Apocalypse Postponed

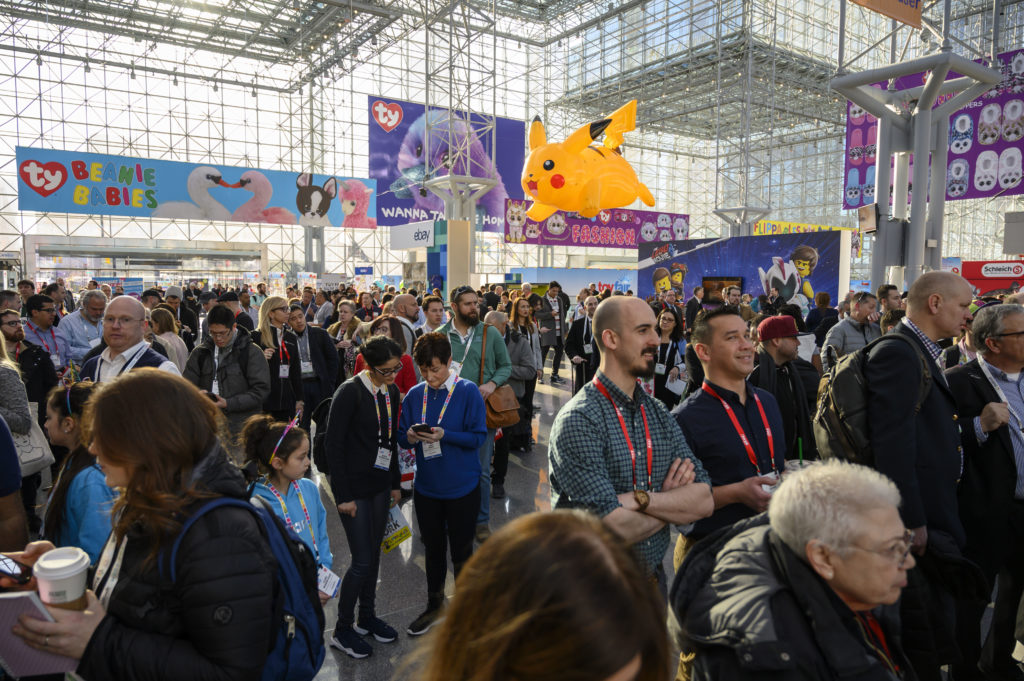

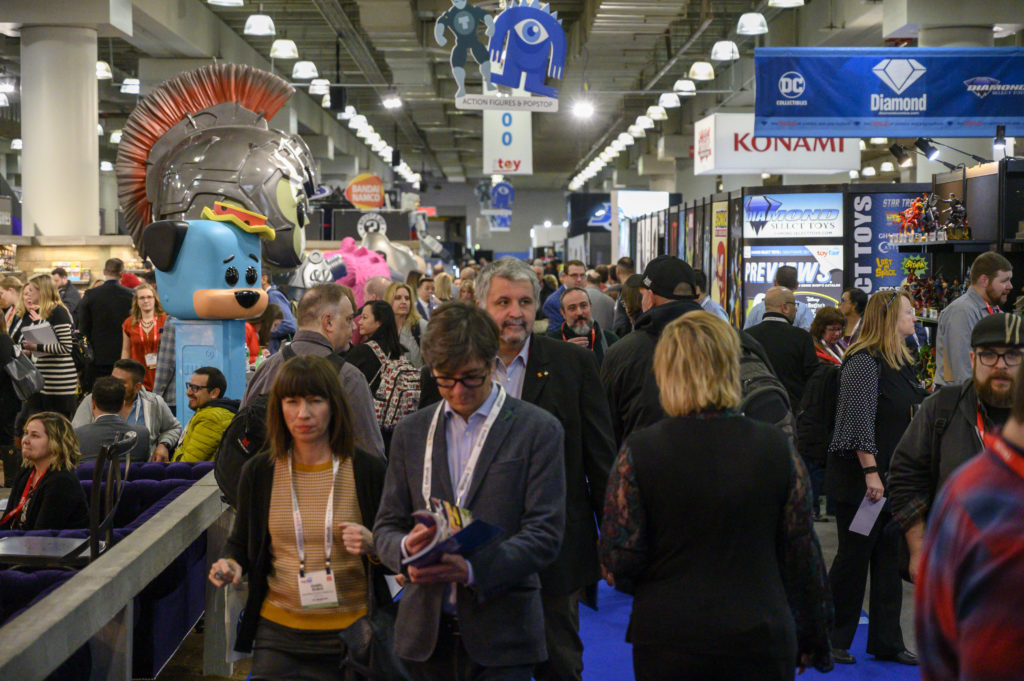

By now, the Dallas Fall Toy Preview follows a familiar script. We arrive and everybody grumbles, “There’s nobody here” and “This place is empty,” but by the time that the Opening Night cocktail party gets underway, everybody realizes that things are actually going pretty well.

By now, the Dallas Fall Toy Preview follows a familiar script. We arrive and everybody grumbles, “There’s nobody here” and “This place is empty,” but by the time that the Opening Night cocktail party gets underway, everybody realizes that things are actually going pretty well.

This year there was strong retailer presence with very few new no shows aside from Big Lots (shrug). That said, I did notice that a few additional substantial manufacturers were not exhibiting and that the 8th floor had all but disappeared.

There were the usual questions and concerns about having three trade shows in three locations over the same two or three week period. “How will the Toy Association fix this?” Personally, I’m resigned to the view that they won’t. Mainly because most of the toy manufacturers involved are reasonably happy doing what they’re doing. Companies showing in Los Angeles are happy showing in Los Angeles and are equally happy that half of the industry isn’t there diverting attention away from their product lines. Companies showing in Dallas like showing in Dallas as long as the buyers show up. It would, however, be helpful if Kohl’s and Meijer would attend so we can avoid treks to Grand Rapids, Michigan or Menomonie, Wisconsin. From what I’ve been told there was much less of an early October presence in Hong Kong. It’s probably too early to call that a trend, especially since it’s difficult to tease out the deterrent effect of the ongoing Hong Kong street protests. We should be able to get a better read on that next year.

