Toy Industry Walks Through the Fog of Uncertainty

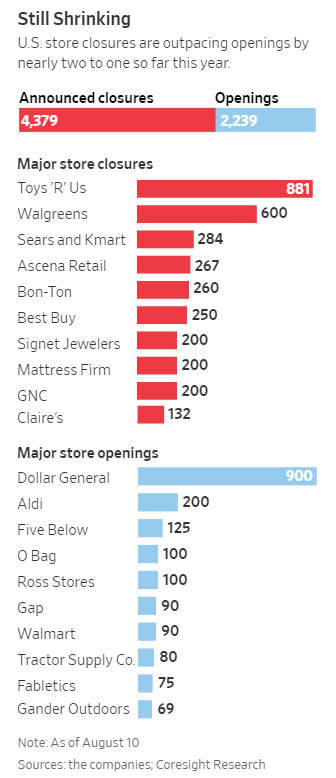

Most toy industry executives are telling me that while they certainly would have preferred to still have Toys “R” Us as a viable entity, that they have mostly replaced the shelf space and think that the year will turn out alright. That said, they want to make sure that they are on firm footing before they start investing in additional staff. They would like to put behind them the uncertainty of whether new product placement equals new sell through.

The good news is that consumers still want toys. We just have to figure out how to best get those toys in front of them and make them take notice. From cell phones to video games to WhatsApp to Fortnite to over scheduling by parents: kids have a lot more things competing for and dividing their attention than the days when we would just go out and play. To complicate things further, the array of choices is changing at an increasingly rapid pace. The challenge for Marketers is how to get their wares noticed on a increasingly pixelated and changing pallete of potential diversions.

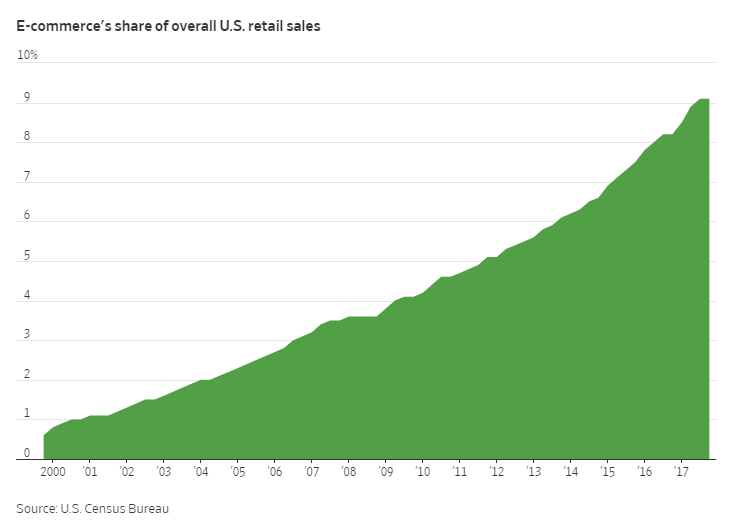

At the same time, the retail landscape is undergoing revolutionary change. E-commerce is booming but physical stores still do the bulk of consumer sales. Buy online and then get in the car and drive to the store to pick it up is also increasingly popular although for the life of me I can’t imagine why. Manufacturers have to figure out how to best operate in this changing environment. Complicating that further is that you can’t just change from A to B. The retail formula is changing constantly and more rapidly all the time. The only certainty is the ever-increasing velocity of change.

Thus far, the holiday shopping season appears to be off to a strong start. Foot traffic over the Thanksgiving weekend was down somewhat but retailers began offering deals earlier which pulled some sales forward. The Black Friday weekend is still a good indicator but consumers are broadening their shopping window so there is much less of a pronounced spike.

In the meantime, online sales have been exploding with approximate growth of 25% over the long Thanksgiving weekend plus Cyber Monday. We should expect a strong holiday sales season. The economy is humming, and the consumer is flush with lower unemployment, lower taxes, lower gas prices and as of the last few months higher wages. Event more importantly, the consumer is willing to spend. Top line numbers for retailers should be strong but profit margins for retailers of all stripes may be challenged by higher labor costs for brick and mortar locations and higher freight costs for items purchased online. Retailers may be willing to pass some of these cost increases on to consumers, but it is likely that for the larger portion they will be looking toward vendors.

