At Precycle, a grocery store in New York, the big draw is what it doesn’t offer: there are no plastic bags or containers of any sort. PHOTO: SANGSUK SYLVIA KANG FOR THE WALL STREET JOURNAL

The backlash against single-use plastic has sent big brands scrambling to reinvent packaging. So far, they are struggling.

To tackle waste and emissions tied to plastic, consumer- goods companies such as Unilever UL -0.40% PLC and Nestlé SA NSRGY -0.10% are trying to use less, switch to other materials and persuade customers to use refillable containers. But those efforts face big challenges. Switching to paper or glass has its own environmental downsides, while refill models are often expensive or inconvenient. Efforts so far are small and it isn’t clear whether they will scale up.

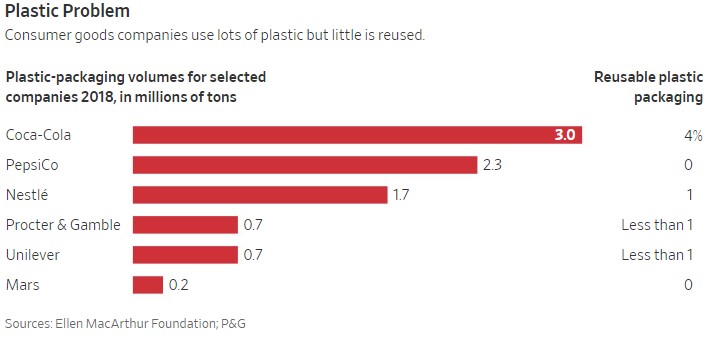

Cutting down on plastic is “the area that’s going to require the most innovation,” said Richard Slater, Unilever’s head of research and development. The maker of Dove soap and Hellmann’s mayonnaise recently promised to reduce its plastic packaging—which stands at 700,000 metric tons a year—by 100,000 metric tons by 2025 through refillable packaging, smaller containers and swapping materials.

Unilever recently scrapped individual wrappers for bulk packs of its Solero ice pops, instead using a polyethylene-covered cardboard box with dividers, cutting plastic by 35%. It also launched a concentrated version of its Cif household cleaner intended to be diluted with water at home and attached to a reusable spray bottle, reducing plastic by 75%. The Solero change only applied to one seasonal flavor at a single British retailer, while the Cif refill was packaged in plastic and wrapped in a nonrecyclable plastic safety seal, also just in Britain.

Philip Vasquez, a 27-year-old lawyer, said he isn’t drawn to products like the Cif refill because it still uses plastic. Mr. Vasquez said he would like to cut down on plastic but finds it difficult. “If everything is plastic, we literally have no choice but to consume it.”

Mr. Slater said Unilever’s plastic-reduction efforts are “all very niche” but it needs to start small to learn what works. “The daunting challenge we’ve got is we need to take these to scale.”

Consumer companies are trying to cut virgin plastic to appeal to shoppers and comply with—or forestall—regulation. Unilever plans to halve its use of virgin plastic by 2025, while Procter & Gamble Co. has pledged to do the same by 2030. Mars Inc. and PepsiCo. Inc. have similar plans.

Companies hope to achieve most of those reductions by switching to recycled plastic, but there isn’t supply to keep up with surging demand, Rabobank analyst Richard Freundlich said. That is prompting them to look beyond recycling.

One fledgling effort, which aims to deliver products and collect back empty packaging, harks back to the milkman.

Recycling firm TerraCycle this summer launched a service called Loop in New York and Paris that sells products like Unilever’s Axe deodorant, Nestlé’s Häagen-Dazs ice cream and P&G’s Pantene shampoo in containers designed to be returned and refilled. But customer numbers are limited and its launch in London was delayed to give brands more time to figure out logistics.

Sources: Ellen MacArthur Foundation; P&G, The Wall Street Journal

Analysts say Loop, which charges a flat shipping fee of $15 for orders under $100 and deposits of as much as $10, is aimed at the wealthy and therefore unlikely to scale widely. Loop says it is still in pilot phase and costs will drop as it scales and starts joining with more retailers.

An August survey by Global Data showed 71% of 2,000 U.K. shoppers polled said they would buy food from a refill store if the option were available. Shoppers aged 16 to 24 were more than twice as likely to have shopped for food refillables as older ones.

Curtis Rogers of Austin, Texas, washes his clothes with P&G’s Tide, which comes in hard plastic containers, but the 38-year-old entrepreneur said he would switch to any brand that offers detergent refills.

“Hard plastic will last forever, which makes it a great candidate for refilling and reusing,” he said, adding that brands should set up refill stations at farmers markets and outside stores.

Despite consumer interest, refillable packaging is rare due to logistical complications around cleaning, returning and refilling.

“As soon as you raise the barrier of convenience or cost to consumers their propensity to change their behavior changes significantly,” said Simon Lowden, PepsiCo’s chief sustainability officer.

Just 3% of packaging from 139 consumer goods companies, retailers and packaging producers polled by the Ellen MacArthur Foundation—a nonprofit focused on waste—is designed to be reusable.

Notable examples are mostly limited to beverages, like water jugs for offices or bottle-deposit programs. In Brazil, Coca-Cola Co. is investing about $25 million to launch “a universal bottle,” which can be returned and refilled with of its brands.

Beyond drinks, past trials have flopped. Walmart Inc. ’s U.K. unit, Asda Group Ltd., a decade ago ran a trial selling fabric conditioner in refillable pouches. The conditioner was transported to stores in bulk, stored at the back and piped into the aisle. It failed to take off because there were spillages and shoppers didn’t reuse the pouches enough.

Using alternative materials can also get messy. Nestlé this summer launched a line of its Nesquik powder in paper packets rather than plastic tubs. But a sample sent to The Wall Street Journal arrived leaking. A company spokeswoman said it found “no major issues” with the packaging in regular use, and said it was likely due to the product arriving via mail.

Paper, as well as being less resilient, requires more water and energy to produce, argue plastic manufacturers. Plastic also better protects against contamination and food waste.

Helen Bird of WRAP, a British nonprofit, said plastic-reduction targets “could encourage the wrong behavior” given that all materials have some environmental impact. Instead, WRAP encourages companies to scrap unnecessary plastic and ensure what remains is recycled.

Corrections & Amplifications

Simon Lowden is PepsiCo’s chief sustainability officer. An earlier version of this article incorrectly gave Mr. Lowden’s previous title, president of PepsiCo’s global snacks group. (Nov. 26, 2019)

Source: Wall Street Journal, November 27, 2019 | Saabira Chaudhuri