Xi Jinping, long distrustful of the private sector, is moving assertively to bring it to heel.

China’s most powerful leader in a generation wants even greater state control in the world’s second-largest economy, with private firms of all sizes expected to fall in line. The government is installing more Communist Party officials inside private firms, starving some of credit and demanding executives tailor their businesses to achieve state goals.

In some cases, it is taking charge entirely of companies it regards as undisciplined, absorbing them into state-owned enterprises.

The push is driven by a deepening conviction within the country’s leadership that markets and private entrepreneurs, while important to China’s rise, are unpredictable and not to be fully trusted. The view that state planners are better at running a complex economy has gained currency this year, with Beijing relying heavily on state directives to engineer a V-shaped recovery from the shock of Covid-19.

Mr. Xi has made his priorities especially clear in recent months. In September, the party issued new guidelines for private companies, reminding them to serve the state and vowing to use education and other tools to “continuously enhance the political consensus of private business people under the leadership of the party.”

Just a few weeks later, Mr. Xi personally intervened to block the $34 billion initial public offering of one of China’s biggest private firms, Ant Group, partly out of concerns it was too focused on its own profits rather than the state’s goal of controlling financial risk.

The message isn’t lost on entrepreneurs, who are reorienting their businesses to appease the state or giving up on private enterprise altogether.

“For us small businesses, we have no choice but to follow the party,” says Li Jun, a 50-year-old owner of a fish-farming business in the eastern Jiangsu province. “Even so, we’re not benefiting at all from government policies.”

Mr. Li recently closed down a seafood-processing plant because it couldn’t get bank loans—a persistent problem for private firms, despite Beijing’s repeated pledges to make credit more available for them.

The risk for China is that Mr. Xi’s vigorous assertion of statist prerogatives will dull the kind of innovation, competitive spirit and unbridled energy that powered China’s explosive growth in recent decades. The economic policies that helped nurture e-commerce giant Alibaba Group Holding Ltd., tech conglomerate Tencent Holdings Ltd. and other global success stories seem to be at an end, say economists inside and outside China. As a result, they say, Chinese companies are becoming less like American ones, which are driven by market forces and depend on private innovation and consumption.

The information office of the State Council, China’s cabinet, didn’t respond to written questions for this article.

Private-Sector Squeeze

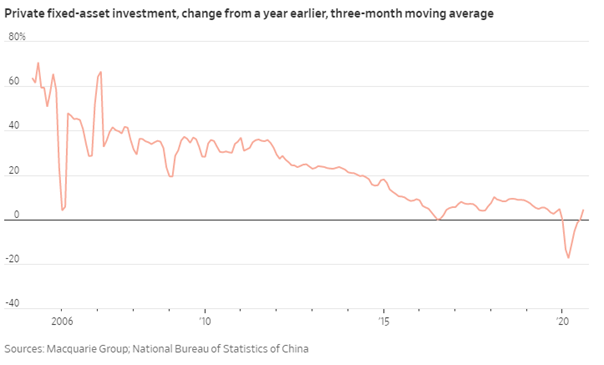

With Chinese entrepreneurs unwilling or unable to expand, private investment in fixedassets—manufacturing and infrastructure—has plunged.

The percentage of Chinese manufacturing and infrastructure investment coming from private companies, after growing in recent decades, peaked in 2015 at more than half of total fixed-asset investments and has been shrinking since then.

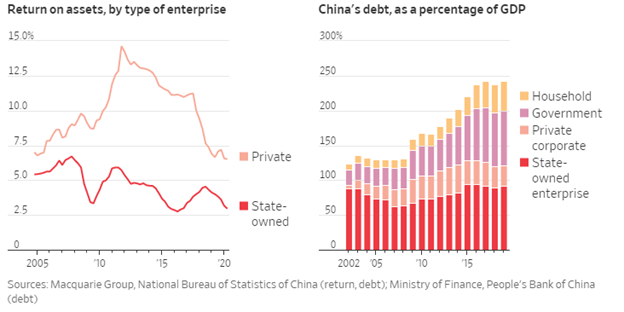

China’s economy as a result has become less efficient. The amount of capital input needed to generate one unit of economic growth has nearly doubled since 2012, when Mr. Xi rose to power, according to the China Dashboard, a data project between research firm Rhodium Group and the Asia Society Policy Institute, a think tank. That is partly because China’s state-owned enterprises, which have swollen in size, are often less productive than private businesses, official data shows.

