores that have struggled to compete on price, such as department stores, might not get as much of a sales boost while still facing higher labor costs. As with so much else, it will be a case of haves and have nots.

Source: WSJ 2/18/18 | Justin Lahart