In its early stages, the Republican tax plan didn’t bode well for retailers. Speaker of the House Paul Ryan wanted to include a border-adjusted tax on imports that would have been disastrous for an industry that sources much of its merchandise overseas.

That didn’t make it into the final plan. Instead of coal for Christmas, retailers got a war chest. Their corporate tax rate of 35% will drop to 21%, handing them a free cash flow boost as they fight for survival in the Amazon era.

“It’s like manna from heaven,” says Anthony Chukumba, a retail analyst at Loop Capital. “It couldn’t have come at a better time.”

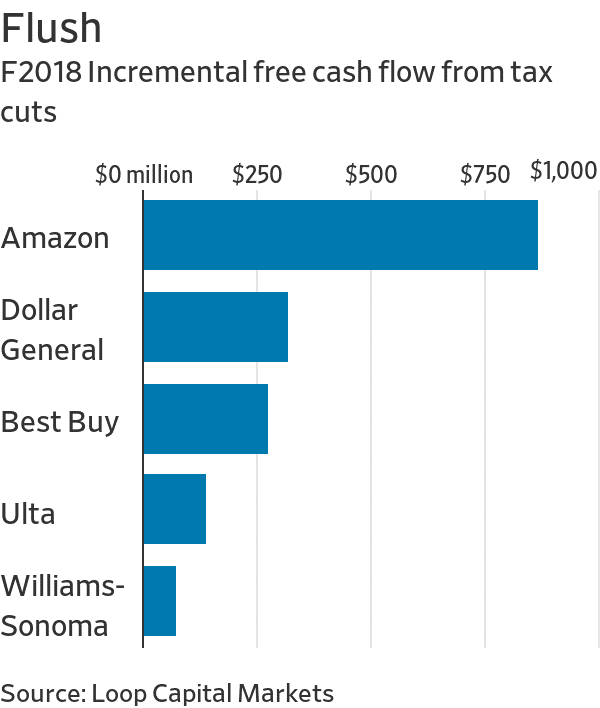

Retail stocks have rallied since passage of the plan, and analysts calculate an average 15% earnings-per-share lift across the industry. Yet the benefits will vary by company. Domestically-focused retailers like Nordstrom and Ross Stores will fare better than those that have already taken advantage of loopholes associated with foreign business—for instance, Nike. Retailers that cater to high-income consumers also will benefit since the plan’s tax savings will accrue overwhelmingly to them. Research by Loop Capital points to Williams-Sonoma, Best Buy and Ulta Beauty as those likely to reap such rewards.

Meanwhile, deep-discount retailers have less to celebrate. Paltry tax breaks for low-income consumers will leave them with little extra to spend. Indeed, potential changes in entitlement programs to offset low corporate income tax means they could be worse off.

For those retailers flush with savings, the question is how to use them. Some will reward shareholders. Others are more likely to reinvest savings in store remodelings, customer service and e-commerce capabilities.

A report by Nomura Securities, analyzing which companies have historically preferred invest-to-grow strategies, suggests that Amazon, Nordstrom and Urban Outfitters are among those likely to reinvest.

Michael Kors and Ross, by contrast, have tended to let savings flow to the bottom line.

Fourth-quarter guidance will indicate just how favorable the changes are and how much companies plan to reinvest. Many will see a one-time fourth-quarter hit due to a mandatory repatriation tax on foreign earnings, but the amount is actually payable over several years.

In the long-term, though, retailers can look forward to battling Amazon with renewed resources. Will it be money well spent, or just expensive life-support for a dying industry?

Source: Wall Street Journal January 8, 2018 I Elizabeth Winkler