Making Sense of Conflicting Economic Signals

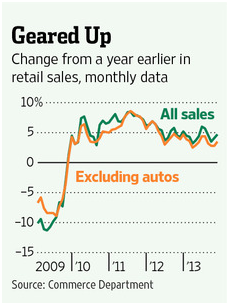

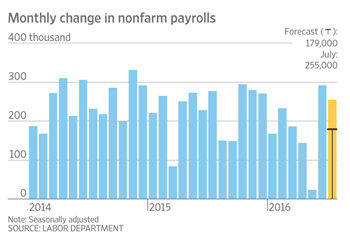

To better understand all the conflicting economic indicators being reported, one needs to dig a little deeper than the headline numbers. Hiring has been strong for most of the year which has lead an increasing number of people who left the workforce to rejoin it. More jobs has meant higher consumer confidence and a greatly increased consumer spending. Some of the increased consumer spending has also been driven by banks.

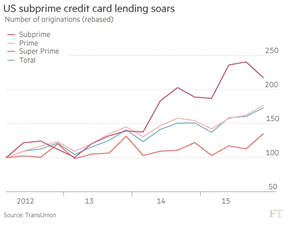

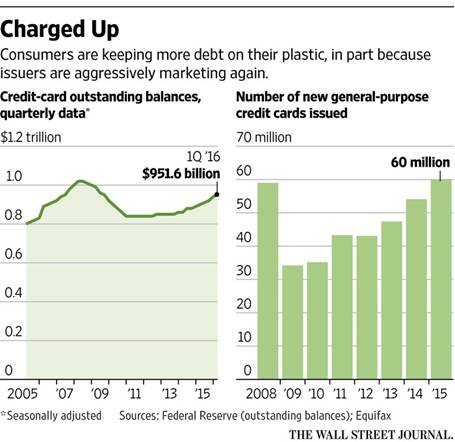

Bank pr ofits have been squeezed by long term, record low interest rates. To make up for it, they have been pumping credit cards out to more people and increasing credit card loan limits while at the same time increasingly loaning that money to riskier borrowers. Over the past year, US banks have added $54 billion in loans to consumers through loans on credit cards. After contracting during the financial crisis, credit card debt is not expanding at its fastest rate since 2007.

ofits have been squeezed by long term, record low interest rates. To make up for it, they have been pumping credit cards out to more people and increasing credit card loan limits while at the same time increasingly loaning that money to riskier borrowers. Over the past year, US banks have added $54 billion in loans to consumers through loans on credit cards. After contracting during the financial crisis, credit card debt is not expanding at its fastest rate since 2007.

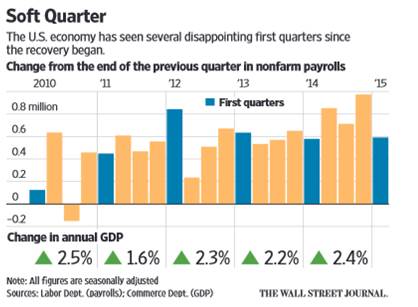

You would think that economy would be booming but GDP has only grown at a 1% rate thus far this year. The problem is that businesses have been holding back on spending on everything from computers to new equipment and factories. We need both consumer and business spending otherwise it’s as if the economy was trying to ride a bicycle with only one pedal.

If businesses are confident enough to hire, why aren’t they also putting money into expansion efforts? Oneexplanation is that workers are relatively cheap and also easy to get rid of should the economy slow. There is also plenty of spare production capacity, so companies don’t yet have much incentive to devote funds to new projects. Most companies will be conservatives with their balance sheets until they see signs of a growth rebound. They will also hold off investing until they have a better sense of the future tax and regulatory regimes that they are likely to  face next year. Business spending should begin to pick up after the November elections, regardless of who is elected as businesses are better able to forecast.

face next year. Business spending should begin to pick up after the November elections, regardless of who is elected as businesses are better able to forecast.

The good news for the toy industry is that business is booming. Toy sales have been growing for the last year and a half at a 6 to 7% annualized rate. Strong sales have also mean that toy companies have been adding people. Toyjobs is having a bang-up year and is placing people at a level we haven’t seen since 2008. It is also heartening to see the return of hiring in the Marketing and Product Development sectors. Hiring in these areas has been extremely slow since the beginning of the financial crisis. I’m a little concerned that we haven’t seen the usual avalanche of toy Sales jobs that we usually see this August. Perhaps toy execs are all away on vacation. They better wake up! Fall Toy Previews are only four weeks away! I look forward to seeing everybody there.

All the best,

Tom Keoughan

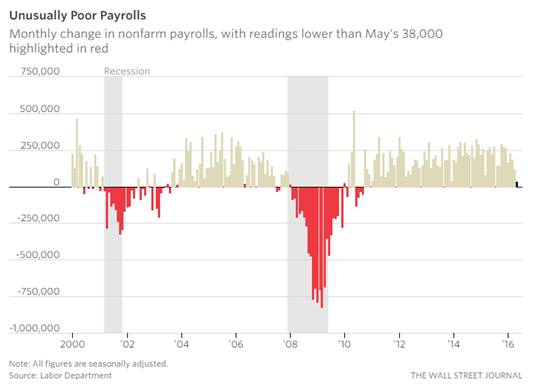

90,000 jobs. Days when the office is closed due to weather also takes a greater toll than it is generally given credit for. There are the snow days themselves and then there are the next few days of playing catch up. Yes, I know everyone claims that they can get all the work done or are even more productive from home but we all know that’s not entirely true, don’t we? This means multiple days taken away from interviewing and decision making all of which pushes actual hiring down the road.

90,000 jobs. Days when the office is closed due to weather also takes a greater toll than it is generally given credit for. There are the snow days themselves and then there are the next few days of playing catch up. Yes, I know everyone claims that they can get all the work done or are even more productive from home but we all know that’s not entirely true, don’t we? This means multiple days taken away from interviewing and decision making all of which pushes actual hiring down the road.