If Beijing won’t let Hong Kong’s courts function as intended, the city’s standing as an international business and financial center is in trouble.

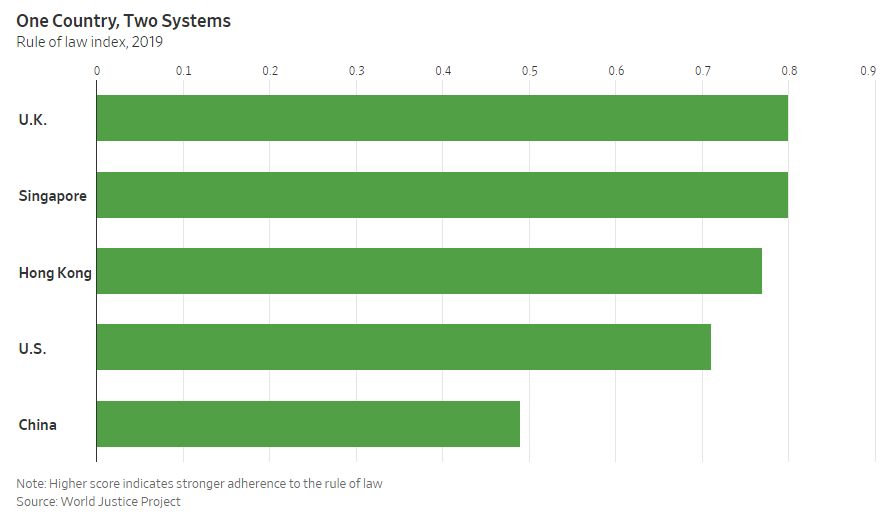

Hong Kong’s property markets and financial system have so far weathered the recent upheaval relatively well. In part, that is because business people still believe that when it comes to the courts, the “one country, two systems” formula applies. Among other things, that confidence rests on the existence of an independent judiciary that upholds the rule of law and individual rights.

Hong Kong’s High Court demonstrated that independence on Monday, ruling against a controversial ban on wearing masks at public gatherings that was meant to curb escalating street protests. Police officials said they would stop making arrests based on the ruling. On Tuesday morning, however, China’s state-run Xinhua News Agency released a statement from China’s legislature saying the court’s judgment impaired the Hong Kong chief executive’s rights and only the National People’s Congress could decide whether Hong Kong laws were constitutional.

That isn’t how the system has worked up until now. True, the legislature’s standing committee does have the power to interpret Hong Kong’s mini-constitution, the Basic Law. But it has only exercised this ultimate authority five times since the 1997 handover from the U.K. Meanwhile, the city’s courts have also ruled on numerous constitutional issues.

The ramifications for Hong Kong’s business environment are ominous. The mask ban was introduced using an emergency framework created in 1922, during British colonial rule. If the courts can’t overrule the city’s leader in such cases, he or she need only declare an emergency to have effectively unlimited regulatory powers—including censoring the press, seizing property and detaining or deporting individuals.

Hong Kong’s mask ban was introduced using an emergency framework created in 1922, during British colonial rule PHOTO: PHILIP FONG/AGENCE FRANCE-PRESSE/GETTY IMAGES. SourcE: The Wall Street Journal

Much will depend on what happens next. One worrying possibility is that the National People’s Congress could issue a new interpretation of the Basic Law, tying judges’ hands in the future. That could give the city’s leaders access to broad, unchecked powers and limit the courts’ ability to protect anyone who runs afoul of powerful interests in China.

The implications are obvious. Such a move would probably make businesses more wary about investing, listing or transacting in the city. It could also damage confidence in the security of intellectual property and the free movement of people and capital—especially if tensions between the U.S. and China escalate.

Should confidence in Hong Kong’s distinct legal identity disappear, the city risks a deeper downward spiral—with collateral damage for mainland China’s own prosperity and financial stability.

Source: The Wall Street Journal, November 20, 2019 | Nathaniel Taplin and Jacky Wong