Human herds were out in force during the four day long national disgrace presided over by Wal-Mart, Best Buy and their retail brethren. The long weekend “wilding” saw shopping devolve into a full contact sport replete with tramplings, taserings, shootings, various acts of police brutality and people robbing each other in the parking lots. Unfortunately, this seems to be the real “99%”.

At a Wal-Mart in Southern California a 10PM stampede turned ugly when a woman used pepper spray to “gain an upper hand” over her fellow creatures. Over twenty people suffered minor injuries as she attempted to clear a path to the electronics section. The woman has since turned herself in but, as of this moment, Toyjobs has been unable to determine whether she was indeed an active member of the Oakland police force – another national disgrace.

In Pennsylvania, it was reported that “girls(?)” AND their mothers were shoving and punching each other in a melee at a Victoria’s Secret outlet. We can only imagine that this will inspire the next big late-nite cable TV reality show. New Jersey officials were heartened by the fact that their cultural ambassador – Snooki – was not involved. Retailers were “pleased” with the strong start to the holiday shopping season, According to the National Retail Federation. Total sales over the four days grew 16.4% and individual consumers spent an average of $398.62 up 9% from last year. Online sales were extremely strong for the entire period as well as Cyber Monday.

Black Friday is a notoriously poor indicator of sales for the entire holiday shopping season and some analysts are warning that this could be only a temporary bright spot rather than a true revival of the consumer economy. This gloomier interpretation says that short-lived deep discounts merely pulled forward from December sales and that price slashing is the only thing that can encourage cash-strapped consumers to spend and that they will shut their wallets again now that the deals have gone. My gut tells me that those human herds aren’t exactly the types that are able to adhere to a budget. I think they will be ready to stampede Pamplona style whenever retailers wave their red capes.

On the bright side, retail sales have risen for six months in a row. Even Wal-Mart broke a two year stretch of same-store sales declines by growing 1.9% in the third quarter but this came at the cost of lower margins. More deep discounts mean lower profit margins for retailers who will, of course, pass that on to their suppliers through auctions and price beat downs. That is reflective of what I continuously hear from senior toy executives: “higher sales but lower margins.” Also, retailers brought in very lean inventories and that could limit upside potential if holiday demand continues to be strong. The scramble is now on to get more goods out of domestic manufacturers and those with domestically warehoused product.

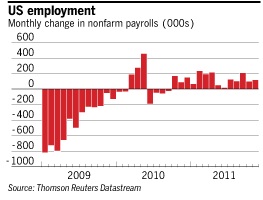

After a June/July slowdown, since early August the US economy has been improving slowly but at an increasing rate.The November unemployment rate fell from 9% to 8.6% while payroll growth accelerated to 120,000. The difficulty with the jobs report is that it is actually two reports: the unemployment rate is based on a survey of 60,000 households while the jobs number comes from a different survey that covers the payroll records of about 140,000 businesses. The payroll number is less volatile and widely viewed as the more reliable of the two. The sharp drop in the unemployment rate was partly due to a shrinking labor force which suggests that some unemployed people have become discouraged and stopped looking for work. Once they start searching for a job again the unemployment rate could tick higher. Meanwhile, payroll growth of 120,000 remains well below the level that most economists consider consistent with a strong economic recovery. In addition, payroll numbers were lifted last month (as they will be for the next two) by temporary holiday retail hiring. Taken together the jobs report does signal improvement but not as much as headlines suggest.

After a June/July slowdown, since early August the US economy has been improving slowly but at an increasing rate.The November unemployment rate fell from 9% to 8.6% while payroll growth accelerated to 120,000. The difficulty with the jobs report is that it is actually two reports: the unemployment rate is based on a survey of 60,000 households while the jobs number comes from a different survey that covers the payroll records of about 140,000 businesses. The payroll number is less volatile and widely viewed as the more reliable of the two. The sharp drop in the unemployment rate was partly due to a shrinking labor force which suggests that some unemployed people have become discouraged and stopped looking for work. Once they start searching for a job again the unemployment rate could tick higher. Meanwhile, payroll growth of 120,000 remains well below the level that most economists consider consistent with a strong economic recovery. In addition, payroll numbers were lifted last month (as they will be for the next two) by temporary holiday retail hiring. Taken together the jobs report does signal improvement but not as much as headlines suggest.

As the US economy continues to slowly improve, the European debt crisis is the joker in the deck. The euro is now close enough to going off the rails that Angela Merkel and other European “leaders(?)” are now less focused on provincial politics and finally closing in on a solution. The Cliff Notes version is that Merkel supports European Union treaty revisions which would force debtor nations to fix their financial problems. This is, of course, the long term solution but ignores the crisis that it upon them right NOW. The rest of Europe is looking for a “backstop” or lender of last resort to guarantee all debts. That would likely be either a European Central Bank declaration or the issuance of Eurobonds for which all EU members would be liable.

In either case, the weight would fall heavily on Germany’s shoulders because they have the strongest economy and have behaved in a fiscally responsible manner. Bailing out the basket cases of Southern Europe doesn’t play well in domestic German politics. Think of it like the displeasure that responsible US households would have at being told to pay higher taxes in order to bail out people who took a flyer and “bought” a house that they couldn’t possibly afford. True, many American households are in trouble because someone lost a job or got sick or are underwater due to the housing market meltdown. Everyone seems to be able to get their minds around that sort of thing. Germans see a completely different type of situation in the irresponsible behavior of the Greeks not paying their taxes and then retiring to the government dole at age 50.

The truth is that Europe is like America. It needs both a long term fix AND short term crisis relief. In Europe’s case the clock is ticking down to a matter of weeks and with their backs to the wall, they finally seem to be looking at a two-pronged approach. Once the ticking time bomb is taken from the room, US markets should stabilize and the economy should continue to move forward. That said, in the US it appears as is nobody is prepared to act like a grown up until after the upcoming election. Fortunately that is less than a year away.

In the toy industry, search starts have remained strong and some companies have actually been hiring while others continue to play “hurry up and wait” even after they have selected a candidates. I suspect that decent holiday sales numbers will lead toy companies to have an increased sense of stability spurring somewhat larger budgets. This should lead to continued strength in search starts and companies feeling more confident in actually completing a hire. Things are getting better faster but…

Muddling through,

Tom Keoughan