While the overall holiday sales environment looks quite positive despite potential back end shearing by retailers, there is another big concern for toy manufacturers. That is a potential Trade War with China. As of now, it appears that Xi Jinping and the Trump Administration have made small concessions that permitted each other face saving gestures and agreed to a temporary cease fire.

That allows toy manufacturers to breathe a little easier for now but kicking the can down the road doesn’t alleviate uncertainty. In ninety days, when a full agreement still hasn’t been reached, tariffs on the $200 Billion of goods now set at 10% will be increased to 25%. The good news is that toys, as it stands now, still will not be affected. Unknown is what happens next. How long will the next negotiating window be? What will the consequences be if a deal is still not reached? Most likely, the next step of tariff escalation will include the toy business. Will the toy industry be able to ship goods for the holiday season of 2019 by, let’s say, June 1st? Especially, when you realize that vendors and retailers may be at cross purposes. Manufacturers will be trying to ship products as early as possible to try to beat the clock while at the same time retailers tend to try to postpone commitments to buy as long as possible.

If there is any kind of silver lining in this fog uncertainty, it is that the toy industry is more agile and better equipped to navigate uncertainty than most other manufacturers. After all, even in a year that is all blue skies and smooth sailing (and I can’t remember that ever happening) we are in a seasonal fashion business. Turbulence is our middle name. We are used to it.

My view is one of cautious optimism – but that’s pretty much my default setting. Things tend to work out… eventually. The worry is how long will it take.

Crossing the River by Feeling the Stones.

Tom Keoughan

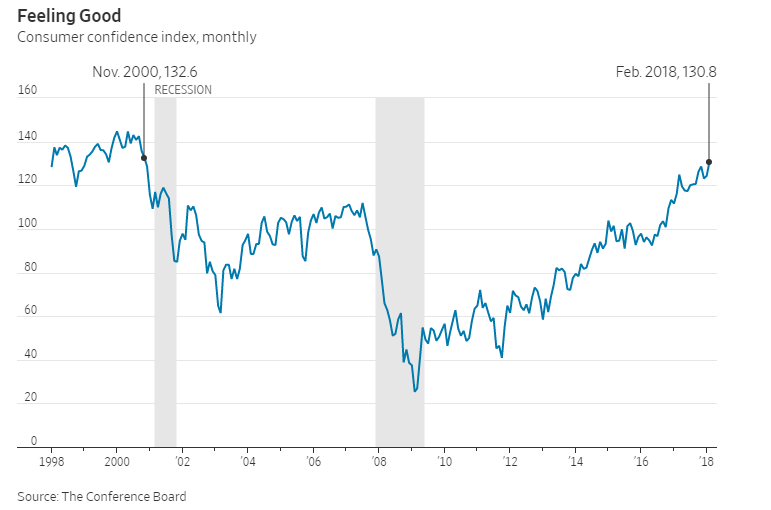

This along with the lowest employment rate in fifty years, the highest consumer sentiment in 18 years and rip-roaring consumer spending should help toy manufacturers in 2018. The National Retail Federation expects that holiday sales-excluding autos, gas, and restaurants – should be up to 4.3 to 4.8 percent over 2017.

This along with the lowest employment rate in fifty years, the highest consumer sentiment in 18 years and rip-roaring consumer spending should help toy manufacturers in 2018. The National Retail Federation expects that holiday sales-excluding autos, gas, and restaurants – should be up to 4.3 to 4.8 percent over 2017.

Two trends seemed to emerge among the award winners that night. First, collectibles continue to be a very hot category with WowWee’s Fingerlings and MGA’s L.O.L. Surprise! sharing top honors as “Toy of the Year.” In addition, Funko’s Mystery Minis won the “People’s Choice Award” which is chosen by tallying the votes of consumers.

Two trends seemed to emerge among the award winners that night. First, collectibles continue to be a very hot category with WowWee’s Fingerlings and MGA’s L.O.L. Surprise! sharing top honors as “Toy of the Year.” In addition, Funko’s Mystery Minis won the “People’s Choice Award” which is chosen by tallying the votes of consumers.