Party officials, for their part, see an opportunity to rein in the excessive risk-taking, debt and graft that accompanied the rapid rise of private businesses. Mr. Xi’s brand of state capitalism, which mixes markets with stepped-up state intervention, has survived a trade war with the U.S. and outperformed free-market economies recently, based on economic growth rates.

In one of the clearest signs of China’s direction, more state firms are gobbling up private companies, redefining a government initiative called “mixed-ownership reform.” The original idea, dating back to the late 1990s, was to encourage private capital to invest in state firms, bringing more private-sector acumen to China’s often-bloated state-owned enterprises.

Now, under Mr. Xi, the process often works the other way around, with big state companies absorbing smaller ones to keep them going, and reconfiguring the smaller firms’ strategies to serve the state.

Transactions involving state firms buying into private ones exceeded $20 billion last year, more than double the 2012 level, in industries including financial services, pharmaceuticals and technology, disclosures by publicly traded companies show.

Government Priority

Although private companies remain more profitable than state ones, they are becoming less so as the Chinese government directs more credit to state-owned enterprises, depriving entrepreneurs of capital.

“State-owned enterprises must play a leading role and important influence on the healthy development of private enterprises,” says a new central-government action plan for the next three years, which calls for more mergers between state and private firms.

Beijing OriginWater Technology Co. , a provider of sewage-treatment services that competes with the likes of General Electric Co. , was one of the target firms. It was started in 2001 by Wen Jianping, an engineer who had studied in Australia. He was eager to help clean up China’s polluted water supply and take advantage of the country’s increasingly open business environment.

As demand for water purification grew, Mr. Wen’s business thrived. An initial public offering in 2010 helped turn him into a billionaire. In 2018, he made Forbes magazine’s list of China’s richest people, with a reported net worth above $1.1 billion.

Over time, Mr. Wen took on more risk, pledging his shares to borrow more and finance bigger projects. A government “deleveraging” campaign launched under Mr. Xi to curb excessive risk-taking forced companies to pare back on debt and caused stock markets to swoon, sending the value of Mr. Wen’s shares down. His lenders started calling in loans.

Adding to Mr. Wen’s problems, the government in 2018 started to reverse an initiative that teamed private investors with local governments to build big-ticket infrastructure projects, citing fears of overspending. Companies like Mr. Wen’s were left with unfinished projects and debt that was maturing fast.

A subsidiary of China Communications Construction Co. , a big state contractor for Beijing-led infrastructure projects overseas, swooped in, buying a controlling stake in Beijing OriginWater for more than $440 million. Mr. Wen’s stake was reduced to around 10%, from 23%.

Now, instead of focusing on the domestic market, Beijing OriginWater says it plans to help facilitate the party leadership’s Belt and Road Initiative, a huge infrastructure program promoted by Mr. Xi to pull Asian, European and African nations into Beijing’s orbit.

Workers at China Communications Constructions, a big state contractor that bought a controlling stake in private Beijing OriginWater.

PHOTO: RUSHDI SAMSUDIN/AGENCE FRANCE-PRESSE/GETTY IMAGES

Several longtime board members were replaced with appointees approved by the State-owned Assets Supervision and Administration Commission, which regulates and holds majority stakes in big state companies, including China Communications Construction.

A notice posted on the website of the company’s regulator late last year, when the China Communications Construction subsidiary began acquiring shares in Beijing OriginWater, lays out qualifications for project managers. Among them: Candidates must disclose their political affiliations and should have “unyielding fighting spirit.”

In response to questions, China Communications Construction described the acquisition of Mr. Wen’s firm as an “alliance of the strong.” Mr. Wen declined to comment.

In an interview with a Chinese weekly, China Times, last year, Mr. Wen likened state companies to trees and private firms to shrubs. “In the future, the trees may become larger and larger, absorbing more soil, water and sunlight,” he said. “The shrubs will be transformed, becoming either a branch on the tree or an herb, and the herb will die.”

Zhuji Water Group Co., a water utility run by a city government in the coastal province of Zhejiang, last year spent $147 million for a 28% stake in Zhejiang Great Southeast Co., a publicly listed plastic-packaging firm, after that firm ran into debt troubles.

The government of Zhuji has been trying to make Zhuji Water a conglomerate of sorts by having the company take over hotels, real estate and other assets. Its acquisition of the Great Southeast is also a way for Zhuji Water to get itself listed, a Zhuji official says.

Most often, though, government officials just want to make sure large private companies are adhering to the state’s goals and policies. To that end, the state is installing more Communist Party committees in corporate offices and encouraging them to play more assertive roles in decision-making.

