Economy and Employment Continue Gradual Improvement

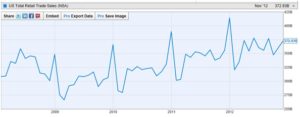

U.S. consumers continued to increase spending in July as the economy continued to grind out a slow but steady expansion. The Commerce Department last week announced that retail sales for July climbed a seasonally adjusted 0.2%. They also adjusted the June growth rate upward from 0.4% to 0.6%.

People are seeing the value of their homes and retirement accounts rise, which has begun to create a “wealth effect.” Also, Americans have spent the last few years struggling to shed debt. Total consumer debt is now 12% lower that at its peak in the fall (just before “the fall”) of 2008. Lending and spending are on the rise, especially for the big ticket items like homes, cars, furniture, and my favorite – barbecue grills.

Consumer confidence is increasing and is at its highest level in years, which economists attribute to the gradually improving employment picture. Toyjobs concurs that, at least in the children’s product business, hiring has increased dramatically. On the jobs front, things seemed to turn the corner in 2012 after three dismal years. In 2013, hiring has been much more robust. Even the annual summer doldrums period has seen more hiring than in any of the last five years.

Consumer confidence is increasing and is at its highest level in years, which economists attribute to the gradually improving employment picture. Toyjobs concurs that, at least in the children’s product business, hiring has increased dramatically. On the jobs front, things seemed to turn the corner in 2012 after three dismal years. In 2013, hiring has been much more robust. Even the annual summer doldrums period has seen more hiring than in any of the last five years.

That said, there is a puzzling disconnect behind the rise in overall consumer spending and the weak recent showing of many retailers. Wal-Mart, Kohl’s, Nordstrom’s, and Macy’s last week, posted poor second quarter results and cut their profit forecasts for the year. Aeropostale, American Eagle Outfitters, and Abercrombie & Fitch also lowered their sales and profit outlook.

Part of the problem may be that spending for cars, houses, and home improvement may have eaten up dollars that would have been spent on clothing, accessories, and general merchandise. The hope is that once this pent-up demand is sated that spending will trickle down to retail more broadly. After all, one can only buy so many cars and washing machines before you have all you can use.

Holiday spending, in the aggregate, can be looked at as one big ticket item which bodes well for toy manufacturers. However, consumers will likely chase sales and hunt for value, thereby causing margin pressure on retailers. The question is will retailers eat those margin hits or will they beat it out of their suppliers in small Bentonville rooms.

On the “good news” side of the ledger, Toys’R’Us, which has been reeling as of late, has announced that it plans to add 100 stores internationally by the end of the year. There will be 19 new or reconfigured stores in the US and a total of 51 stores in China by year end. This is good news for two reasons. First, there will be more shelf space to fill which should translate into more goods sold in to the retailer. Also, it appears that ownership of the private entity is investing for growth rather than backing off after recent poor results. We wish them all the best as a strong Toys’R’Us makes the toy industry stronger.

All told, the economy is slowly gaining ground and increasing momentum like a train leaving the station. That said, we should not forget that we currently live in a bifurcated society. Most people have jobs and, for them, things are slowly getting better. However, U6 (the number of people either unemployed or having to accept only part time jobs) is still at 14%. So while 86% of us are doing alright, at least 14% are still struggling.

Fortunately, increased consumer spending on big ticket items should start to trickle down to improve retail sales as a whole. As this couples with increased consumer and business confidence, it should lead to a much better employment picture. This is already beginning to happen. We should all hope that as the train chugs out of the station and begins to pick up speed that the long term unemployed and the under employed will be able to climb aboard. As employers, we should try to haul them aboard when we can.

See ya’ll in Dallas,

Tom Keoughan

PS – Dallas Alert! Dallas Alert! If you want to upgrade your sales team for the 2014 sales season, you better get cracking. You should have started two weeks ago!