Toyjobs Continued Its Hot Hand

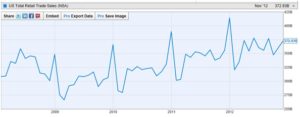

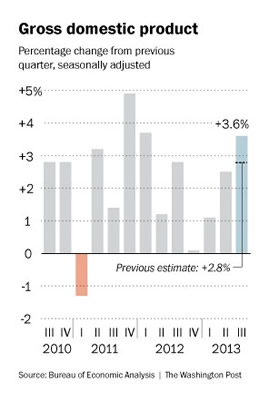

After a weak first quarter, Toyjobs followed up April, its best month ever, with a strong May showing. This mirrors the economy as a whole which, during the last couple of years, has had a series of weak first quarters following by markedly increased (although still tepid) growth. The latest projections from the Federal Reserve Bank of Atlanta are for second quarter GDP growth of 2.5%. Overall, it should come as no surprise that the toy industry has been hiring, even though some companies have experienced a bit of a Star Wars hangover. NPD has reported that toy sales in the US increased 6.5 % in 2015 and another 6% in the first quarter of 2016.

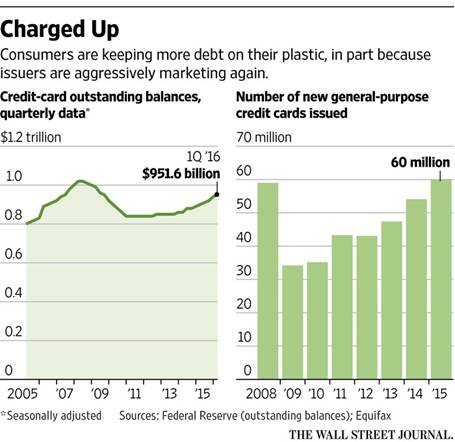

Moving forward economic signals appear to be mixed. US credit and debt balances have been soaring as consumers grow more comfortable carrying debt and spending money.

Pending home sales rose in April to the highest level in over ten years. April also saw consumer spending rise after a six-month slump. Wal-Mart rocked to a strong quarter even while many other retailers struggled.

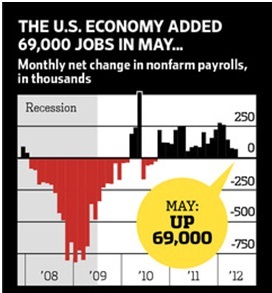

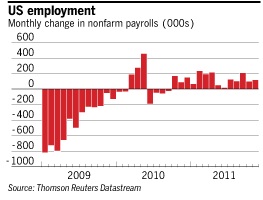

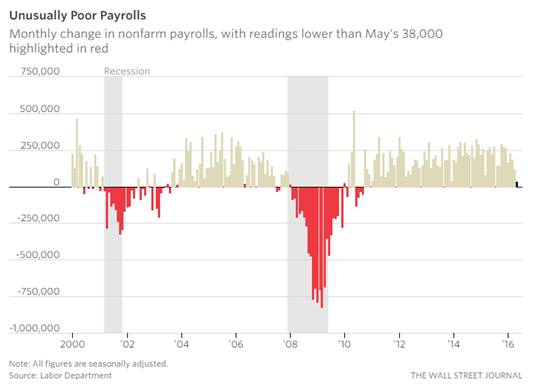

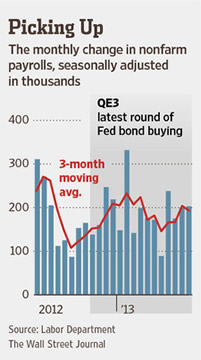

On the other hand, the US has suffered two weak job reports in a row with the May report being particularly devastating. In May, employers added only 38,000 jobs – the fewest in almost six years.

Revisions to prior reports also subtracted a total of 59,000 jobs from payrolls in the previous two months. Add to that the numbers of Americans working part-time jobs who want full-time jobs shot up from 6 million to 6.4 million. These “involuntary part-timers” continue to be a sign of considerable weakness in the job market. Finally, although the headline unemployment rate dropped to 4.7% this was largely due to a steep decline in labor force participation as millions of people have left the workforce in frustration.

The future is murky. Two bad months do not make a trend, but they may be a sign that the economy is losing what momentum it did have. On the other hand, maybe this is just the annual summer doldrums beginning a couple of weeks early. In any case, this is not the time to load up on debt or go out and buy a new Ferrari. Uncertainty calls for caution.

Here at Toyjobs, we are cautious but also quite optimistic. Over the last fifteen months, toy sales have been much stronger than the economy as a whole. I have no doubt that in six to eight weeks, toy companies will realize that the 2017 toy selling season is coming up fast and will begin the annual mad scramble for new or additional Sales Executives. Be advised that the Dallas “October” Fall Toy Preview arrives a little early this year on September 27th. It would be prudent to start your sales searches in late July or early August if you want your new people on board and ready to go.

