Mondelez International, the maker of Oreo cookies, expects to continue to spend more on digital ads than on television ads next year. PHOTO: RICHARD B. LEVINE/ZUMA PRESS

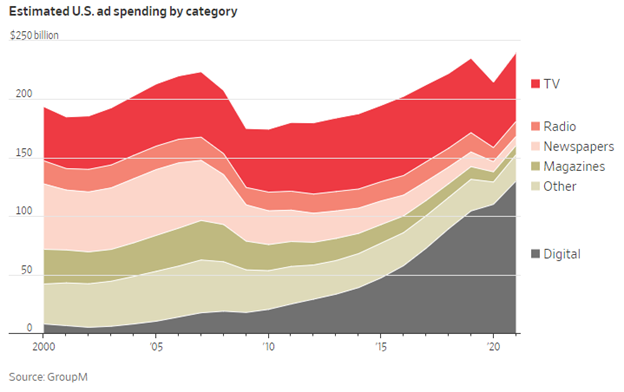

For the first time, more than half of U.S. advertising spending is set to go to digital platforms such as Google and Facebook, the world’s largest ad buyer said, a reflection of marketers’ strategy shift as the coronavirus pandemic pummeled the industry this year.

The milestone is just the latest proof of digital advertising’s meteoric rise, a development that has concentrated ad spending with several tech giants at the expense of other platforms, including newspapers, local television and magazines.

Online ads can be cheaper than those placed on other media platforms and they allow marketers to better target and measure the performance of their ads. These advantages have become ever more important during the pandemic as businesses cut ad budgets and consumers spend more of their time and dollars online.

“Digital advertising has been a remarkable bright spot in an otherwise dark year for the advertising industry,” GroupM, a unit of WPP, said in a report expected to be released Tuesday.

GroupM expects marketers to spend $110.1 billion on digital ads this year, or 51% of the total $214.6 billion total U.S. advertising-spending forecast, excluding political ad outlays. Next year, it expects U.S. ad spending to grow 12% to $240 billion, and digital advertising to account for $130 billion, or 54% of the total.

Digital First

Digital ad spending is expected to account for the majority of U.S. ad spending this year

Three years ago, digital advertising accounted for just one-third of all U.S. ad spending, GroupM said—about the same size as newspapers, radio, magazines and local TV combined. As of 2020, these four categories’ combined share of the U.S. advertising market has shrunk to 21%.

When the pandemic hit the U.S. in March, many companies slashed their ad spending as businesses around the world were shut to restrict the virus’s spread. Homebound consumers started doing more of their shopping online, causing small and large companies to place more emphasis on digital ads, said Brian Wieser, GroupM’s president of global intelligence.

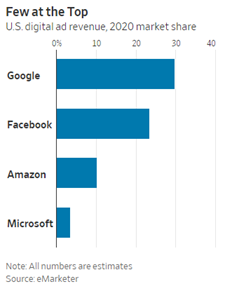

Digital advertising is dominated by three competitors—Facebook Inc., Amazon.com Inc. and Alphabet Inc.’s Google—which together account for nearly two-thirds of ad dollars spent on U.S. digital advertising this year, according to research company eMarketer.

“The biggest beneficiaries are Google, Facebook and Amazon,” Christian Juhl, GroupM’s global chief executive, said in an interview. “They have done a good job of showing ad performance—and when they show performance marketers shift dollars.”

Small-to-midsize businesses in particular have flocked to digital advertising during the pandemic, according to a recent report from media analyst Michael Nathanson. “Due to the favorable combination of granular targeting and low creative marketing costs, small businesses have gravitated to digital marketing in force,” the report said.

The growth of digital ad spending comes despite headwinds faced by some tech giants this year. Facebook was the target of a high-profile ad boycott in August that was called for by civil rights groups demanding the social-media company do more to rein in hate speech on its website. Despite that, Facebook said its ad revenue jumped 22% from a year earlier in the third quarter.

Digital ad revenue for Google rose nearly 10% to $37.1 billion in the most recent quarter, while Amazon’s ad business grew sharply, with sales up 51% to $5.4 billion in the quarter.

Consumer-goods giant Mondelez International Inc., the maker of Oreo cookies and Ritz crackers, said last month that it would spend more on digital advertising than on television commercials for the first time this year.

Jonathan Halvorson, Mondelez’s vice president of consumer experience, said consumers typically bought snacks in stores, but the pandemic has led to more snack-buying online as shoppers try out grocery-delivery and other online services.

The company started shifting ad spending toward digital ads, which “allow a faster link to the actual sale,” he said in an interview. Chicago-based Mondelez expects to continue to spend more on digital ads than on TV ads next year, according to Mr. Halvorson.

As they compete with digital rivals, TV networks have been beefing up their ability to offer brands targeted ads, while retailers such as Walmart Inc. and Target Corp. are using consumer data they have amassed to ramp up their online ad offerings.

National TV advertising is forecast to drop 7.9% to $39.5 billion this year, GroupM said, but the company expects a bounceback in 2021, with a 6.6% increase to $42.1 billion.

National TV ad spending in 2021 is still expected to remain below 2019’s $42.9 billion as the industry faces structural challenges, including consumer decisions to cancel traditional pay-television service in favor of internet-based alternatives—a move known as cord-cutting.

GroupM expects the pandemic to accelerate the downward trends for print. It predicts that next year ad spending in newspapers and magazines will decline 12% and 8%, respectively.

The largest ad buyer in the world, GroupM is responsible for purchasing an estimated $63 billion in ads each year, according to research firm Comvergence. Its clients include Ford Motor Co. , Unilever and Google.

Source: The Wall Street Journal, December 2, 2020 | Suzanne Vranica