Sanyue Industrial Co., a private maker of electronics in the southern city of Dongguan, in October formed the first party committee in the company’s 11-year history. It did so after the government told the company it needed to, says company executive Huang Shengying.

The committee, which is made up of five party members who were already working at the company, including two from management, plans to meet often to “study the spirit” of government policies and Mr. Xi’s speeches, Ms. Huang says. “We need to understand the policy better to survive. Party building, we’re told, is good for corporate development.”

Three other private companies in Dongguan also set up party cells recently, including an electronics maker, an auto-parts manufacturer and a chemical company. A Dongguan official, Zhao Zhijia, calls the party committees “red charging stations” saying that “these companies will integrate party building into their corporate culture. It’s a win-win.”

Such party committees often trump the decision-making of corporate management and boards. A party cell at Baowu Steel Group, a state-owned company that is China’s largest steel producer, held 55 meetings in the past two years and reviewed some 137 business and other proposals submitted by management, according to company filings. It revised 16 of the proposals before sending them on to Baowu’s board of directors.

It also turned down some, including one involving a fundraising proposal for a company subsidiary, saying the need for more capital was unclear, according to an article posted on Baowu’s website.

The party committee has directed the company to set aside more funds to help the poor even though the profits of Baowu’s listed arm declined 42% in the previous year. Eliminating poverty is a top political objective of Mr. Xi.

A Communist Party cell meets frequently at Baowu Steel Group, a state-owned company that is China’s largest steel producer.

PHOTO: TPG/ZUMA PRESS

Chinese officials say Mr. Xi doesn’t intend to crush entrepreneurship or eliminate market forces. He has promised to support the private sector, which contributes half of the government’s tax revenues and employs 80% of urban workers.

Unlike his predecessors who steadily expanded the private economy, Mr. Xi focuses on bringing entrepreneurs into the party’s fold.

Chinese officials close to the leadership say Mr. Xi’s thinking has been influenced by excesses that emerged under predecessors Jiang Zemin and Hu Jintao, when corruption and environmental degradation were rampant, and by market disruptions that rattled Mr. Xi in the early years of his rule.

Initially, Mr. Xi had been open to advancing market reforms that began in China under Deng Xiaoping in the 1980s. In late 2013, Mr. Xi’s leadership vowed to give market forces a “decisive role.” He blessed market-minded regulators who talked up stock investing and relaxed government control over China’s currency. His administration even pondered a proposal to have professional managers rather than party apparatchiks run state companies.

One after another, those reform plans led to chaos. In the summer of 2015, a big stock-market selloff pounded markets and embarrassed Mr. Xi. The central bank’s move to set the Chinese yuan freer spooked the public further.

In closed-door meetings with underlings, Mr. Xi made his displeasure clear, according to the officials close to the leadership, and unleashed state forces to fix what he saw as the market’s woes.

Senior state-sector officials successfully lobbied Mr. Xi’s leadership to scratch plans to bring more market-oriented managers to state companies.

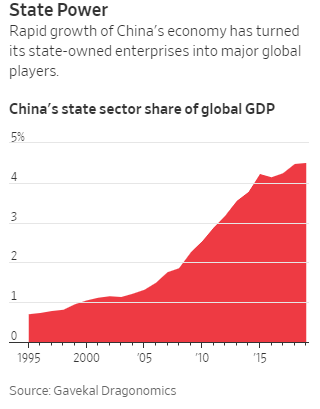

Beijing now directly supervises 128 state firms. Although that is down from about 140 in 2012, the enterprises have grown larger, encroaching more on the private sector, amid government-led consolidations aimed at creating national corporations. Local governments manage thousands more of the firms.

Until last year, Xu Zhong was head of the research department of China’s central bank. He publicly blamed China’s poor governance and market distortions on the state’s hand in allocating credit, which had caused private firms to be deprived of financing.

“The first institutional problem that leads to financial chaos is unclear boundaries between government and the market,” he wrote in an article published in December 2017. In a high-level economic forum in February 2019, he called for accountability of the government when it came to market reforms.

Shortly after that, he was moved to a new role outside the central bank in an association of market dealers.

“The market-reform camp is all but gone,” says an economist who advises the government. “By now, it’s pretty clear what kind of reform the top guy really wants.”

There was no mistaking the shifting winds in September, when Liu He, the leadership’s top economic adviser with a reputation for supporting market reforms, summarized Beijing’s plans for the state sector for the next three years.

“State-owned enterprises,” he said, “must become the competitive core of the market.”

Source: The Wall Street Journal, December 10, 2020 | Lingling Wei