All the best,

Tom Keoughan

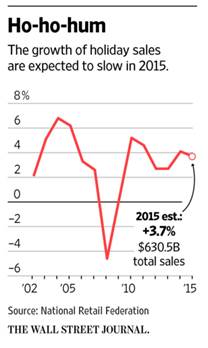

Early forecasts for Holiday Spending 2015 have been quite optimistic. Households have been enjoying fatter wallets, thanks to lower gasoline prices and cheaper imports, thanks to a stronger dollar. Retail sales reflected this by growing from January to July. NPD has reported that toy sales were up 6.5% in the first half and is projecting 6.2% growth for the year as a whole. The National Retail Federation is forecasting a holiday sales increase of 3.7%. That sounds good but less so when you consider last year’s 4.1% gain.

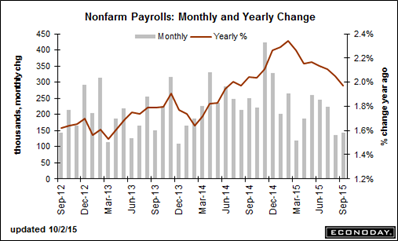

Early forecasts for Holiday Spending 2015 have been quite optimistic. Households have been enjoying fatter wallets, thanks to lower gasoline prices and cheaper imports, thanks to a stronger dollar. Retail sales reflected this by growing from January to July. NPD has reported that toy sales were up 6.5% in the first half and is projecting 6.2% growth for the year as a whole. The National Retail Federation is forecasting a holiday sales increase of 3.7%. That sounds good but less so when you consider last year’s 4.1% gain. Concurrent to the slow-down in the retail sales is what we’re seeing in the job market. While job creation was strong in the first six months of the year, in September there were only 142,000 net new jobs. The numbers for July and August were also revised downward so that the third quarter monthly average for net new jobs was 167,000. That’s down from a monthly average of 198,000 for all of 2015 so far, which is down from 260,000 a month in 2014. While we should be concerned, again let’s not get overly pessimistic quite yet. Third quarter job gains have a historical tendency to run below average for the year and the deceleration often turns out to be temporary, rebounding in the October to December quarter. Again – it’s summer! …I’m going to wait for the October numbers before I really try to figure out what’s going on.

Concurrent to the slow-down in the retail sales is what we’re seeing in the job market. While job creation was strong in the first six months of the year, in September there were only 142,000 net new jobs. The numbers for July and August were also revised downward so that the third quarter monthly average for net new jobs was 167,000. That’s down from a monthly average of 198,000 for all of 2015 so far, which is down from 260,000 a month in 2014. While we should be concerned, again let’s not get overly pessimistic quite yet. Third quarter job gains have a historical tendency to run below average for the year and the deceleration often turns out to be temporary, rebounding in the October to December quarter. Again – it’s summer! …I’m going to wait for the October numbers before I really try to figure out what’s going on. mean bad news for its suppliers. Already they are asking all suppliers to pay fees to keep inventory in Wal-Mart warehouses and in some cases, they are strong arming vendors into accepting extended payment terms. One can only imagine that there will be more of this type of thing to come.

mean bad news for its suppliers. Already they are asking all suppliers to pay fees to keep inventory in Wal-Mart warehouses and in some cases, they are strong arming vendors into accepting extended payment terms. One can only imagine that there will be more of this type of thing to come. like I’m crossing a deep river barefoot and just feeling around for smooth stones with my feet. Not that anyone listens to me but I am going to acknowledge, but not put much faith in, all of the conflicting

like I’m crossing a deep river barefoot and just feeling around for smooth stones with my feet. Not that anyone listens to me but I am going to acknowledge, but not put much faith in, all of the conflicting signals until I see the October numbers. Historically, October is a solid bellwether month. I’m optimistic but am going to be conservative in planning and spending until things actually happen. I think that there’s going to be an absolute ton of Star Wars merchandise sold but I also think there will be an awful lot of it left on the shelves. What then? “Curb Your Enthusiasm” and don’t become “Irrationally Exuberant.” It’s likely to be a strong holiday shopping season, but at this point that is far from certain. Be prepared for the aftermath. I am filled with both optimism and uncertainty and I’d prefer to be surprised on the upside.

signals until I see the October numbers. Historically, October is a solid bellwether month. I’m optimistic but am going to be conservative in planning and spending until things actually happen. I think that there’s going to be an absolute ton of Star Wars merchandise sold but I also think there will be an awful lot of it left on the shelves. What then? “Curb Your Enthusiasm” and don’t become “Irrationally Exuberant.” It’s likely to be a strong holiday shopping season, but at this point that is far from certain. Be prepared for the aftermath. I am filled with both optimism and uncertainty and I’d prefer to be surprised on the upside.

That is nearly enough to impact the unemployment rate in a meaningful way. The jobs recovery has had false starts before, but this time it seems much more solid and sustainable.

That is nearly enough to impact the unemployment rate in a meaningful way. The jobs recovery has had false starts before, but this time it seems much more solid and sustainable.