Star Wars May Make Us – Then Break Us

The human herds at the annual Black Friday Disgrace were lighter this year as retailers started early, spread out the sales, and put many of the same bargains online. Still, like a scene from the zombie apocalypse, America was at its worst.

Why would anybody allow themselves to be anywhere near a retail store at that time? Well, if you look carefully at the videos – not just at the “combatants” but the gawkers, the bystanders and the “fratboy film crews” – “for them, this is just entertainment.” (Michael Caine as Harry Browne).

Over the Thanksgiving weekend, perhaps the biggest loser was Target. Not only did they have slow store traffic, but this year, rather than then letting the hackers in, they just let the shoppers break their website. I can clearly imagine a stream of profanity featuring elongated o’s volleying around the Nicollet Mall.

Elsewhere around the web, online sales have been smoking hot as mainstream consumers seem to have switched from danger and doorbuster deals to “shopping on the sofa.” Cyber Monday was historically strong. The ladies in the Toyjobs’ offices were unusually quiet that day. I’m sure they outfoxed me with their superior computer skills. I never caught them, but I suspect they were quite “busy” – not that I care, as long as they get their work done.

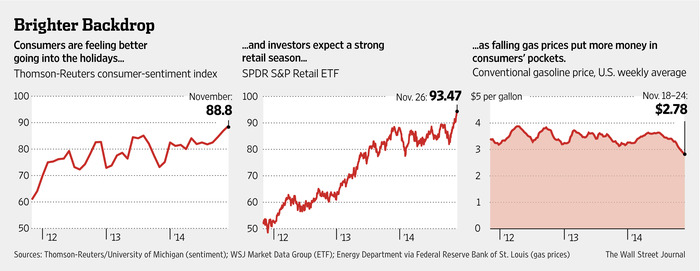

I expect strong overall holiday sales. Consumer confidence has improved and gas prices are down so consumers have a bit more discretionary income to spend. Frozen merchandise has slowed down in the second half, but Shopkins and all sorts of R/C drones have been “flying off the shelves” (sorry). Star Wars merchandise is everywhere, but I’m told hasn’t really started selling in waves yet. It seems as if Disney is releasing the film at the perfect time to maximize box office receipts, but late in the day for the holiday shopping season. I think there will be a ton of Star Wars merch sold, but also expect a lot of inventory carry over. That could impact toy company hiring in the first half of next year.

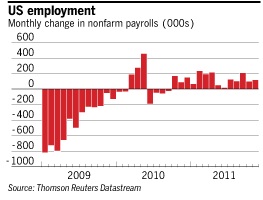

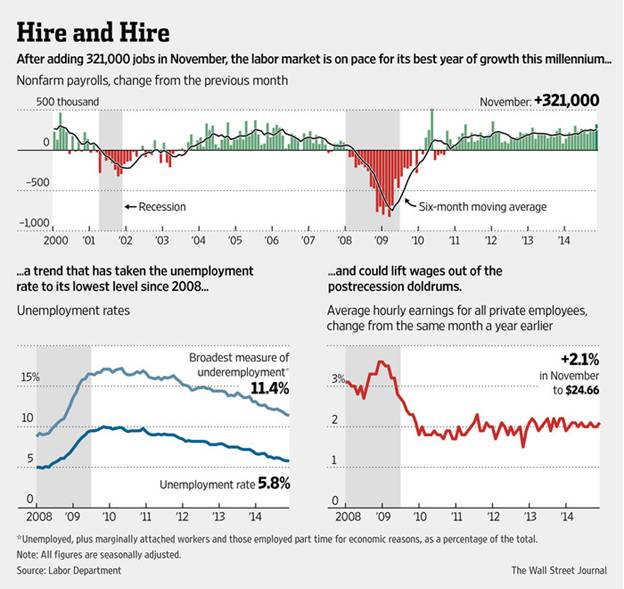

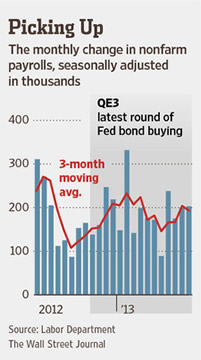

Employment in the US economy at large seems to have hit its stride. There was a slowdown during the summer, which highly paid Wall Street analysts have used all sorts of esoteric jargon to explain. I would suggest that it’s a simple cyclical phenomena known as “late summer.” Since then, we have had three strong jobs reports in a row

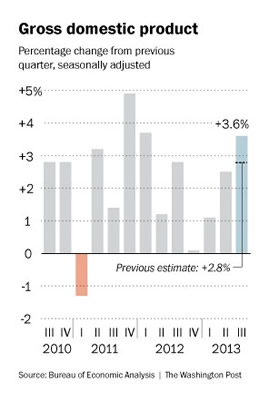

Now if we could just get the economy growing beyond its currently anemic 2.1% rate. By definition, companies will have a lot of uncertainty until the November 2016 election so I don’t expect a step up in corporate spending until then.

As for toy industry hiring – at Toyjobs, we are really cranking right now. We have lots of ducks in the air and are just waiting for employers to pull the trigger. I think the toy industry is generally strong but I see Star Wars leftovers and uncertainty ahead of the US Presidential election as potential drags on toy hiring. We’ll have to wait and see how that plays out.

In the meantime, the very best for the holidays to one and all.

May the Force Be With Us,

Tom Keoughan

That is nearly enough to impact the unemployment rate in a meaningful way. The jobs recovery has had false starts before, but this time it seems much more solid and sustainable.

That is nearly enough to impact the unemployment rate in a meaningful way. The jobs recovery has had false starts before, but this time it seems much more solid and sustainable.