By Thursday afternoon, most toy manufacturers in Dallas were telling me that they had very productive meetings with retailers. They also said they were able to create additional interest by laying out their entire product range. Additionally, I heard about a lot of positive surprises coming from walk-ins. The Dallas Toy Preview remains an exercise in quality over quantity. Continued success of the show will depend on The Toy Association maintaining and preferably increasing the breadth of retailer participation.

Source: justplayproducts.com

Recently, consolidation has been in the forefront of toy industry news. Jazwares has bought Wicked Cool Toys and Just Play is closing in on a purchase of Jakks Pacific. It’s interesting to note that most of the major players involved are former Jakks employees. Michael Rinzler and Jeremy Padawer were long-time Jakks employees who quickly built Wicked Cool into an exciting and innovative company. Both Geoffrey Greenberg and Charlie Emby previously sold toy companies to Jakks and then worked for them for a spell. They founded and built Just Play into a toy industry powerhouse. All this makes one wonder what Jakks might have become if it wasn’t saddled with such inept senior management.

Source: wickedcooltoys.com

Toys ‘R’ Us continues to create headlines but I suspect little else. Last time out, we discussed their 6 store “Flea Market” model where they will rent space and then in turn rent it out to toy manufacturers to try to sell their wares. With that they will also provide “powerful analytics” but since those will be based on such a small sample they aren’t of much real value.

They have now partnered with Candytopia on a two store “experience” model. Reported entry ticket prices look like they will be deal breakers for consumers. Reportedly it will cost $20 per child and $28 per adult to enter “the experience.” That means it will cost a family of four $96 before even thinking about purchasing a “shut up” toy on the way out. This is the opposite of the old Italian Restaurant model where everyone leaves happy after a free shot of Sambuca. Instead, it sounds like a lot of unhappy kids walking out the door with a roll of Smarties. Paying $96 to end up with a car full of crying kids doesn’t sound like an exciting prospect. Maybe families will go once…maybe.

