Toy Fair: Return of the Snows

After two snow-free years, the weather hit back with a vengeance at the 110th American International Toy Fair. While New York City itself only received eight inches or so the rest of the Northeast was hit hard by the Snowpocalypse.

Things kicked off Saturday night with the TOTY awards. As always, Carter Keithley and his Toy Industry Association (TIA) team led by Stacy Leistner organized a terrific affair. The food was superb and everyone seemed to be having a good time.

The evening awards program, organized by Jamie Gallagher of Faber Castel and Shirley Price of Funrise was fun and kept everyone engaged. The night belonged to Lego and Leapfrog who each garnered several awards. That said, it was good to see awards won by several small companies such as: Just Play, Plasmart, and Cloud B. The boys category was dominated by Teenage Mutant Ninja Turtles from Nickelodeon/Playmates.

Traffic seemed a bit off on Sunday, most likely due to weather-related travel disruptions. Countless war stories were shared by sleep deprived refugees from New England and Toronto. At the end of the day, action shifted to the Women in Toys (WIT) dinner. Genna Rosenberg and Ashley Maidy again did a great job organizing the annual event at The Lighthouse at Chelsea Piers. The evening was presided over by the always glamorous WIT president Joan Luks and it was good to see an award given to “The Queen of Toy Fair” Gail Jarvis. Particularly fun was the presentation of capes to the award winners.

Confidential sources tell me that someone looking very much like a cape wearing Nancy Zwiers was spotted over the next several days dancing around the Javits Center 🙂 Congratulations to all Wonder Woman winners and nominees.

Toy Fair traffic picked up substantially on Monday and Tuesday. Between bouts of “Javits feet”, Toyjobs was able to pick up on several young, under-exposed companies with exciting product lines. Some of these will undoubtedly be amongst our “sudden surprise” toy manufacturers of the future.

On Wednesday, we headed down to New Orleans for a few 65 degree days of good food, good music, and an evening glass of wine or three. We at Toyjobs will never drink anything out of a large Dayglo plastic toy – nor should you.

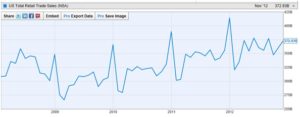

On the economic front the toy industry continues to have its challenges. Leftover retail inventory will likely mean that the first half of 2013 will be even slower than usual as little restocking needs to be done. Also, due to the management shuffle at the top, one has to believe that Toys ’R’ Us will be stuck like deer in the headlights for a considerable period of time. In addition, we continue to have a condition of torpor in Washington D.C. – nothing seems to move except their mouths. That said, total retail trade sales continue to trend cyclically upward. Warren Buffet, in last weekend’s shareholder letter said “ignore short term uncertainties, the immediate future is uncertain; America has feared uncertainty since 1776…American business will do fine over time”.

That’s the spirit that we’re seeing from our vantage point. As is usually the case, we were given a large number of search assignments in late December and January but those searches generally don’t close until the toy industry finishes cycling through trade shows in Hong Kong, London, Nuremburg and New York. Here at Toyjobs, we’re expecting to have an excellent

March as companies start to pull the trigger. In addition, search starts have been accelerating since the close of New York Toy Fair. Should this trend continue it bodes well for the industry as a whole. After the usual summer slowdown, I foresee hiring to come back even stronger in the fall as the headwinds of retail inventory and Washington gridlock abate and the economy continues to strengthen. Let us all hope it is so.

More light at the end of the tunnel,

Tom