What a Long Strange Trip It’s Been

In the words of Bart Simpson “Ay Caramba!”

At my age you rarely get the opportunity to take a four month long backyard sabbatical but that’s exactly what I did. Nobody was hiring and it didn’t make any sense for me to be reaching out to my clients and pestering them when I knew they didn’t need my services. So sabbatical it was. After quickly tiring of interminable White House Coronavirus Task Force Briefings, I focused on perfecting my barbecue techniques.

Meanwhile, depending on the product category many toy companies were knocking it out of the park. With both parents and kids staying home – together – 24 hours a day, 7 days a week! – parents had to find something – anything – to occupy the youngsters. Early on games, puzzles, activities and crafts were flying off the shelves. By late spring and early summer outdoor toys, scooters and inflatable pools were quickly sold out. On the other hand, makers of action figures, plush and vehicles were struggling.

During this period, I had several searches that had been put on hold so I continued to check on those and diligently monitored the job boards to see when activity would pick up. And there is was. As I sort of expected in mid-July the market for toy industry jobs started to bubble up under the surface. This made perfect sense as the 2021 sales cycle for toys would be beginning in mid-September. Companies who want to add to or upgrade their sales staffs have to move quickly. Toyjobs traditionally gets a big jump in search starts in late July. So we did get a bump but it has been much more subdued than usual.

Since retailers have stopped physical meetings; sales people can cover more ground since they don’t have to travel (pun intended). In conducting business by Zoom or Microsoft Teams companies can make do with less sales staff. That said, making do is not optimum. Most sales executives can’t help but feel that they could have gotten that one or two extra items on the shelves if they had met in person. Also, it’s pretty difficult to really further a relationship with a Buyer when you’re playing Hollywood Squares. So, while it’s good to save money now, toy companies will eventually want to get back in front of buyers and will need additional sales staff to do that. Retailers, on the other hand, may decide that virtual only sales calls makes their Buyers more efficient. I can certainly envision Wal-Mart and Amazon moving that way. As in all things, retailers will call the tune and manufacturers will just have to fall in line. It will be interesting to see how it plays out.

How do I see Covid-Time affecting the toy business moving forward? This is by no means a complete list but here are some quick thoughts:

- Hiring- While hiring is just starting to pick up it is at a very subdued level. Even though many companies have done extremely well, we are in a very low-visibility environment. Will there be a vaccine? How long will it last? Who will be President? What will that mean for the economy? What will that mean for relations with China? Will virtual sales calls become the norm for the long term? I expect hiring to grow but slowly and off of a zero base until next June or so as companies continue to play things close to the vest. By June we should be out of the pandemic; we will have a clear picture on sell-ins for the holidays 2021 and… hopefully…we will know who our President is going to be for the next four years.

- Work from home– I think we will replay the script from the financial crisis. For several years companies were doing a lot more remote work but by 2015-16 I was seeing a huge pushback from employers. Teams were nowhere near as efficient. Unless you were parked in Bentonville or Minneapolis companies wanted their people in the office where teams could work together more efficiently and companies could build a corporate culture. That said, by 2016 companies were also more relaxed about working one day a week from home. I expect that too will continue.

- Supply chain– It has become cliché that Covid-19 has accelerated all the trends that were in place already. This is very evident in supply chains. Trump’s China policies had already jump started an effort by toy companies to diversify their supply chains if only to avoid tariffs. All types of businesses have recently seen up close and personal the danger of having too concentrated a supply chain and that will accelerate the diversification process. Lastly, it’s not just Trump, the entire Washington establishment has moved decidedly in an anti-China direction. Regardless of who is President, the U.S. and China will have, at best, a strained relationship into the foreseeable future.

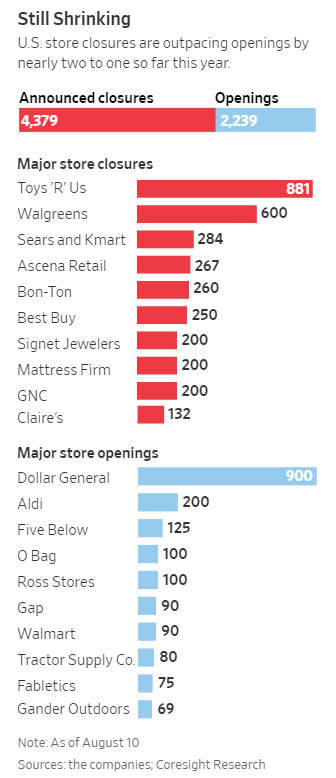

- Retail- The shutting down of the economy has greatly accelerated the collapse of brick and mortar retail. Will some of the retailers who are now on the ropes bounce back when the pandemic lifts? Sure, but many of the ones that were wobbly even before Covid-19 will be gone forever. The good news is that manufacturers have learned to be much more effective at online marketing and online sales although sadly, online selling squeezes margins. Additionally companies that began online are now opening physical stores which is a trend that is likely to grow. The move to omnichannel retail is happening even faster than before. Joseph Schumpeter are you listening?

- Toys ‘R’ Us– Does anybody remember Toys ‘R’ Us?