Source: linkedin.com/company/trukidsbrands1/

Lastly, TRU has announced that it has essentially outsourced its startup e-commerce business to Target. That sounds to me like the actual owners of TRU Kids Brands won’t give management the money necessary to build or buy their own e-commerce platform. If the owners of the company don’t have any confidence in the holdover management from the Toys ‘R’ Us’ collapse, why should we? TRU should have had a first mover advantage in kids e-commerce twenty years ago and have flubbed it numerous times since. Unless they can come up with some spectacular content that isn’t available anywhere else (put me down as skeptical), I don’t see them becoming the hot go-to location.

TRU Kids Brands “strategy” looks like a shotgun approach of schemes by a company that has no money, doesn’t want to spend any money, but wants to convince both toy manufacturers and consumers to give them money while they milk their brand for what they can, while they can. Even before this new reincarnation, the Toys ‘R’ Us brand had been badly damaged by shoddy stores, bad management, and undercapitalization. I don’t see anything different here except a fresh coat of paint.

Source: insidethemagic.net

That said, it’s good to see Target really stepping up and looking to grow its toy business. The Toysrus.com deal should help them to jumpstart that, at least in the beginning. After a few years I expect that Target will have eaten whatever lunch TRU has left. Putting miniature Disney stores into its locations should be a much more powerful long-term growth driver. Unfortunately, with Target one must always bear in mind the words of Mark Tritton that will forever ring in infamy: “We will refuse to accept any new cost increases related to tariffs on goods imported from China.”

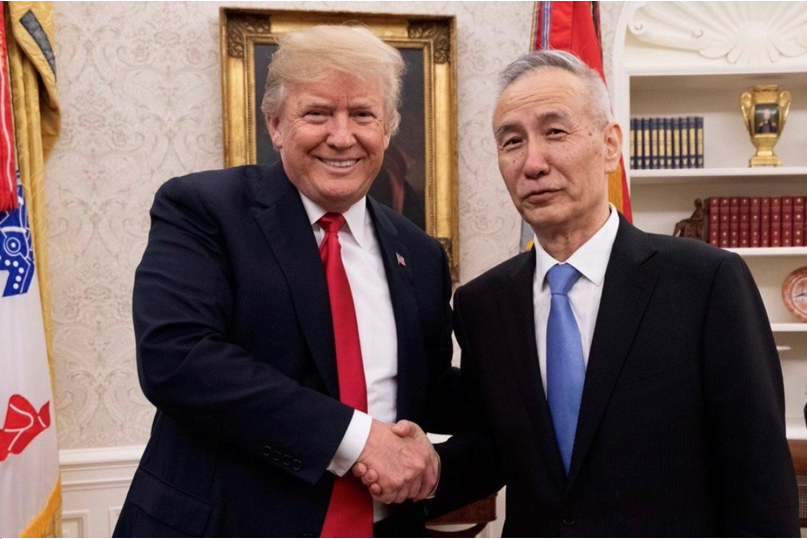

Which brings us to tariffs. Late Friday, the US and China reached a truce on trade war escalation. While an all-encompassing trade deal would be better than a partial deal, a partial deal is better than no trade deal at all. Since the details still haven’t really been worked out, it’s better to view this as a cease-fire rather than even a partial deal. But that’s still better than continued trade war escalation.

Source: scmp.com

Next week’s planned increase in tariffs to 30% from 25% on $250 billion in Chinese imports has been put on hold. In return, China will greatly increase purchases of U.S. agricultural products. However, planned December 15th tariff increases on a wide array of consumer goods remain on the table at this time. Both parties are said to be discussing Chinese intellectual property rights, forced joint ventures, and technology transfers and increased U.S. access to Chinese markets. Those negotiations will be hard fought, and the devil is likely to be in the details. For a final deal to be struck, the Trump administration is going to have to give up its demands that China end its support for state-owned enterprises. The Chinese are not about to change the way their entire economy is organized – especially when for the last thirty years, it has been working very well for them. Also, the U.S. will have to cease demands that China dismantle its Made in China 2025 New Technology initiative. That demand is ludicrous. Its not hard to imagine what the U.S. would say if China demanded that of us.

