On Beijing’s typically bustling Wangfujing street, the luxury boutiques selling handbags, shoes, and clothing are mostly deserted on a Saturday afternoon. But wedged between Prada and Tiffany, one shop is packed: Lego. The 6,700-square-foot outlet of the Danish toymaker is crowded with parents watching their children snap together plastic bricks to a soundtrack of Christmas songs, while store employees explain the basics of Lego construction to shoppers unfamiliar with the toys. “Legos can keep him away from the TV and the iPad,” Emily Fang says as her 5-year-old marvels at Chinese-themed plastic-brick models of dragons and pandas. “It undoubtedly has enhanced his patience and creativity and makes him feel more confident.”

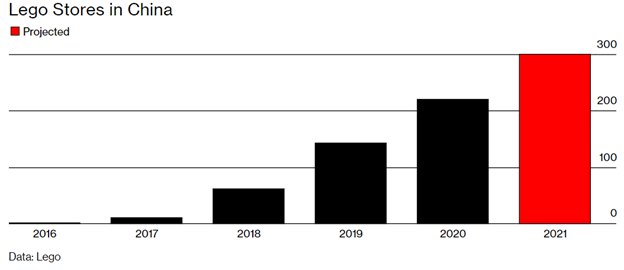

While the double threat of the coronavirus pandemic and online competition has slammed sales at toy stores elsewhere, Lego Group is betting big on brick-and-mortar retailing in China. With more than two-thirds of the world’s 2 billion children expected to be living in East Asia by 2032, the company says it must be physically present in the region. Over the two years ending in December 2021, Lego plans to more than double the number of stores it has in China, to 300 in 85 cities. Although Lego doesn’t disclose sales by country, it says China is already one of its best markets, clocking double-digit growth as the company’s global sales last year rose 6%, to a record $6.3 billion.

Stores are needed to address the particular challenges of China, says Cindy Chiu, who oversees the company’s retail operations in Asia. Lego is a relative newcomer in the country, so few Chinese parents played with the bricks as children. Stores give families a chance to experience Legos directly, building a connection with the brand. “We need to get bricks into the hands of more kids,” she says as shoppers jostle around her in the Wangfujing store.

Outside the Beijing flagship store.PHOTOGRAPHER: GILLES SABRIE/BLOOMBERG

At the same time, Lego is aggressively expanding online to make it easier for parents to buy the products they see in stores. This year the company has introduced web initiatives such as extra discounts, a membership program, and special promotions for holidays. In May the livestreamed launch of a Lego set based on the classic tale, Journey to the West, featuring the mythical Monkey King, drew more than 10 million viewers. And Lego has 3.9 million followers on Tmall, the shopping site owned by Alibaba Group Holding Ltd.—the most of any foreign toy brand. The two-pronged strategy is working, with Lego’s Tmall sales topping 4.6 billion yuan ($700 million) in the 12 months ended in November—far more than Mattel Inc. and Hasbro Inc., according to researcher WPIC Marketing + Technologies. “People with the most retail stores do better online,” says Jacob Cooke, WPIC’s chief executive officer. “I don’t think anybody has the reach offline that Lego has.”

In three years the company will add a third leg to its strategy when a Legoland theme park opens in Sichuan province in southwestern China. Merlin Entertainments Plc, the operator of Lego’s parks, in June started construction at a 24-hectare (59-acre) site with a local partner. The park, Lego’s first in the country, will have two rides not available in other Legolands and a Lego-brick depiction of the Great Wall of China and other Chinese landmarks along with global icons like the Eiffel Tower or Statue of Liberty. The company has an agreement to build a park near Shanghai and says it’s in talks with other partners across China. “I think of the Legoland parks as the clubhouse of the brand, where fans can have the ultimate Lego experience,” says John Jakobsen, who oversees the Legoland business for Merlin.

Lego’s biggest hurdle in China is copycats. It’s easy to find plastic bricks from brands such as Gudi, Jiego, and Lepin, all of which feature white-on-red logos with script almost identical to Lego’s. But Lego is fighting back hard, with aggressive actions in Chinese intellectual-property courts to win damages and apologies from imitators. In September a Shanghai court sentenced nine people to jail terms of as long as six years and fines as high as 90 million yuan for selling counterfeit Legos. The legal push has dovetailed with growing concern among consumers about fakes. Cathy Liu, a 26-year-old superfan with dozens of Lego sets, says she fears the plastics used in knockoffs might be toxic. “The biggest plus of Lego is its quality,” she says, while waiting in line to purchase a set from the latest collection. “Counterfeits just aren’t as well-made.”

The company is similarly benefiting from the concerns of families worried about China’s cutthroat education system. Many parents say schools do little to foster creativity, instead focusing on rote learning that doesn’t give kids the skills needed to prosper in the modern economy, says Mark Tanner, managing director of China Skinny, a marketing agency in Shanghai. “Lego really plays to Chinese parents’ desire to invest in toys and activities to prepare their children for the competitive world,” he says. One of those parents is Zoe Li, 35, who spends 9,000 yuan a month on Lego robotics classes for her daughter, hoping the lessons will help the 7-year-old excel in robot competitions and increase her odds of getting into a top school. “She’s learning to think more logically and improving her motor skills,” says Li, who says the family has dozens of model kits. “The classes are so worth the cost.” —

A girl plays near a panda made of Legos at the Beijing store.PHOTOGRAPHER: GILLES SABRIE/BLOOMBERG

BOTTOM LINE – As Lego doubles its retail presence in China to introduce the brand to parents who never played with the blocks as children, it’s also cracking down on knockoffs.

Source: Bloomberg Businessweek, December 21, 2020 | Bruce Einhorn, Tom Mackenzie, and Claire Che, with Irene Garcia Perez and Christian Wienberg