In other news, Hasbro was named the global master toy licensee for Power Rangers. That might not impact the toy industry as much as Bandai losing what had been a long-time licensee. Lastly, Basic Fun announced that they had bought K’nex. K’nex has always been one of the most inventive and versatile construction toys in the pure product sense but never seemed to have been brought to market in the right way. Jay Foreman and his team should be able to change that.

In other news, Hasbro was named the global master toy licensee for Power Rangers. That might not impact the toy industry as much as Bandai losing what had been a long-time licensee. Lastly, Basic Fun announced that they had bought K’nex. K’nex has always been one of the most inventive and versatile construction toys in the pure product sense but never seemed to have been brought to market in the right way. Jay Foreman and his team should be able to change that.

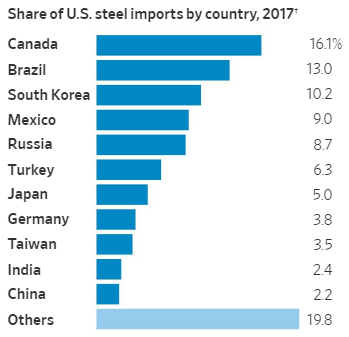

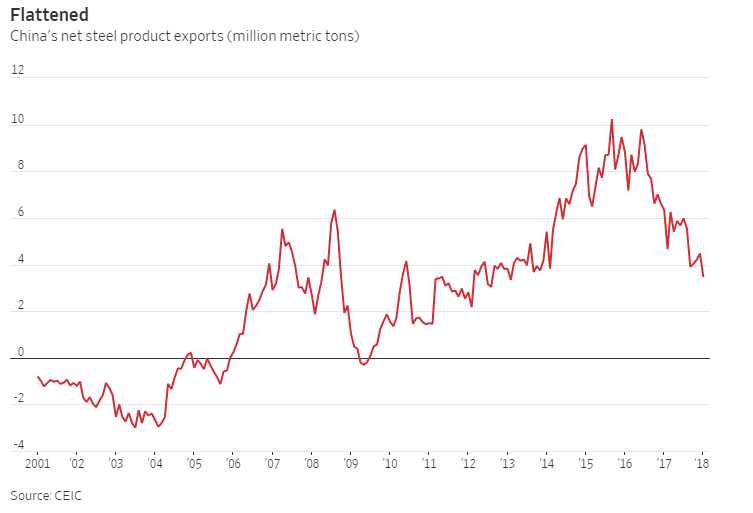

The only thing consistent about Mr. Trump is that his proclamations are much more extreme than his actual actions. I suspect that last week’s news burst was his way of opening negotiations since Chinese Trade Minister Liu He was just arriving in Washington. It is interesting to note that China doesn’t really export much steel, solar panels or washing machines into the United States. Steel exports have dropped rapidly over the last few years due to China’s own internal construction boom. They do ship a fair amount of aluminum here. That lends credence to the idea that these are really shots across the bow…. negotiating tactics. Would Donald Trump enjoy an international spectacle with him at the center? Surely he relishes the idea of global players rushing to him in order to curry favor. That said, the presence of Peter Navarro and Wilbur Ross in the Administration is troubling. So are we entering a trade war? Will he or won’t he? …..only his hairdresser knows for sure.

The only thing consistent about Mr. Trump is that his proclamations are much more extreme than his actual actions. I suspect that last week’s news burst was his way of opening negotiations since Chinese Trade Minister Liu He was just arriving in Washington. It is interesting to note that China doesn’t really export much steel, solar panels or washing machines into the United States. Steel exports have dropped rapidly over the last few years due to China’s own internal construction boom. They do ship a fair amount of aluminum here. That lends credence to the idea that these are really shots across the bow…. negotiating tactics. Would Donald Trump enjoy an international spectacle with him at the center? Surely he relishes the idea of global players rushing to him in order to curry favor. That said, the presence of Peter Navarro and Wilbur Ross in the Administration is troubling. So are we entering a trade war? Will he or won’t he? …..only his hairdresser knows for sure.