I have no special knowledge or shining track record of predicting the future, but if I were to prognosticate – my guess is that there will be a series of “skinny deals” which will both allow a number of declarations of victory as well as eat up the calendar moving toward Election Day 2020. Only after the election will the U.S. reduce its China 2025 and state sponsored entity demands. In other words, I believe that the process is to a degree being staged managed. That doesn’t mean that the players have complete control over it and it doesn’t mean that things can’t still go wrong. It also doesn’t help companies making plans for business year 2020. Proceed with caution. Steady as she goes.

All the best,

Tom Keoughan

One highlight was the Doll of the Year Award which went, unsurprisingly, to L.O.L. Surprise! The award was accepted by Isaac Larian of MGA who approached the podium and said – the least he ever has. It was a comically gracious moment…only to be later ruined when he climbed the stage out of turn and out of line to display his usual boorish behavior. That said, let’s give credit where credit is due – both under the byzantine TOTY process and by popular acclaim L.O.L. Surprise! garnered three TOTY’s and was the overall Toy of the Year. Mattel and Lego also had good nights as they each came home with three TOTYs.

One highlight was the Doll of the Year Award which went, unsurprisingly, to L.O.L. Surprise! The award was accepted by Isaac Larian of MGA who approached the podium and said – the least he ever has. It was a comically gracious moment…only to be later ruined when he climbed the stage out of turn and out of line to display his usual boorish behavior. That said, let’s give credit where credit is due – both under the byzantine TOTY process and by popular acclaim L.O.L. Surprise! garnered three TOTY’s and was the overall Toy of the Year. Mattel and Lego also had good nights as they each came home with three TOTYs.

A shout out to Marian Bossard of the Toy Industry Association for winning the Wonder Women of Sales Award. Marian is one of the key people making all of the toy industry’s tradeshows and events go as smoothly as possible for the rest of us. Congratulations to all of the Wonder Women. As an employment expert, I suggest regularly wearing your pink capes to the office around salary review time!

A shout out to Marian Bossard of the Toy Industry Association for winning the Wonder Women of Sales Award. Marian is one of the key people making all of the toy industry’s tradeshows and events go as smoothly as possible for the rest of us. Congratulations to all of the Wonder Women. As an employment expert, I suggest regularly wearing your pink capes to the office around salary review time!

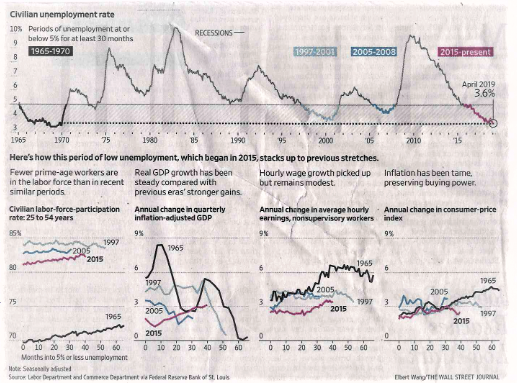

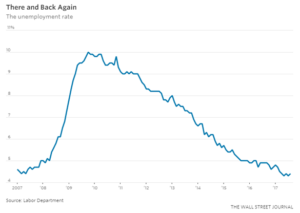

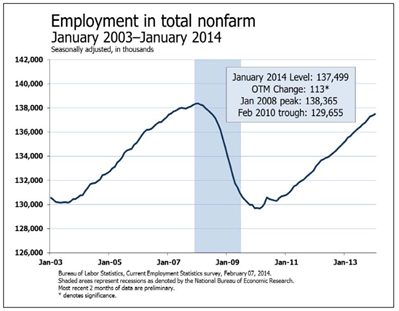

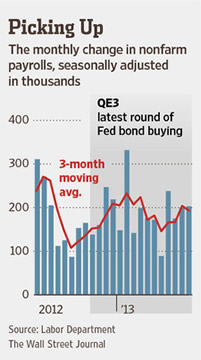

That is nearly enough to impact the unemployment rate in a meaningful way. The jobs recovery has had false starts before, but this time it seems much more solid and sustainable.

That is nearly enough to impact the unemployment rate in a meaningful way. The jobs recovery has had false starts before, but this time it seems much more solid and sustainable.