The tax overhaul has probably given your paycheck a welcome bump. Now it’s important to check your withholding—or risk a bad tax surprise in a year.

To help with this task, the Internal Revenue Service has just released a new tax withholding calculator. There is also a new W-4, the form workers provide to employers to determine paycheck withholding. Filling out this form isn’t required, as it was after the 1986 tax reform, but doing so is a good idea.

Tax specialists say self-employed business owners, pension recipients, Social Security recipients and filers paying estimated tax may also find the new calculator useful.

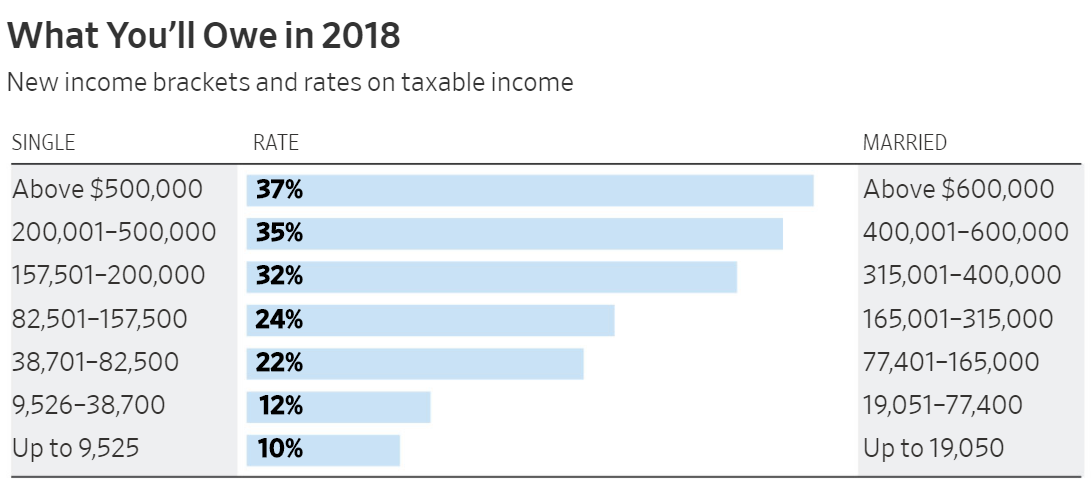

The tax overhaul didn’t shift rates as much as some lawmakers proposed, but it made landmark changes to individual provisions. So the overhaul’s effects will vary widely among filers depending on which changes apply.

For example, in 2018 many couples with children under 17 years old will get an expanded tax credit that reduces their bill by $2,000 per child. But some residents of high-tax states such as New York or California could owe more because of the new $10,000 cap on state and local tax deductions.

Treasury officials also recently revised the withholding tables used by employers. In January, they said these revisions would raise take-home pay for more than 90% of workers.

Source: Joint Explanatory Statement of the Committee of Conference, H.R. 1

The varying effects of tax changes plus lower withholding will lead to unexpected results for some filers for 2018. Here’s a hypothetical example for a higher-earning single taxpayer in a high-tax state provided by Gil Charney, director of the Tax Institute at H&R Block.

Sarah is a New York resident. For 2017, she had $200,000 of wages and other income and $33,000 of itemized deductions, including $28,000 for state and local taxes. She owes about $41,400 of federal tax, and her withholding was set so that she’ll receive a tax refund for 2017 of about $100.

For 2018, Sarah has the same income and deductions, and she doesn’t adjust her withholding to account for the loss of $18,000 in state and local tax deductions. Her take-home pay rises by $5,300, reflecting the lower withholding in the 2018 tables.

The overhaul lowers Sarah’s total federal income-tax bill by about $520. But because her withholding went down so much, she’ll owe the IRS about $4,700 when she files in spring 2019.

Other taxpayers could get lower refunds for 2018 if they don’t adjust withholding. This could come as a shock to those who expect large refunds and use them to make major purchases or pay down debt. In 2017, nearly three-quarters of filers received refunds averaging nearly $2,900.

The new tax calculator nudges taxpayers to reduce refunds, although it leaves the decision up the individual.

To be sure, not all of next year’s surprises will be bad. Some filers will reap a tax windfall due to benefits from several changes. In other cases, lower taxes in one area could help offset higher ones in another, says Mr. Charney.

Overall, 65% of individual filers will see a tax cut on their 2018 returns, while about 6% will see an increase, with no change for the rest, according to estimates by the Tax Policy Center. These results don’t include indirect effects, such as from corporate tax cuts or increased federal borrowing.

Which filers most need to check their withholding? At a news conference this week, acting IRS Commissioner David Kautter urged two-earner couples and filers with large itemized deductions on Schedule A to be sure to use the new calculator.

Mary Hevener, a payroll-tax specialist with Morgan, Lewis & Bockius, also recommends that filers who claimed more than two “personal allowances” on a prior W-4 form check their withholding, even if they take the standard deduction.

If the personal allowances on a prior W-4 are for household members or other dependents age 17 or older, she says, it’s likely that a tax break is shrinking. Last year, these individuals would typically have qualified for a $4,050 exemption each, but this year there is a $500 tax credit for each.

Workers with income such as bonuses, commissions and certain stock options should be wary as well, says Ms. Hevener, as the withholding rate on this income has dropped to 22% from 25% for many.

While tax rates and withholding have changed, underpayment penalties haven’t. Mr. Kautter said the IRS hasn’t yet decided whether it will show leniency on underpayments for 2018. The basic rule is that to avoid the risk of a penalty, filers must pay in at least 90% of what they owe during the year—or by the following mid-January if they’re paying estimated taxes.

The penalty is based on an interest rate that currently is 4%.

Source: The Wall Street Journal Laura Sanders / March 2, 2018