So that’s my two cents. I may be wrong about any or all of it. Fortunately, for the toy industry it is always stormy seas so we’re used to scrambling. Very cautious optimism is the phrase of the day. We’ll muck and muddle through. I look forward to a very happy second half of 2021!

Keep your heads down and your hands clean.

Tom Keoughan

Target seems to be a special case. Some of their woes likely stem from inflated expectations. Why did they expect holiday sales to jump by 4 percent? Did the population increase by that much? I don’t think so. I suspect that the Toys ‘R’ us.com/Target tie up happened too late in the year to make much of a difference. With Disney’s recent movies pretty much tanking, Target’s Disney “store-in-store” promotions likely hurt Target toy sales. While those initiatives may not have had much success in 2019, I expect that they will have a much more positive effect longer term.

Target seems to be a special case. Some of their woes likely stem from inflated expectations. Why did they expect holiday sales to jump by 4 percent? Did the population increase by that much? I don’t think so. I suspect that the Toys ‘R’ us.com/Target tie up happened too late in the year to make much of a difference. With Disney’s recent movies pretty much tanking, Target’s Disney “store-in-store” promotions likely hurt Target toy sales. While those initiatives may not have had much success in 2019, I expect that they will have a much more positive effect longer term.

By now, the Dallas Fall Toy Preview follows a familiar script. We arrive and everybody grumbles, “There’s nobody here” and “This place is empty,” but by the time that the Opening Night cocktail party gets underway, everybody realizes that things are actually going pretty well.

By now, the Dallas Fall Toy Preview follows a familiar script. We arrive and everybody grumbles, “There’s nobody here” and “This place is empty,” but by the time that the Opening Night cocktail party gets underway, everybody realizes that things are actually going pretty well.

One highlight was the Doll of the Year Award which went, unsurprisingly, to L.O.L. Surprise! The award was accepted by Isaac Larian of MGA who approached the podium and said – the least he ever has. It was a comically gracious moment…only to be later ruined when he climbed the stage out of turn and out of line to display his usual boorish behavior. That said, let’s give credit where credit is due – both under the byzantine TOTY process and by popular acclaim L.O.L. Surprise! garnered three TOTY’s and was the overall Toy of the Year. Mattel and Lego also had good nights as they each came home with three TOTYs.

One highlight was the Doll of the Year Award which went, unsurprisingly, to L.O.L. Surprise! The award was accepted by Isaac Larian of MGA who approached the podium and said – the least he ever has. It was a comically gracious moment…only to be later ruined when he climbed the stage out of turn and out of line to display his usual boorish behavior. That said, let’s give credit where credit is due – both under the byzantine TOTY process and by popular acclaim L.O.L. Surprise! garnered three TOTY’s and was the overall Toy of the Year. Mattel and Lego also had good nights as they each came home with three TOTYs.

A shout out to Marian Bossard of the Toy Industry Association for winning the Wonder Women of Sales Award. Marian is one of the key people making all of the toy industry’s tradeshows and events go as smoothly as possible for the rest of us. Congratulations to all of the Wonder Women. As an employment expert, I suggest regularly wearing your pink capes to the office around salary review time!

A shout out to Marian Bossard of the Toy Industry Association for winning the Wonder Women of Sales Award. Marian is one of the key people making all of the toy industry’s tradeshows and events go as smoothly as possible for the rest of us. Congratulations to all of the Wonder Women. As an employment expert, I suggest regularly wearing your pink capes to the office around salary review time!

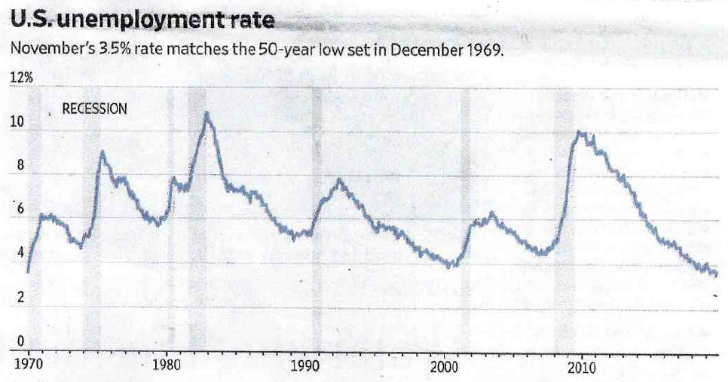

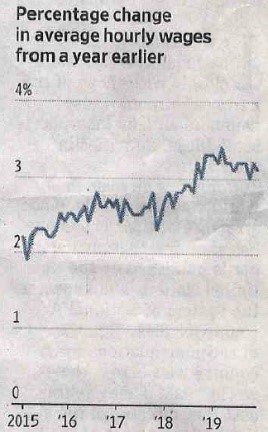

This along with the lowest employment rate in fifty years, the highest consumer sentiment in 18 years and rip-roaring consumer spending should help toy manufacturers in 2018. The National Retail Federation expects that holiday sales-excluding autos, gas, and restaurants – should be up to 4.3 to 4.8 percent over 2017.

This along with the lowest employment rate in fifty years, the highest consumer sentiment in 18 years and rip-roaring consumer spending should help toy manufacturers in 2018. The National Retail Federation expects that holiday sales-excluding autos, gas, and restaurants – should be up to 4.3 to 4.8 percent over 2017.